What Types of Life Insurance Can You Borrow From?

As a Life Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I’ve found that one of the most powerful—and least understood—features of a life insurance policy is the ability to use it while you are still alive.

In my years serving neighbors from Downtown Tampa to the quiet streets of Safety Harbor, the goal is often simple: “I want to protect my family if I’m gone.” But as the economy in the Tampa-Saint Petersburg-Clearwater Metro Area continues to evolve in 2026, many are looking for their insurance to do double duty—acting as both a safety net and a source of liquidity.

The question I hear frequently is: “What types of life insurance can you borrow from?” For a local resident, this isn’t just about finding cash; it’s about strategic financial planning that leverages Florida’s unique asset-protection laws. In this deep-dive analysis, we will explore the mechanics of “borrowable” life insurance, the pros and cons of policy loans, and how to navigate the 2026 interest rate environment right here in our backyard.

The Fundamental Divide: Term vs. Permanent Insurance

Before we identify the specific policies, we must understand the “why.” In the world of insurance, there are two primary categories: Term and Permanent.

Term Life Insurance (The “Non-Borrowable” Policy)

Most Tampa Bay Residents are familiar with Term Life. It is affordable, straightforward, and provides a massive death benefit for a low cost. However, Term Life is pure insurance. It does not accumulate cash value.

- Can you borrow from it? No.

- Pro: Lowest initial cost for families in Clearwater or St. Pete.

- Con: No “living benefits” or cash accumulation.

Permanent Life Insurance (The “Asset” Policy)

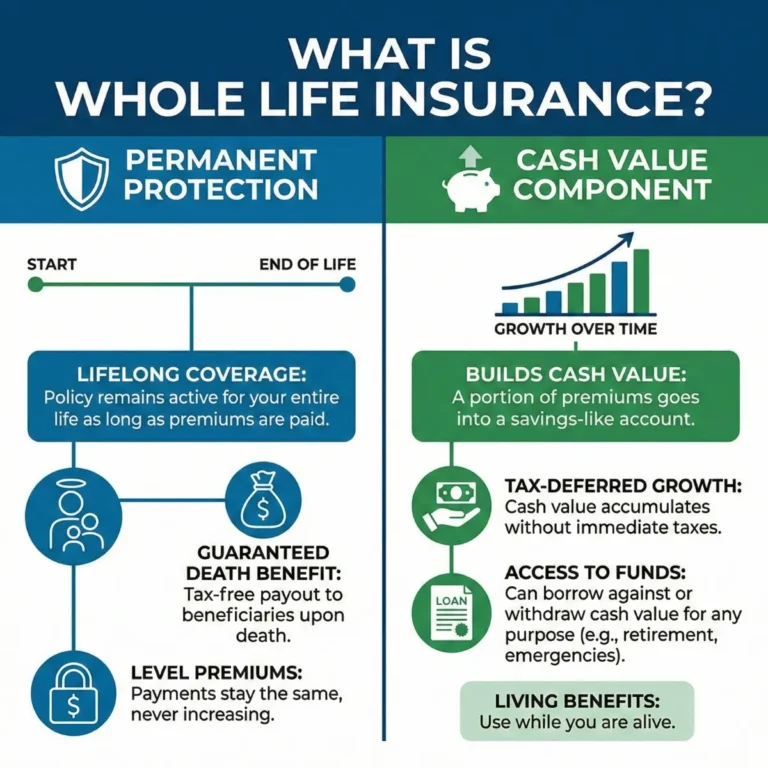

Permanent insurance—which includes Whole, Universal, and Variable life—is designed to last your entire life. A portion of every premium you pay goes into a “cash value” account. Over time, this account grows, and it is this equity that you can borrow against.

The Four Main Types of Life Insurance You Can Borrow From

If you are looking for a policy that offers liquidity, you are looking for Cash Value Life Insurance. In the Tampa-Saint Petersburg-Clearwater Metro Area, four main types dominate the market.

1. Whole Life Insurance

This is the most traditional form of insurance that can be borrowed. It offers a guaranteed death benefit, guaranteed premiums, and a guaranteed rate of return on your cash value.

- The “Borrowing” Hook: Many policies I write for residents in Old Northeast St. Pete are through “Mutual” companies that pay dividends. These dividends can significantly accelerate your borrowing power.

- Pro: Extreme stability and predictability.

- Con: The highest initial premium of the four types.

2. Universal Life (UL) Insurance

Universal Life is often called “Flexible Premium” life insurance. It allows you to adjust your death benefit and your premium payments as your life in the Tampa Bay Metro changes.

- The “Borrowing” Hook: Your cash value grows based on current market interest rates. In the 2026 environment, where rates have stabilized, UL can be an attractive middle ground.

- Pro: Flexibility for those whose income might fluctuate (like local real estate agents or small business owners).

- Con: Requires more oversight to ensure the policy remains properly funded.

3. Indexed Universal Life (IUL)

IUL has surged in popularity among Tampa, Saint Petersburg, and Clearwater Area Residents who want market-linked growth without the risk of market losses.

- The “Borrowing” Hook: Growth is tied to a stock market index (like the S&P 500), but with a “floor” (usually 0%). If the market crashes, your cash value stays flat; it doesn’t drop.

- Pro: Higher growth potential than traditional Whole Life.

- Con: Gains are “capped,” and the internal costs can be complex.

4. Variable Universal Life (VUL)

VUL is the most aggressive option. It allows you to invest your cash value directly in sub-accounts (similar to mutual funds).

- The “Borrowing” Hook: If your investments perform well, your borrowing power can skyrocket.

- Pro: Maximum growth potential for savvy investors in Downtown Tampa.

- Con: Your cash value can actually decrease if your investments lose money, which could lead to a policy lapse if not managed carefully.

Deep Analysis: How Does a Policy Loan Actually Work?

When you “borrow” from your life insurance, you aren’t actually withdrawing your own money. Instead, the insurance company gives you a loan and uses your cash value as collateral.

No Credit Check, No Hassle

This is a major “pro” for residents in Pinellas and Hillsborough counties. Unlike a bank loan or a mortgage on a house in Palm Harbor, there is no application process, no credit check, and no “reason for the loan” required. You simply request the funds, and the check is usually sent within days.

Flexible Repayment

You are not required to make monthly payments. You can choose to pay back only the interest, pay back the principal and interest, or pay nothing at all.

Warning: If you choose not to pay back the loan, the interest will be added to the principal. If the total loan balance eventually exceeds your cash value, your policy will lapse.

Impact on the Death Benefit

If you pass away with an outstanding loan, the balance is deducted from the death benefit. For example, if you have a $500,000 policy and a $50,000 loan, your family in Clearwater will receive $450,000.

The “Florida Advantage”: Asset Protection and Statute 222.14

As an Insurance Agent and Broker, I always remind my clients that Florida is one of the most “debtor-friendly” states in the nation. This is a critical factor when considering what types of life insurance you can borrow from.

Under Florida Statute § 222.14, the cash surrender value of a life insurance policy issued on a Florida resident is exempt from the claims of creditors.

- Why this matters: If you are a business owner in Tampa or a medical professional in Saint Petersburg and you are sued, your cash value is generally untouchable.

- Strategic Play: Even the funds you borrow from the policy may remain protected if they can be traced back to the exempt asset, providing a unique layer of financial security that traditional savings accounts cannot match.

2026 Market Context: Life Insurance Loans vs. HELOCs

In 2026, we are seeing mortgage rates and Home Equity Lines of Credit (HELOCs) hovering around 7-8%. In contrast, many life insurance companies offer policy loan rates between 4% and 6%.

For a family in Clearwater Beach looking to renovate their home or a resident in Largo facing an emergency medical bill, the life insurance loan is often the most cost-effective and least stressful way to access capital.

Comparing the Options for Tampa Bay Residents

| Feature | Life Insurance Loan | Home Equity Loan (HELOC) | Credit Card / Personal Loan |

| Interest Rate (Est. 2026) | 4.5% – 6% | 7.25% – 8.5% | 12% – 24% |

| Credit Check? | No | Yes | Yes |

| Repayment Terms | Totally Flexible | Strict Monthly | Strict Monthly |

| Collateral | Cash Value | Your Home | None (usually) |

| Tax Impact | Generally Tax-Free | Interest not deductible* | No benefit |

** Rates shown are estimates and subject to change.

Identifying the Best Life Insurance Companies for Borrowing

When comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, the carrier choice is paramount. Some companies are “Borrower Friendly,” while others have complex rules.

Top Carriers for Local Residents:

- MassMutual: Known for high dividend payments and a “Direct Recognition” model that allows for efficient borrowing.

- Mutual of Omaha: Highly rated for their customer service and ease of accessing cash value for seniors in Pinellas County.

- New York Life: One of the strongest financial ratings (A++) and excellent whole life options for residents in South Tampa.

- Prudential: A leader in the UL and IUL space, offering modern, flexible borrowing options for younger professionals.

- Transamerica: Often provides the most competitive rates for hybrid policies that combine borrowing power with long-term care benefits.

Strategic Uses of Life Insurance Loans in Tampa Bay

How are our neighbors using these loans in 2026?

- Down Payments on Real Estate: With the Tampa-Saint Petersburg-Clearwater Metro Area real estate market remaining competitive, some residents use policy loans to bridge the gap between homes without needing a “Contingent” offer.

- Business Liquidity: Entrepreneurs in Downtown St. Pete use policy loans as a working capital line that doesn’t show up on their business credit report.

- Supplementing Retirement: Retirees in Clearwater use loans (which are tax-free) to supplement their income during years when the stock market is down, allowing their 401(k)s time to recover.

- The “Infinite Banking” Concept: Some advanced planners use high-cash-value policies to “finance” their own lives, effectively paying interest back to their own policy rather than a commercial bank.

SEO Long-Tail Keywords to Watch For

When you are researching these topics online, be aware of the keywords that lead to the best information. You’ll want to look for phrases like:

- “How to borrow from cash value life insurance in Florida.”

- “Best life insurance with cash value Tampa FL”

- “Tax implications of life insurance loans for seniors”

- “Universal life insurance vs. whole life for borrowing”

These terms will help you filter through generic advice and find the specific data points that apply to the Tampa, Saint Petersburg, and Clearwater Metro Area.

Pros and Cons: A Final Summary

The Pros:

- Immediate Access: No approval process.

- Lower Interest: Typically lower than market rates for unsecured debt.

- Asset Protection: Protected from creditors under Florida law.

- Tax Efficiency: Loans are generally not considered taxable income.

The Cons:

- Reduced Legacy: Death benefit drops by the loan amount.

- Lapse Risk: If interest accumulates unchecked, you could lose the policy.

- Slow Start: It takes several years of paying premiums before you have significant borrowing power.

Conclusion: Making Your Insurance Work for You

Life insurance is more than just a “death benefit.” In the right hands, it is a versatile financial tool that can provide security during your life and peace of mind after. For Tampa-Saint Petersburg-Clearwater Metro Area Residents, choosing a borrowable policy is a way to ensure that you have access to capital when you need it most, without the hurdles of the traditional banking system.

However, choosing between Whole, Universal, or Indexed policies requires a thorough analysis of your personal goals, health, and financial timeline. You shouldn’t have to navigate these complexities alone.

Steve Turner Insurance Specialist is here to be your guide. As an expert agent and broker with years of experience helping residents of the Tampa Bay Metro, Steve can compare every carrier and plan type to find the one that best matches your specific needs.

The best part? Steve’s services are 100% free to you. Like all independent agents and brokers, he is compensated by the insurance company that you choose. This means you receive his years of research, his local expertise, and his personalized advice without ever receiving a bill.

Would you like me to run a customized illustration showing how much cash value you could accumulate—and borrow—over the next 10 years based on your current age?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

What Types of Life Insurance Can You Borrow From?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.