2026 Medicare Part B Changes

2026 Medicare Part B Changes

2026 Medicare Part B Changes

Welcome to your official guide to one of the most important parts of your retirement healthcare: Medicare Part B. If you are getting ready to enroll in Medicare in 2026, you are likely hearing a lot about the different “parts” of the program. While they are all important, Part B is the true workhorse of your day-to-day medical coverage. However, it’s also the part with the most costs, rules, and potential financial risks to understand. [2026 Medicare Part B Changes]

This article is designed to be your friendly and patient guide. We will walk through everything you need to know about Part B, from what it is and who needs it, to what it covers and what it costs. Most importantly, we will focus on the specific changes you can expect in 2026, comparing them to 2025 so you can see a clear picture of the evolving landscape. Our goal is to demystify Medicare Part B, turning confusion into clarity and empowering you to make the best possible decision for your health and your wallet. [2026 Medicare Part B Changes]

So, let’s start with the most basic question: What is Medicare Part B? In simple terms, Medicare Part B is your medical insurance. If you think of Part A as your “hospital insurance” that covers the building and your room, then Part B is the insurance that covers the doctors, tests, and services you receive both inside and outside the hospital. It’s the coverage for your doctor visits, outpatient procedures, preventive care, and medical equipment. It is the core of your health coverage for nearly everything other than a long-term inpatient hospital stay. [2026 Medicare Part B Changes]

Almost every single person who enrolls in Medicare needs to have Part B. You qualify for Part B if you are eligible for Medicare, which for most people means turning 65. Unlike Part A, which is free for most, Part B is optional, and you must actively enroll and pay a monthly premium for it. [2026 Medicare Part B Changes]

The deadline for enrolling is absolutely critical. You have a 7-month window called your Initial Enrollment Period (IEP) to sign up. This period begins 3 months before the month you turn 65, includes your birthday month, and ends 3 months after your birthday month. For example, if your 65th birthday is on May 20, 2026, your IEP starts on February 1, 2026, and runs through August 31, 2026. Missing this deadline can result in a lifelong late enrollment penalty, which is a permanent surcharge added to your monthly Part B premium for the rest of your life. It’s one of the most important deadlines you’ll ever have, so let’s make sure you’re ready for it. [2026 Medicare Part B Changes]

The A-to-Z of Part B: What Is Covered in 2026? (A Deep Dive)

Medicare Part B covers a vast and comprehensive range of medical services and supplies that are deemed medically necessary to treat your health condition. This coverage is not expected to change significantly in 2026, as the core benefits are well-established. Let’s take a detailed look at what is included. [2026 Medicare Part B Changes]

Doctor and Specialist Services

This is the benefit people use most often. Part B covers the services you receive from physicians and other healthcare providers. [2026 Medicare Part B Changes]

- Primary Care Doctor Visits: For your regular check-ups, sick visits, and management of chronic conditions.

- Specialist Visits: When you need to see a cardiologist, an oncologist, a dermatologist, a rheumatologist, or any other specialist. With Original Medicare, you do not need a referral to see a specialist.

- Surgeons’ Fees: For surgeries performed in a hospital outpatient setting or at an ambulatory surgical center.

- Second and Third Opinions: Part B will cover the cost for you to get a second opinion from another doctor before a major surgery, and even a third opinion if the first two disagree.

Outpatient Hospital Services

This covers care you receive at a hospital or hospital-affiliated clinic when you have not been formally admitted as an inpatient. [2026 Medicare Part B Changes]

- Emergency Room Visits: For urgent medical needs.

- Outpatient Surgery: For procedures where you go home the same day.

- Chemotherapy and Radiation: For cancer treatment administered in an outpatient clinic.

- Diagnostic Tests: This includes a wide range of services like X-rays, MRIs, CT scans, and EKGs.

- Observation Stays: Sometimes, a hospital will keep you for a day or two for observation without formally admitting you. These stays are covered by Part B, not Part A.

Preventive Care: The Key to Staying Healthy

Medicare Part B places a strong emphasis on maintaining your health and detecting problems early. It covers a wide array of preventive services, many of which are available to you at no cost ($0). This is a powerful benefit that helps you take control of your health. [2026 Medicare Part B Changes]

- “Welcome to Medicare” Visit: A one-time check-up you can get within the first 12 months you have Part B. [2026 Medicare Part B Changes]

- Annual Wellness Visit: A yearly appointment with your doctor to develop or update a personalized prevention plan. [2026 Medicare Part B Changes]

- Vaccinations: Covers annual flu shots, pneumonia shots, and Hepatitis B shots. [2026 Medicare Part B Changes]

- Cancer Screenings: Includes mammograms for breast cancer, Pap tests for cervical cancer, colonoscopies for colorectal cancer, and screenings for prostate and lung cancer. [2026 Medicare Part B Changes]

- Diabetes Screenings and Supplies: Covers screenings for people at risk of diabetes, as well as supplies like test strips and glucose monitors for those diagnosed with it. [2026 Medicare Part B Changes]

- Bone Density Measurements: To check for osteoporosis. [2026 Medicare Part B Changes]

Other Important Part B Coverage

- Durable Medical Equipment (DME): Part B covers 80% of the cost of medically necessary equipment that you use in your home. This includes things like walkers, wheelchairs, hospital beds, and oxygen tanks. You must get your equipment from a supplier that is enrolled in Medicare. [2026 Medicare Part B Changes]

- Ambulance Services: Covers emergency transportation by ambulance to the nearest appropriate medical facility. [2026 Medicare Part B Changes]

- Mental Health Services: Includes coverage for outpatient therapy and counseling. [2026 Medicare Part B Changes]

- Clinical Research: Helps pay for the costs of participating in approved clinical research studies. [2026 Medicare Part B Changes]

What Part B Does NOT Cover

Understanding the gaps in Part B is the first step to finding solutions. In 2026, these gaps will remain the same. Part B does not cover: [2026 Medicare Part B Changes]

- Most Prescription Drugs: The medications you pick up at a pharmacy are not covered. That’s the job of a separate Part D plan.

- Long-Term Care: It does not cover custodial care in a nursing home or assisted living facility.

- Routine Dental, Vision, and Hearing: Cleanings, fillings, dentures, eye exams for glasses, and hearing aids are not covered.

- Routine Foot Care and Cosmetic Surgery.

The Price of a Promise: Your Part B Costs in 2026

Part B coverage comes with several out-of-pocket costs. These are the numbers that change each year due to healthcare inflation and other factors. Here is a detailed look at what you can expect to pay in 2026, based on projections from 2025 data. [2026 Medicare Part B Changes]

The Monthly Premium: Your Ticket to Coverage

This is the monthly bill you pay to have Part B insurance. It is usually deducted directly from your Social Security check. [2026 Medicare Part B Changes]

- The 2025 Standard Premium: $185.00 per month.

- The 2026 Projected Standard Premium: Approximately $206.50 per month.

Why is it changing? The Part B premium is recalculated each year and is based on the overall spending within the Medicare program. As the costs of doctor services, new technologies, and treatments rise, the premium must also rise to cover those expenses. This projected increase of about $21.50 per month is a direct reflection of medical inflation. [2026 Medicare Part B Changes]

IRMAA: The High-Earner Surcharge

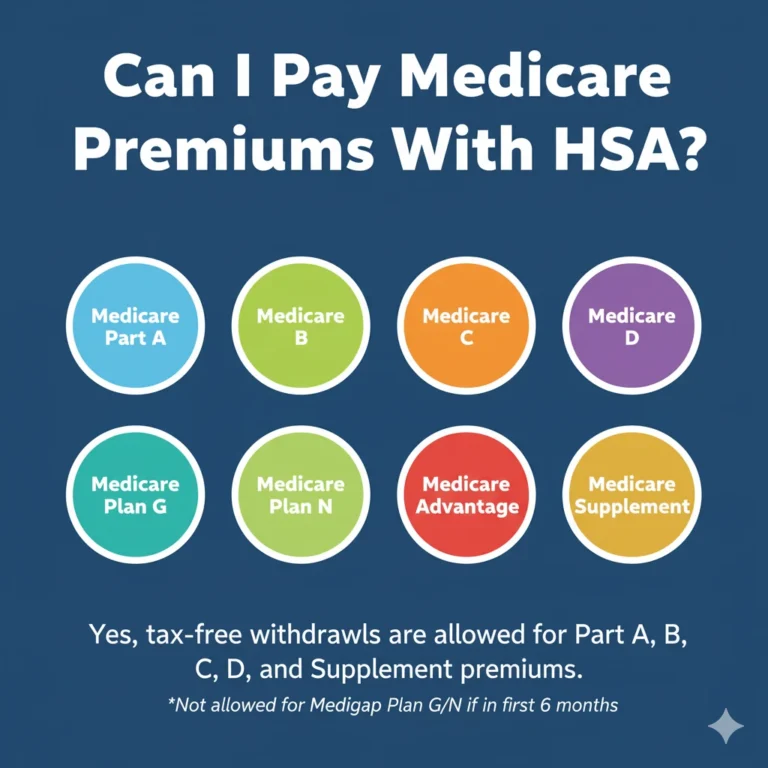

It’s important to know that not everyone pays the standard premium. Medicare uses your tax returns from two years ago to determine if you need to pay a higher premium. This is called the Income-Related Monthly Adjustment Amount (IRMAA). [2026 Medicare Part B Changes]

- How it works: If your Modified Adjusted Gross Income as reported on your tax return from two years prior is above a certain threshold, you will pay the standard premium plus an extra IRMAA amount. [2026 Medicare Part B Changes]

- 2026 Projections: The income brackets for IRMAA are adjusted for inflation each year. For 2026, the first income threshold for an individual is expected to be around $109,000 (up from $106,000 in 2025). If your income exceeds this level, you will pay a premium higher than the standard rate. There are several brackets, and the highest earners can pay a Part B premium of over $600 per month. [2026 Medicare Part B Changes]

The Annual Deductible: Your First Step

This is the amount you must pay out-of-pocket for your medical services before Part B begins to pay its share. [2026 Medicare Part B Changes]

- The 2025 Annual Deductible: $257.

- The 2026 Projected Annual Deductible: Approximately $288.

What this change means for you: This means that in 2026, you will be responsible for the first $288 of your doctor bills and other outpatient services for the year. Once you have paid this amount, your deductible is met, and you will proceed to the coinsurance phase for the remainder of the year.

The 20% Coinsurance: The Great Uncapped Risk

This is, without a doubt, the single most important and most dangerous out-of-pocket cost in all of Original Medicare. This fundamental risk is not changing in 2026. [2026 Medicare Part B Changes]

How it works: After you have paid your annual deductible, you are responsible for 20% of the Medicare-approved amount for most Part B services. Medicare pays the other 80%. [2026 Medicare Part B Changes]

Let’s look at how this plays out in real life: [2026 Medicare Part B Changes]

- A Simple Doctor Visit: The bill is $150. Medicare pays $120 (80%). You pay $30 (20%).

- An MRI Scan: The bill is $2,000. Medicare pays $1,600 (80%). You pay $400 (20%).

- Outpatient Surgery: The bill is $15,000. Medicare pays $12,000 (80%). You pay $3,000 (20%).

- A Year of Cancer Treatments: The total bills are $150,000. Medicare pays $120,000 (80%). You pay $30,000 (20%).

The most critical fact to understand is that there is NO ANNUAL LIMIT on your 20% coinsurance under Original Medicare. Your financial exposure is unlimited. A serious illness could lead to tens of thousands of dollars in medical bills that you are responsible for. This is the primary reason why it is essential to have additional insurance coverage to protect yourself from this risk. [2026 Medicare Part B Changes]

Building Your Shield: How to Cover the Gaps in Part B for 2026

The projected increases in the 2026 Part B premium and deductible, combined with the ever-present danger of the uncapped 20% coinsurance, make choosing a solution for these gaps your most important Medicare decision. You have two main paths to build your financial shield. [2026 Medicare Part B Changes]

Solution #1: Medicare Supplement Insurance (Medigap)

A Medigap plan is a private insurance policy that works in coordination with Original Medicare. Its sole purpose is to pay for the “gaps” that Medicare leaves behind, like your deductibles and coinsurance. [2026 Medicare Part B Changes]

How Medigap Solves Your Part B Problems:

- It Covers the 20% Coinsurance: This is the number one job of a Medigap plan. The most popular plans, like Plan G and Plan N, will pay the 20% coinsurance for you, completely and automatically. That potentially devastating $30,000 bill for cancer treatment in our example? A Medigap plan would cover it in full. [2026 Medicare Part B Changes]

- Predictable Costs: By covering the unpredictable 20% coinsurance, Medigap transforms your healthcare costs into a stable, predictable monthly premium. You know exactly what your medical expenses will be each month, which makes budgeting in retirement simple and stress-free. [2026 Medicare Part B Changes]

- Freedom and Flexibility: Because Medigap works with Original Medicare, you retain the freedom to see any doctor or visit any hospital in the country that accepts Medicare. There are no networks to worry about. [2026 Medicare Part B Changes]

What’s Changing for Medigap in 2026?

The benefits of Medigap plans are standardized and do not change. A Plan G will always cover the 20% coinsurance. However, the premiums for Medigap plans will likely see a small inflationary increase in 2026, as they do most years, to keep up with rising healthcare costs.

Solution #2: Medicare Advantage (Part C)

A Medicare Advantage plan is an all-in-one alternative where you get your Part A and Part B benefits from a private company. [2026 Medicare Part B Changes]

How Medicare Advantage Solves Your Part B Problems:

- Replaces the 20% Coinsurance with Copayments: Instead of paying 20% of every bill, Advantage plans use a system of fixed, predictable copayments. For example, you might pay $10 for a primary care visit, $45 for a specialist visit, and $300 for an emergency room visit. You know your cost upfront. [2026 Medicare Part B Changes]

- The Ultimate Safety Net: The Out-of-Pocket Maximum: This is the most crucial feature. Every Medicare Advantage plan has a yearly cap on your spending for Part A and Part B services. [2026 Medicare Part B Changes]

- In 2025, the maximum limit was $9,350 for in-network care.

- In 2026, this limit is expected to rise slightly, potentially to over $9,350. However, many competitive plans in Florida will offer limits far below the maximum, often in the $4,000 to $7,000 range.

- Once you reach this maximum by paying your copayments, you pay $0 for all covered medical services for the rest of the year. This provides a powerful financial shield that Original Medicare lacks.

Comparing the Solutions for a Year with High Medical Bills

Imagine in 2026 you have a year with $50,000 in Part B medical bills. Here’s what your approximate out-of-pocket costs would be under each option:

- Just Original Part B:

- $288 (annual deductible)

- $9,942.40 (20% of the remaining $49,712)

- Total Cost: $10,230.40 (And this would keep going up with more bills)

- Part B + Medigap Plan G:

- $288 (annual deductible, which you pay)

- Total Cost: $288 (The Medigap plan pays the entire 20%)

- A Typical Medicare Advantage Plan:

- You would pay your copayments for each service until you hit your plan’s out-of-pocket maximum, perhaps $5,500. After that, you would pay nothing more.

- Total Cost: $5,500

This illustrates how both solutions offer powerful protection, but they achieve this in different ways and come with varying monthly premium costs. [2026 Medicare Part B Changes]

Making the Right Choice for Your Life Situation in 2026

The best path for you depends on your health, budget, and personal preferences. [2026 Medicare Part B Changes]

- If you want maximum freedom and predictability: If your top priority is being able to see any doctor in the country without referrals and having virtually no unexpected medical bills, then Original Medicare with a Medigap plan is the gold standard.25 It is ideal for those who travel, have complex health needs, or simply want the greatest peace of mind.

- If you want the lowest monthly cost and extra benefits: If you are on a fixed budget and want to keep your monthly premiums as low as possible, a $0-premium Medicare Advantage plan is a fantastic option. It provides a strong safety net with its out-of-pocket maximum and often includes valuable dental, vision, and hearing benefits that can save you a lot of money. It is ideal for those who are healthy and don’t mind using a local network of doctors.

Finding Your Personal Medicare Guide

We have taken an extremely deep dive into just Part B of Medicare. We’ve looked at the projected 2026 cost increases, the complex IRMAA rules, and the critical decision between Medigap and Medicare Advantage. Trying to sort through all of this information and apply it to your own situation can be incredibly difficult. A mistake made during your initial enrollment can be costly and, in some cases, permanent.

You do not have to navigate this journey alone. The smartest and safest way to make your Medicare decision is to work with an experienced, independent, licensed insurance agent. An agent who specializes in Medicare acts as your personal advisor and advocate. They understand the entire market, including all the new plan features and cost changes for 2026.

It is also essential to know that their expert help is provided to you at no extra cost. When you enroll in a plan through an agent, the insurance company pays them a commission. The price of your plan is legally required to be the same whether you use an agent or buy it directly from the company. This system allows you to get free, unbiased, professional guidance to help you find the perfect plan.

The decisions surrounding Medicare Part B are too important to leave to guesswork. It is usually best to use a licensed insurance agent, such as Steve Turner of SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Medicare Insurance Carriers. An expert like Steve can help you understand the 2026 Part B changes, analyze your personal needs and budget, and guide you to the solution that offers you the best coverage and the most financial security for all the years ahead.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

MEDICare INSURANCE POSTS

INSURANCE OFFERINGS

2026 Medicare Part B Changes

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.