Medicare 2026 – What You Need to Know

Medicare 2026 – What You Need to Know About

Medicare 2026 – What You Need to Know

Welcome to one of the most important healthcare decisions you will ever make. Turning 65 and enrolling in Medicare is a major life milestone, and while it brings with it the promise of excellent health coverage, it also brings a lot of new terms, rules, and choices that can feel overwhelming. Think of this guide as your friendly roadmap. We are going to break down everything you need to know for 2026 into simple, easy-to-understand pieces. Our goal is to replace confusion with confidence, so you can choose the Medicare path that is perfect for you. [Medicare 2026]

So, what exactly is Medicare? At its heart, Medicare is a federal health insurance program created primarily for people who are 65 or older.1 It is not free, but it is designed to help cover a huge portion of your healthcare costs in retirement. You can also qualify for Medicare before age 65 if you have been receiving Social Security Disability Insurance (SSDI) for at least 24 months, or if you have specific serious conditions like End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s disease. [Medicare 2026]

For most people turning 65 in 2026, the key to a smooth start is understanding your Initial Enrollment Period (IEP). This is your personal 7-month window to sign up for Medicare. It begins 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65. For example, if your 65th birthday is on June 15, 2026, your IEP starts on March 1, 2026, and ends on September 30, 2026. Enrolling during this window is critical to avoid lifelong late enrollment penalties, especially for your medical and prescription drug coverage. Missing these deadlines can cost you money for the rest of your life, so let’s make sure that doesn’t happen. [Medicare 2026]

The Building Blocks: The Four Main Parts of Medicare

Imagine you are building a house for your healthcare needs. You need a foundation, walls, plumbing, and electricity. Medicare is built in a similar way, with four main “parts” that work together to cover different things. Let’s get to know them one by one. [Medicare 2026]

Medicare Part A: Hospital Insurance (The Foundation of Your House)

Think of Part A as the physical building—the hospital itself. It is designed to cover the big, structural costs of being admitted to a hospital or other inpatient facility. [Medicare 2026]

What Does Part A Cover?

- Inpatient Hospital Stays: This is the main benefit. It covers the cost of a semi-private room, meals, nursing services, and drugs administered as part of your inpatient treatment.

- Skilled Nursing Facility (SNF) Care: This is NOT long-term nursing home care. This is for short-term, rehabilitative care you receive after a qualifying hospital stay. For example, if you have hip surgery, spend three days in the hospital, and then need to go to a facility for physical therapy to learn how to walk again, Part A helps cover this.

- Hospice Care: For individuals with a terminal illness, Part A covers care focused on comfort and quality of life, including pain relief, nursing services, and grief counseling.

- Home Health Care: If you are homebound and need skilled care (like changing wound dressings or getting injections), Part A can help cover these services for a limited time.

What Does Part A Cost in 2026?

Here is the good news: for most people, Part A is premium-free. If you or your spouse worked and paid Medicare taxes for at least 10 years (which equals 40 quarters), you will not have to pay a monthly bill for Part A. [Medicare 2026]

However, Part A is not completely free when you use it. It has costs you pay out-of-pocket:

- The Part A Deductible: When you are admitted to the hospital, you must pay a deductible before Medicare starts paying. In 2025, this deductible was $1,676 per benefit period. (A benefit period starts when you’re admitted and ends when you haven’t received any inpatient care for 60 days in a row). This means you could potentially pay this deductible more than once in a year. The 2026 Medicare Part A deductible projection: $1716.

- Hospital Coinsurance: For a hospital stay, Medicare covers the first 60 days in full after you’ve paid your deductible. But for longer stays, you start paying a daily coinsurance. For 2026, this will be several hundred dollars per day for days 61-90, and a much higher amount for “lifetime reserve days” after that.

Medicare Part B: Medical Insurance (The Doctors and Services Inside Your House)

If Part A is the hospital building, Part B is everything and everyone you need inside it to get better. This part of Medicare covers your doctors, tests, and a vast range of outpatient services. [Medicare 2026]

What Does Part B Cover?

- Doctor Visits: This includes visits to your primary care doctor and specialists.

- Outpatient Care: Covers services you get at a hospital or clinic when you are not formally admitted, like emergency room visits, outpatient surgery, and chemotherapy.

- Preventive Services: Medicare places a strong emphasis on staying healthy. Part B covers many preventive services at no cost to you, such as your annual “Welcome to Medicare” visit, annual wellness visits, flu shots, and screenings for things like cancer and diabetes.

- Durable Medical Equipment (DME): This includes things like walkers, wheelchairs, and oxygen tanks that are deemed medically necessary by your doctor.

- Ambulance Services: Covers emergency transportation to a hospital.

- Clinical Research and Mental Health Services.

What Does Part B Cost in 2026?

Unlike Part A, everyone pays a monthly premium for Part B. [Medicare 2026]

- The Part B Premium: In 2025, the standard premium was $185.00 per month. This amount is usually deducted directly from your Social Security check. The 2026 premium will be announced in late 2025 but is expected to see a slight increase. People with higher incomes pay a higher monthly premium, a charge known as the Income-Related Monthly Adjustment Amount (IRMAA). The 2026 Medicare Part B premium projection: $206.50.

- The Part B Deductible: Before Part B starts to pay, you must meet a small annual deductible. In 2025, it was $257 for the entire year. Once you pay this amount, your deductible is met for the rest of the year. The 2026 Medicare Part B deductible projection is $288.

- The Part B Coinsurance: This is the MOST IMPORTANT number to remember. After your deductible is met, you are responsible for 20% of the Medicare-approved cost for most services. Your doctor’s visit might cost $200. Medicare pays $160 (80%), and you pay $40 (20%). This doesn’t sound too bad for a doctor’s visit, but what if you need something major, like a $100,000 cancer treatment? Your 20% share would be $20,000. The scariest part? There is no cap or limit on your 20% share with Original Medicare. This unlimited financial risk is the number one reason people choose to get more coverage.

Original Medicare: Your Starting Point

When you have just Part A and Part B, you have what is called Original Medicare. This is the basic health plan run by the federal government. It gives you incredible freedom: you can go to any doctor or hospital in the entire United States that accepts Medicare, with no referrals needed to see a specialist. [Medicare 2026]

However, as we’ve seen, it also leaves you with significant gaps and potentially unlimited costs. This is where you face your first big decision: how will you protect yourself from these gaps? [Medicare 2026]

Medicare Part D: Prescription Drug Coverage (Your Pharmacy Pass)

One of the biggest surprises for new Medicare beneficiaries is learning that Original Medicare (Part A and B) does not cover the prescription drugs you pick up at the pharmacy. To get help with the costs of your medications, you need to enroll in a separate Medicare Part D plan.

How Does Part D Work?

- Private Plans: Part D plans are not sold by the government. They are offered by private insurance companies that are approved by Medicare.

- Monthly Premium: You will pay a separate monthly premium for your drug plan, which varies depending on the plan you choose.

- Annual Deductible: Most plans have a deductible you must pay before the plan starts helping with your drug costs. The maximum allowed deductible for 2026 will be set by Medicare.

- Copayments and Coinsurance: Once your deductible is met, you will pay a copayment (a fixed amount, like $10) or coinsurance (a percentage, like 25%) for each prescription you fill.

- The “Donut Hole” or Coverage Gap: Under the standard Part D benefit, there used to be a gap where you had to pay a much higher percentage of your drug costs. Thanks to recent changes from the Inflation Reduction Act, your out-of-pocket costs for drugs are now capped. For 2025, that cap was set at $2,000 for the year. This means once your total out-of-pocket spending on covered drugs reaches this cap, you will pay $0 for your prescriptions for the rest of the year. This new cap is a massive improvement and provides incredible protection against catastrophic drug costs. The 2026 Medicare Part D Cap is projected to be $2100.

Important Note: Even if you don’t take any prescription drugs when you turn 65, it is highly recommended that you enroll in a low-cost Part D plan. If you don’t sign up when you are first eligible and decide you need a plan later, you will be charged a lifelong late enrollment penalty that gets added to your monthly premium. [Medicare 2026]

Medicare Part C: Medicare Advantage (The All-in-One Package)

This is the other major piece of the Medicare puzzle. Medicare Part C, more commonly known as Medicare Advantage, is an alternative way to get your Medicare benefits. Instead of getting your Part A and Part B coverage from the government, you can choose to get it from a private insurance company that has a contract with Medicare. [Medicare 2026]

How Does Medicare Advantage Work?

- Bundled Plan: Think of it like a bundled cable and internet package. A Medicare Advantage plan combines your Part A (hospital) and Part B (medical) benefits into a single, convenient plan.

- Includes Part D: The vast majority of Medicare Advantage plans also include Part D prescription drug coverage, so you have everything in one package with one monthly premium (if there is one) and one insurance card.

- Extra Benefits: To compete for your business, these plans often include extra benefits that Original Medicare does not cover. This can include routine dental care, vision exams and eyeglasses, hearing aids, and even gym memberships (like SilverSneakers).

- Out-of-Pocket Maximum: This is perhaps the most important feature. Every Medicare Advantage plan is required by law to have an annual out-of-pocket maximum. This is a hard cap on your medical spending for the year. Once you reach this limit (which varies by plan but cannot exceed a federally set amount), you pay $0 for all covered medical services for the rest of the year. This protects you from the unlimited 20% coinsurance of Original Medicare. [Medicare 2026]

The Trade-Offs of Medicare Advantage

The benefits sound great, but they come with trade-offs. The biggest one is networks. [Medicare 2026]

- HMOs and PPOs: Most Medicare Advantage plans are structured as either an HMO (Health Maintenance Organization) or a PPO (Preferred Provider Organization).

- HMO: You generally must use doctors, hospitals, and specialists within the plan’s network. You will also typically need a referral from your primary care physician to see a specialist.

- PPO: You have more flexibility. You can see doctors both in- and out-of-network, but you will pay less if you stay in-network. You usually don’t need referrals.

- Prior Authorizations: Advantage plans may require you or your doctor to get approval from the insurance company before they will cover certain procedures or medications. [Medicare 2026]

Filling the Gaps: Your Two Main Choices for 2026

Now that we understand all the parts, it’s time to put them together. When you enroll in Medicare in 2026, you will face a fundamental choice between two main paths. This is the most important decision you will make. [Medicare 2026]

Path #1: Original Medicare + Medigap + Part D

This path is often referred to as the “freedom of choice” option. You keep Original Medicare (Part A and Part B) as your primary coverage, and then you add two more pieces to protect yourself financially. [Medicare 2026]

What is Medigap?

A Medicare Supplement Insurance policy, known as Medigap, is a private insurance plan that helps pay for the “gaps” in Original Medicare. It pays for things like your Part A and B deductibles and, most importantly, your 20% coinsurance. [Medicare 2026]

- How it Works: When you go to the doctor, you show your Original Medicare card and your Medigap card. Medicare pays its 80% share, and then it sends the rest of the bill to your Medigap plan, which pays its share automatically. In many cases, you are left with $0 out-of-pocket for medical services.

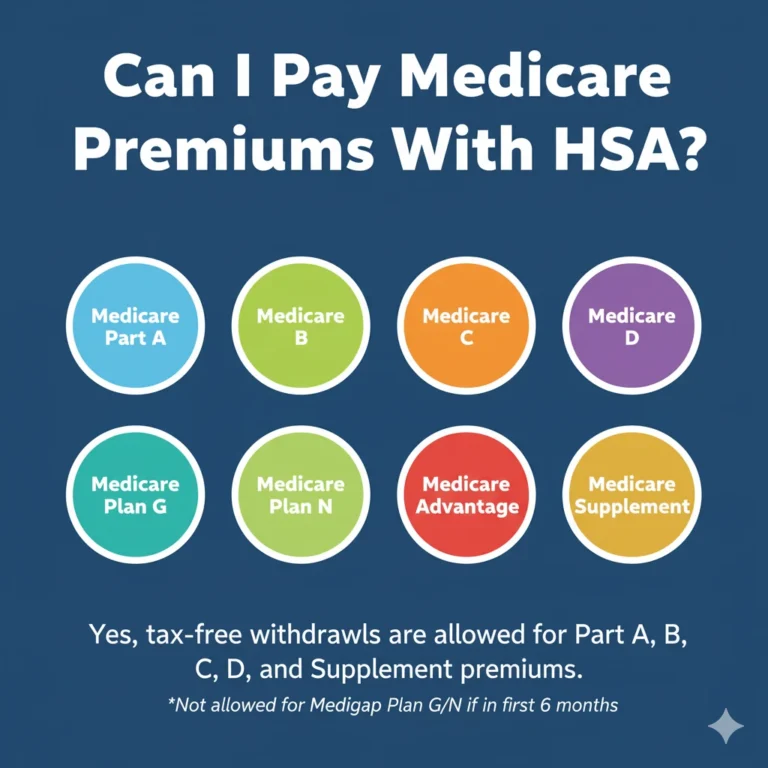

- Standardized Plans: Medigap plans are standardized by the federal government. This means that a “Medicare Plan G” from one company has the exact same core benefits as a “Plan G” from any other company. The only difference is the price. [Medicare 2026]

- Popular Plans for 2026: For new enrollees, the two most popular plans are Plan G and Plan N. [Medicare 2026]

- Plan G is the most comprehensive. It covers nearly everything Original Medicare doesn’t, including your 20% coinsurance and the Part A deductible. The only thing you have to pay is the small annual Part B deductible ($257 in 2025). After that, you have 100% coverage for Medicare-approved medical services for the rest of the year. [Medicare 2026]

- Plan N is very similar to Plan G but has a lower monthly premium. In exchange, you agree to pay small copayments for some doctor visits (up to $20) and emergency room visits (up to $50). [Medicare 2026]

- The Medigap Open Enrollment Period: Just like your IEP for Medicare, you have a special 6-month window to buy a Medigap plan. It starts the first month you have Medicare Part B and are 65 or older. During this window, insurance companies cannot deny you coverage or charge you more due to pre-existing health conditions. This is your one “golden ticket” to get any plan you want. If you miss this window, you may have to go through medical underwriting and could be denied coverage. [Medicare 2026]

Summary of Path #1:

- Your Coverage: Original Medicare + a Medigap Plan + a Part D Drug Plan. [Medicare 2026]

- Pros:

- Freedom and Flexibility: See any doctor or hospital in the U.S. that accepts Medicare. No networks, no referrals.

- Predictable Costs: With a comprehensive plan like Plan G, your healthcare costs are extremely stable and predictable.

- Nationwide Coverage: Your coverage travels with you anywhere in the country. [Medicare 2026]

- Cons:

- Higher Premiums: You will be paying three separate monthly premiums: one for Part B, one for your Medigap plan, and one for your Part D plan. This is usually the more expensive path in terms of monthly outlay. [Medicare 2026]

- No Extra Benefits: Medigap does not include coverage for dental, vision, or hearing. [Medicare 2026]

Path #2: Medicare Advantage (Part C)

This path is often called the “all-in-one” or “convenience” option. You choose one private plan that bundles all of your healthcare needs together. [Medicare 2026]

Summary of Path #2:

- Your Coverage: A Medicare Advantage Plan (which includes Part A, Part B, and usually Part D). [Medicare 2026]

- Pros:

- Lower Premiums: Many Advantage plans have a $0 monthly premium (you still have to pay your Part B premium to the government). This makes it a very attractive option for those on a fixed budget. [Medicare 2026]

- All-in-One Convenience: One card, one plan, and one company to deal with for all your medical and drug needs.

- Extra Benefits: Often includes routine dental, vision, hearing, and fitness benefits not covered by Original Medicare.

- Out-of-Pocket Maximum: Provides a hard safety net on your annual medical spending. [Medicare 2026]

- Cons:

- Network Restrictions: You must use the plan’s network of doctors and hospitals to get the lowest costs. Your favorite doctor may not be in the network.

- Referrals and Prior Authorizations: You may need referrals to see specialists, and the plan can require pre-approval for certain procedures, which can delay care. [Medicare 2026]

- Coverage Can Change Annually: Benefits, networks, and drug formularies can and do change annually. You must review your plan’s “Annual Notice of Change” document each fall to ensure it still meets your needs. [Medicare 2026]

What’s NOT on the Menu? What Medicare Doesn’t Cover

It is just as important to understand what Medicare does not cover so you can plan accordingly. Even the best Medicare plan will not cover everything. [Medicare 2026]

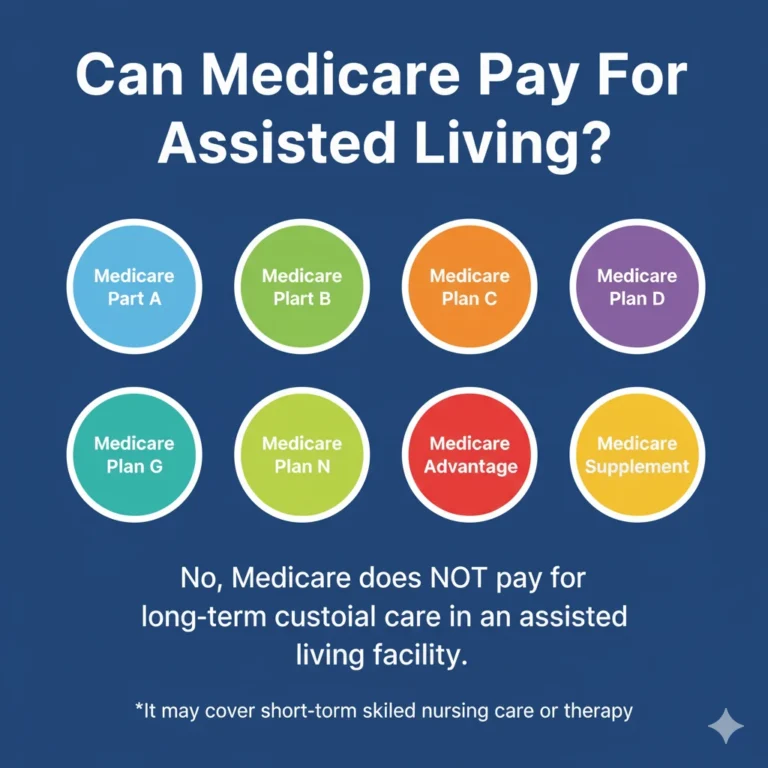

- Long-Term Custodial Care: This is the most significant and most expensive gap. Medicare covers short-term skilled nursing care for rehabilitation, but it does not pay for long-term care in a nursing home or assisted living facility. This type of care, which involves help with daily activities like bathing, dressing, and eating, must be paid for out-of-pocket or with a separate long-term care insurance policy. [Medicare 2026]

- Most Dental, Vision, and Hearing Care: Original Medicare does not cover routine dental cleanings, fillings, dentures, eye exams for glasses, or hearing aids. You can get some of these benefits through a Medicare Advantage plan, or you can purchase separate, stand-alone dental and vision insurance plans. [Medicare 2026]

- Routine Foot Care: Medicare will cover foot care related to a medical condition, such as diabetes, but it does not cover routine care, including clipping toenails. [Medicare 2026]

- Cosmetic Surgery: Any surgery that is purely for cosmetic reasons is not covered. [Medicare 2026]

- Healthcare Outside the United States: With very few exceptions, Original Medicare does not provide coverage when you are traveling abroad. Some Medigap plans and Medicare Advantage plans offer limited emergency coverage for foreign travel. [Medicare 2026]

Putting It All Together: Making Your 2026 Decision

Choosing between Path #1 and Path #2 is a personal decision that depends on your health, your finances, and your lifestyle. Here are some questions to ask yourself to help guide your choice: [Medicare 2026]

- How important is a low monthly premium to you? [Medicare 2026]

- If your top priority is keeping your fixed monthly expenses as low as possible, a $0 premium Medicare Advantage plan might be the best fit.

- How important is it to see any doctor you want, anywhere in the country? [Medicare 2026]

- If you value complete freedom of choice, travel frequently, or have specific specialists you must see, then Original Medicare with a Medigap plan is likely the superior option.

- What is your tolerance for financial risk? [Medicare 2026]

- If the thought of unpredictable copays and coinsurance makes you nervous, and you prefer to know exactly what your healthcare will cost, the comprehensive coverage of a Medigap Plan G offers incredible peace of mind.

- If you are comfortable with paying smaller costs as you go (copays) in exchange for a complex safety net against catastrophic expenses, a Medicare Advantage plan with its out-of-pocket maximum provides excellent protection.

- Are extra benefits like dental and vision a must-have? [Medicare 2026]

- If you want these benefits bundled into your plan for convenience, Medicare Advantage is the only way to get them included in your core health plan.

Why You Shouldn’t Go It Alone: The Value of an Independent Agent

As you can see, Medicare is complicated. The decision you make during your Initial Enrollment Period can affect your healthcare and finances for the rest of your life. While you can certainly research everything on your own, it’s like trying to navigate a foreign country without a map or a guide. You might get there eventually, but you will likely make some wrong turns and miss some important sights along the way. [Medicare 2026]

This is where a good, independent, licensed insurance agent can be your most valuable resource. Think of an agent as your personal Medicare tour guide. Their job is to understand the entire landscape of options available in your specific zip code. They can help you compare dozens of plans from different companies to find the one that truly fits your needs and budget. [Medicare 2026]

Most importantly, you should know how agents are paid. They receive a commission from the insurance company whose plan you choose to enroll in. This means their services are provided at no extra cost to you. The price of the insurance plan is the same whether you buy it through an agent or directly from the company. The agent’s fee is built into the plan’s administrative costs. This allows you to get expert, personalized advice without paying a dime for it.

The rules, the plans, and the deadlines are a lot to handle on your own. A wrong choice can be costly. It is usually best to use a Licensed Insurance Agent like Steve Turner of SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Medicare Insurance Carriers. An expert like Steve can sit down with you, listen to your needs, explain your options in simple terms, and help you enroll in the plan that gives you the best coverage, the most peace of mind, and the greatest value for your healthcare dollar in 2026 and for all the years to come. Tap this link to learn more about the Medicare Offerings available to you.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

MEDICare INSURANCE POSTS

INSURANCE OFFERINGS

Medicare 2026 – What You Need to Know

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.