Where Are Medicare Offices Located In FL

Where Are Medicare Offices Located In FL

Where Are Medicare Offices Located In FL?

Introduction: The Search for a “Medicare Office” and Why It Leads to Social Security

For many Floridians approaching age 65 or becoming newly eligible for Medicare, one of the first practical questions that arises is where to go for in-person assistance. The logical starting point for this search is often a “Medicare office.” However, this common and understandable assumption leads to a crucial discovery about how the federal government has structured its largest health insurance program. While Medicare is a single program, the responsibilities for administering it are divided between two distinct federal agencies. Understanding this division is the first and most important step in efficiently navigating the enrollment process.

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that oversees and administers the entire Medicare program on a national level. CMS sets the rules for coverage, manages the different parts of Medicare, and operates the official Medicare.gov website. The agency’s headquarters is located in Baltimore, Maryland, and it maintains ten regional offices across the country to support state and local operations. The regional office that serves Florida is located in Atlanta, Georgia. It is critical to understand, however, that these CMS offices are administrative hubs; they are not designed or staffed to provide direct, in-person services to the public or to individual Medicare beneficiaries. Therefore, there are no public-facing “Medicare offices” in Florida or any other state.

Instead, the responsibility for handling the public-facing aspects of enrollment into Original Medicare (Part A and Part B) is legally delegated to a different agency: the Social Security Administration (SSA). For decades, the SSA has served as the primary point of contact for Americans regarding retirement and disability benefits, and this role was expanded to include Medicare enrollment when the program was created in 1965. Consequently, when an individual needs to apply for Original Medicare in person, ask questions about their eligibility, or handle related administrative tasks, the correct physical location to visit is a local SSA field office.

The services that SSA employees can provide regarding Medicare are specific and well-defined. They are authorized to assist with:

- Applying for Original Medicare: This includes filing applications for Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance).

- Special Enrollment for Part B: Assisting individuals who delayed Part B enrollment due to having other health coverage (like from an employer) and now need to sign up during a Special Enrollment Period.

- Replacement Medicare Cards: Processing requests for a lost, stolen, or damaged Medicare card.

- Updating Personal Information: Making changes to a beneficiary’s name or address in the official record.

- Applying for Financial Assistance: Helping eligible individuals apply for the “Extra Help” program, which assists with the costs of Medicare Part D prescription drug plans.

It is equally important to understand the limitations of the assistance available at an SSA office. SSA staff are experts in federal benefits and the enrollment process for the government-run parts of Medicare. They can provide general information about the program as a whole, but they are strictly prohibited from offering advice or assistance with choosing or enrolling in private insurance plans. This means they cannot help a beneficiary compare Medicare Advantage (Part C) plans, select a standalone Medicare Part D prescription drug plan, or purchase a Medigap (Medicare Supplement) policy. That part of the process involves the private insurance market and requires different tools and resources, which will be detailed later in this guide.

The Digital-First Approach: Why Your First Stop Should Be Online or on the Phone

Before planning a trip to a physical office, it is essential to recognize that the Social Security Administration has fundamentally shifted its service model to a “digital-first” approach. The agency has developed robust, secure, and efficient online and telephone resources that can handle the vast majority of tasks related to Medicare enrollment and account management. The SSA explicitly encourages the public to use these remote services, as they can save significant time and often eliminate the need for an in-person visit altogether. For those who do require face-to-face assistance, an appointment is now strongly recommended, and in many cases, required. Walking into an office without an appointment may result in long wait times or being asked to schedule a future visit.

Key Online Portals for Medicare Services

Two primary federal websites serve as the foundation for managing Medicare benefits:

- SSA.gov: This is the official website of the Social Security Administration and the primary portal for applying for Original Medicare benefits online. It is also used to apply for Social Security retirement or disability benefits, request a replacement Social Security card, and estimate future benefits.

- Medicare.gov: This is the official website of the Centers for Medicare & Medicaid Services. After an individual is enrolled in Original Medicare through the SSA, Medicare.gov becomes the essential resource for all other aspects of their coverage. It is home to the powerful Medicare Plan Finder tool, which is used to compare and enroll in private Medicare Advantage and Part D plans, find doctors and hospitals, and check the status of claims.

Step-by-Step Guide: How to Apply for Medicare Online via SSA.gov

Applying for Medicare online is the fastest and most convenient method recommended by the SSA. The application process typically takes between 10 and 30 minutes to complete. The following is a step-by-step guide to the online application process:

- Navigate to the Application Portal: Go to the official SSA website at

www.ssa.gov/benefits/medicare. - Start the Application: Select the option to “Apply for Medicare Only.” You will be presented with the Terms of Service. After reviewing and agreeing to the terms, you can proceed.

- Create or Sign In to a

my Social SecurityAccount: To ensure security and allow you to save your progress, the system will direct you to sign in to or create amy Social Securityaccount. This one-time registration process requires a valid email address. The SSA uses trusted third-party credential services, Login.gov or ID.me, to verify your identity and create a secure account. If you are unable to complete the identity verification process, the system will still allow you to continue with the application, but an SSA representative will need to contact you later to finalize it. - Provide Necessary Information: The application will ask for key personal and historical information. It is helpful to gather this information before you begin:

- Basic personal details: Full name, Social Security number, date and place of birth.

- Employment information: Details about your work history and any military service.

- Health insurance information: Start and end dates for any current or past group health plans you have had through an employer (yours or a spouse’s) since age 65.

- Save Your Progress: If you are signed into your

my Social Securityaccount, the system will automatically save your application, allowing you to exit and return later. If you are not signed in, the system will provide a “Re-entry Number.” It is crucial to write down or print this number, as it is the only way to access your saved application later. - Review and Submit: Once all sections are complete, you will be shown a summary of your application. Review all the information carefully for accuracy. You will then sign the application electronically and select “Submit Now”.

- Confirmation: After submission, the website will display a confirmation receipt with an application number. You should save or print this page for your records. This number can be used to check the status of your application online.

Essential National Toll-Free Numbers

For those who cannot use the online services or prefer to speak with a representative, the following national toll-free numbers are the primary points of contact:

- Social Security Administration: The number is 1-800-772-1213 (TTY: 1-800-325-0778). Representatives are available on weekdays from 8:00 AM to 7:00 PM, local time. To minimize wait times, the SSA advises calling early in the morning (between 8:00 AM and 10:00 AM) or later in the afternoon, and during the latter half of the week (Wednesday through Friday). This number should be used for questions about eligibility and to enroll in Original Medicare Parts A and B.

- Medicare: The number is 1-800-MEDICARE (1-800-633-4227) (TTY: 1-877-486-2048). This line is operated by CMS and is available 24 hours a day, 7 days a week. It should be used for questions about what Medicare covers, claims and appeals, and for assistance with finding and enrolling in Medicare Advantage (Part C) and Prescription Drug (Part D) plans.

Comprehensive Directory of Social Security Administration Offices in Florida

For individuals who require in-person assistance after exploring the online and phone options, the following is a comprehensive directory of Social Security Administration field offices located throughout the state of Florida. It is strongly advised to call the national toll-free number (1-800-772-1213) to schedule an appointment before visiting any of these locations to ensure efficient service and avoid potential delays. The phone numbers provided for individual offices typically route to this same national call center. Standard operating hours for these offices are Monday through Friday, from 9:00 AM to 4:00 PM. All offices are closed on federal holidays.

| City/Office Name | Full Physical Address | National Phone Number | Office Fax Number | Standard Hours of Operation |

| Allapattah | 1251 NW 36th St, Ground Floor, Miami, FL 33142 | 1-877-405-0469 | 1-833-950-2218 | Mon-Fri: 9:00 AM – 4:00 PM |

| Belle Glade | 925 SE 1st St, Belle Glade, FL 33430 | 1-855-257-0983 | 1-833-950-2814 | Mon-Fri: 9:00 AM – 4:00 PM |

| Boca Raton | 621 NW 53rd St, Suite 400, Boca Raton, FL 33487 | 1-800-772-1213 | 1-833-950-3757 | Mon-Fri: 9:00 AM – 4:00 PM |

| Bradenton | 5540 State Road 64 E, Suite 100, Bradenton, FL 34208 | 1-877-803-6316 | 1-833-950-2227 | Mon-Fri: 9:00 AM – 4:00 PM |

| Carrollwood | 4010 Gunn Hwy, Suite 100, Tampa, FL 33618 | 1-855-433-5873 | 1-833-921-1895 | Mon-Fri: 9:00 AM – 4:00 PM |

| Clearwater | 2340 Drew St, Clearwater, FL 33765 | 1-888-397-5325 | 1-833-950-2204 | Mon-Fri: 9:00 AM – 4:00 PM |

| Cocoa | 310 Canaveral Groves Blvd, Cocoa, FL 32926 | 1-866-964-0798 | 1-833-902-2712 | Mon-Fri: 9:00 AM – 4:00 PM |

| Dade City | 36630 Adair Rd, Dade City, FL 33525 | 1-866-562-1325 | 1-833-950-2816 | Mon-Fri: 9:00 AM – 4:00 PM |

| Deland | 1629 S Adelle Ave, Deland, FL 32720 | 1-866-964-7396 | 1-833-950-2208 | Mon-Fri: 9:00 AM – 4:00 PM |

| East Hillsborough | 2027 S Parsons Ave, Seffner, FL 33584 | 1-866-593-8721 | 1-833-950-2532 | Mon-Fri: 9:00 AM – 4:00 PM |

| Fort Lauderdale East | 3201 W Commercial Blvd, Suite 100, Fort Lauderdale, FL 33309 | 1-877-253-4720 | 1-833-710-0167 | Mon-Fri: 9:00 AM – 4:00 PM |

| Fort Myers | 4220 Executive Cir, Suite 25, Fort Myers, FL 33916 | 1-888-318-9114 | 1-833-795-0128 | Mon-Fri: 9:00 AM – 4:00 PM |

| Fort Walton Beach | 111B Racetrack Rd NW, Fort Walton Beach, FL 32547 | 1-866-331-2194 | 1-833-950-2514 | Mon-Fri: 9:00 AM – 4:00 PM |

| Gainesville | 4562 NW 13th St, Gainesville, FL 32609 | 1-877-219-8323 | 1-833-710-0163 | Mon-Fri: 9:00 AM – 4:00 PM |

| Hialeah | 6500 W 21st Ct, Hialeah, FL 33016 | 1-866-269-4250 | 1-833-950-2214 | Mon-Fri: 9:00 AM – 4:00 PM |

| Jacksonville North | 1685 Dunn Ave, Jacksonville, FL 32218 | 1-866-635-0789 | 1-833-950-2216 | Mon-Fri: 9:00 AM – 4:00 PM |

| Lake City | (Address Not Provided in Source) | 1-877-600-2859 | 1-833-905-2054 | Mon-Fri: 9:00 AM – 4:00 PM |

| Little Havana | 3663 SW 8th St, 1st Floor, Miami, FL 33135 | 1-877-714-0373 | 1-833-950-3763 | Mon-Fri: 9:00 AM – 4:00 PM |

| Little River | 8345 Biscayne Blvd, Miami, FL 33138 | 1-877-405-0468 | 1-833-950-3755 | Mon-Fri: 9:00 AM – 4:00 PM |

| Marianna | 4125 Jireh Ct, Marianna, FL 32448 | 1-888-397-4815 | 1-833-950-3753 | Mon-Fri: 9:00 AM – 4:00 PM |

| Melbourne | 1715 W Nasa Blvd, Melbourne, FL 32901 | 1-866-716-7667 | 1-833-913-2069 | Mon-Fri: 9:00 AM – 4:00 PM |

| Miami Beach | 1801 Alton Rd, Suite 200, Miami Beach, FL 33139 | 1-877-714-0374 | 1-833-795-0130 | Mon-Fri: 9:00 AM – 4:00 PM |

| Miami North | 16900 NW 12th Ave, Miami, FL 33169 | 1-866-331-2231 | 1-833-795-0125 | Mon-Fri: 9:00 AM – 4:00 PM |

| Miami South | 11401 W Flagler St, Miami, FL 33174 | 1-866-331-7129 | 1-833-921-1879 | Mon-Fri: 9:00 AM – 4:00 PM |

| Naples | 2659 Professional Cir, Suite 1114, Naples, FL 34119 | 1-888-294-0161 | 1-833-950-3467 | Mon-Fri: 9:00 AM – 4:00 PM |

| New Port Richey | 7601 Little Rd, Suite 102, New Port Richey, FL 34654 | 1-866-593-5679 | 1-833-913-2073 | Mon-Fri: 9:00 AM – 4:00 PM |

| North Broward | 5195 Coconut Creek Pkwy, Margate, FL 33063 | 1-866-704-4856 | 1-833-913-2077 | Mon-Fri: 9:00 AM – 4:00 PM |

| Ocala | 933 E Silver Springs Blvd, Ocala, FL 34470 | 1-877-626-9911 | 1-833-913-2071 | Mon-Fri: 9:00 AM – 4:00 PM |

| Orlando | 5520 Gatlin Ave, Suite 101, Orlando, FL 32812 | 1-866-964-6146 | 1-833-579-0467 | Mon-Fri: 9:00 AM – 4:00 PM |

| Port Charlotte | 1600 Tamiami Trl, Suite 200, Port Charlotte, FL 33948 | 1-877-405-0490 | 1-833-950-2192 | Mon-Fri: 9:00 AM – 4:00 PM |

| Port Orange | 4990 S Clyde Morris Blvd, Port Orange, FL 32127 | 1-866-210-8089 | 1-833-710-0165 | Mon-Fri: 9:00 AM – 4:00 PM |

| Port St. Lucie | 6810 S US Hwy 1, Port St. Lucie, FL 34952 | 1-866-366-1627 | 1-833-950-2202 | Mon-Fri: 9:00 AM – 4:00 PM |

| St. Petersburg | (Address Not Provided in Source) | 1-866-613-3965 | 1-833-710-0161 | Mon-Fri: 9:00 AM – 4:00 PM |

| Winter Haven | (Address Not Provided in Source) | 1-877-457-1739 | 1-833-950-2518 | Mon-Fri: 9:00 AM – 4:00 PM |

Note: Data compiled from multiple sources. Some addresses were not available in the provided materials. It is recommended to verify the address using the SSA Office Locator tool online before visiting.

Understanding Your Medicare Coverage Options: A Foundational Overview

Once enrollment in Original Medicare is complete, the next phase of the journey begins: understanding and selecting the right combination of coverage to meet individual health and financial needs. The Medicare system is a complex, hybrid public-private ecosystem. The initial enrollment through the SSA is a standardized interaction with a government agency. The subsequent steps, however, require beneficiaries to act as consumers in a competitive private insurance marketplace. This transition requires a shift in mindset and a foundational understanding of the different “parts” of Medicare.

Original Medicare (The Federal Program)

Original Medicare is the traditional, fee-for-service health plan managed directly by the federal government. It consists of two parts:

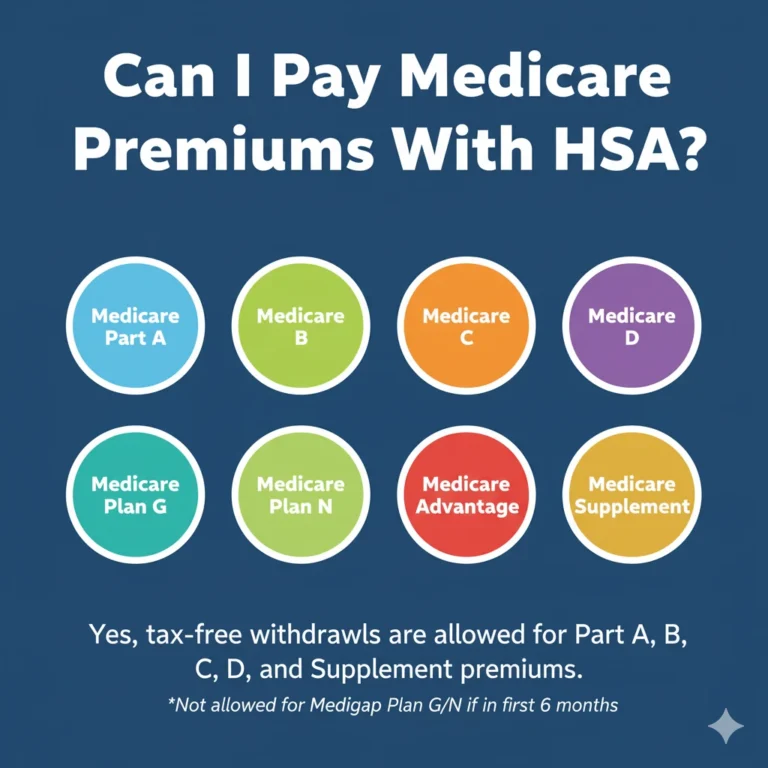

- Part A (Hospital Insurance): This part helps cover costs associated with inpatient care. This includes semi-private rooms in hospitals, care in a skilled nursing facility (following a qualifying hospital stay), hospice care, and some home health care services. For most individuals who have worked and paid Medicare taxes for at least 10 years (or whose spouse has), Part A is premium-free.

- Part B (Medical Insurance): This part helps cover a wide range of outpatient medical services and supplies. This includes services from doctors and other healthcare providers, outpatient hospital care, durable medical equipment (like walkers and oxygen tanks), ambulance services, and many preventive services such as flu shots and cancer screenings. Part B requires a standard monthly premium, which can be deducted from Social Security benefits.

Private Insurance Options (The Marketplace)

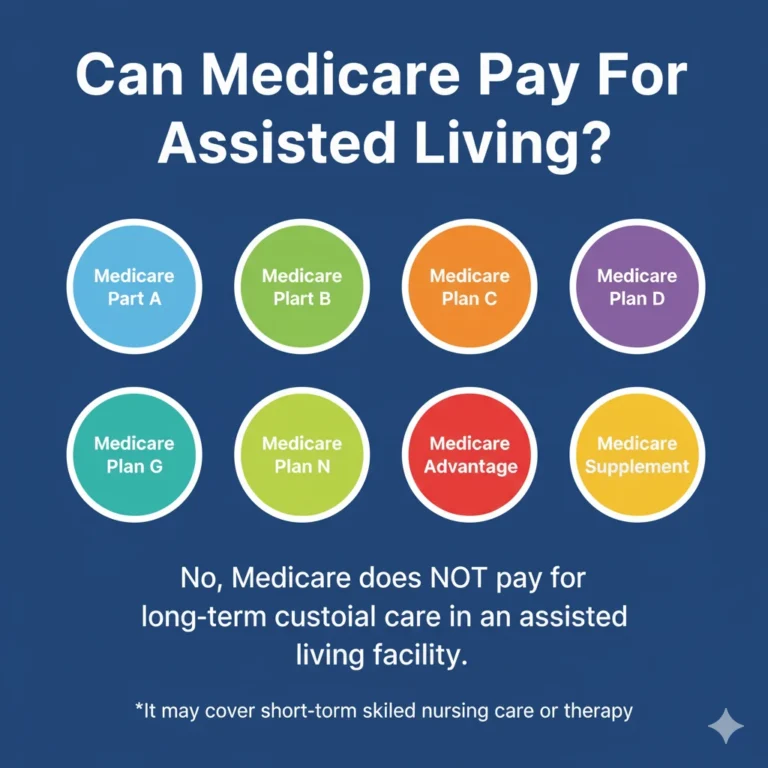

Original Medicare provides a solid foundation of coverage, but it does not cover everything. There are deductibles, coinsurance, and copayments that beneficiaries are responsible for. Most notably, Original Medicare does not cover most prescription drugs, routine dental or vision care, or hearing aids. To fill these gaps, beneficiaries can choose to purchase plans from private insurance companies that are approved and regulated by Medicare.

- Part C (Medicare Advantage): These are all-in-one, bundled plans offered by private insurers. By law, Medicare Advantage plans must cover all the services that Original Medicare (Parts A and B) covers. However, instead of the government paying claims, the private plan does. Most Medicare Advantage plans also include prescription drug coverage (Part D). A key appeal of these plans is that they often include extra benefits not covered by Original Medicare, such as routine dental, vision, and hearing services, as well as fitness program memberships. These plans typically have provider networks, such as HMOs or PPOs, which may require members to use specific doctors and hospitals to receive the lowest costs.

- Part D (Prescription Drug Coverage): This part helps cover the cost of prescription drugs. Part D coverage is only available through private insurance companies. It can be obtained in two ways: as part of a bundled Medicare Advantage plan (often called an MA-PD plan) or as a standalone Prescription Drug Plan (PDP) that can be paired with Original Medicare.

- Medicare Supplement Insurance (Medigap): These policies are also sold by private companies and are designed to work alongside Original Medicare. A Medigap policy helps pay for some or all of the out-of-pocket costs that Original Medicare leaves behind, such as deductibles, coinsurance, and copayments. There are several standardized Medigap plans (e.g., Plan G, Plan N), each offering a different level of coverage. It is a critical rule that an individual cannot have both a Medicare Advantage plan and a Medigap policy at the same time.

Pathways to Enrollment: Choosing and Purchasing Your Medicare Plan

With a clear understanding of the available options, the next step is to navigate the enrollment process for the chosen coverage path. This involves using official, unbiased government tools designed to empower consumers to make informed decisions based on their specific needs.

Enrolling in Original Medicare (A & B)

As established previously, the sole authority for enrolling individuals into Original Medicare is the Social Security Administration. This can be accomplished through one of three methods:

- Online: Using the SSA.gov application portal, as detailed in Section II.

- By Phone: Calling the SSA national toll-free number at 1-800-772-1213.

- In-Person: Scheduling an appointment at a local SSA field office, as listed in the directory in Section III.

Choosing a Private Plan (Medicare Advantage & Part D)

For those seeking coverage beyond Original Medicare, the process shifts from the SSA to the private insurance market. To navigate this complex landscape, CMS provides a powerful, free, and unbiased online tool: the Medicare Plan Finder. This tool is the great equalizer in the Medicare marketplace. It takes the hundreds of variables that differentiate private plans—premiums, deductibles, drug formularies, pharmacy networks, and copayments—and synthesizes them into a single, personalized, and comparable metric: the total estimated annual cost for a specific individual. Mastering this tool is the single most valuable skill a Medicare beneficiary can develop to ensure they are choosing the most cost-effective plan for their needs.

Detailed Step-by-Step Tutorial for Using the Medicare Plan Finder (Medicare.gov/plan-compare)

The following is a detailed walkthrough of how to use the official Medicare Plan Finder tool to compare and enroll in Medicare Advantage and Part D plans.

- Getting Started: Navigate to the official website:

www.medicare.gov/plan-compare. You will be given the option to “Log In” or “Continue without logging in.”- Recommendation: It is highly recommended to create a secure

MyMedicareaccount and log in. This allows the tool to automatically pull your prescription drug history from the past 12 months, saving significant data entry time. It also allows you to save your drug list and plan comparisons for future reference. If you choose to continue without logging in, you will have to enter all information manually and cannot save your work.

- Recommendation: It is highly recommended to create a secure

- Entering Your Information: The tool will first ask for basic information to customize the search results.

- Enter your ZIP code to see plans available in your service area.

- Select the type of plan you are searching for (e.g., Medicare Advantage Plan, Medicare drug plan).

- Indicate whether you receive “Extra Help” or assistance from Medicaid, as this significantly affects cost calculations.

- Building Your Drug List: This is the most critical step for an accurate cost comparison.

- Select “Yes” when asked if you want to see drug costs when you compare plans.

- Begin typing the name of your first prescription drug. A list of matching medications will appear. Select the correct one.

- For each drug, you must specify the exact dosage, quantity, and frequency (e.g., 30 pills per month). Use your prescription bottles for reference to ensure accuracy.

- Continue this process, adding each of your prescription medications to the list. When you have entered all of them, click “Done Adding Drugs”.

- Selecting Your Pharmacies: The cost of your medications can vary depending on which pharmacy you use, as many plans have networks of “preferred” pharmacies with lower copays.

- The tool will display a list of pharmacies near your ZIP code, including mail-order options.

- You can select up to five pharmacies that you use or would be willing to use. This allows the tool to calculate and compare your costs at each location for every plan.

- After making your selections, click “Done”.

- Reviewing and Comparing Plans: The Plan Finder will now display a list of all available plans, sorted by default from the lowest to the highest total estimated annual cost. This figure includes the plan’s monthly premium plus all your estimated out-of-pocket costs for your specific drugs at your chosen pharmacies.

- For each plan, you can view key details like the monthly premium, the annual drug deductible, the overall quality star rating, and whether your drugs are on the plan’s formulary.

- To perform a direct comparison, you can select up to three plans by checking the “Add to Compare” box. This will generate a side-by-side table that clearly lays out the differences in costs and benefits.

- Click on “Plan Details” for any plan to see comprehensive information, including copays for doctor visits, hospital stays, and a month-by-month breakdown of your estimated drug costs.

- Enrolling in a Plan: Once you have identified the best plan for your needs, you can enroll directly through the Plan Finder website.

- A green “Enroll” button is available on the plan results page, the comparison page, and the plan details page.

- Clicking this button will take you to a secure online enrollment form. If you are logged into your

MyMedicareaccount, much of your personal information will be pre-filled. - Complete the form and submit it. You will receive a confirmation number as proof of your enrollment. Your new coverage will typically begin on the first day of the following month, or on January 1st if you are enrolling during the annual Open Enrollment Period.

The Role of Licensed Insurance Agents in Florida’s Medicare Market

While the Medicare Plan Finder is an invaluable tool for independent research, many individuals prefer the personalized guidance of a professional. Licensed insurance agents, particularly independent brokers who are certified to sell plans from multiple insurance companies, can play a significant role in the Medicare enrollment process. A knowledgeable agent can help simplify complex options, conduct a personal needs analysis, answer specific questions, and assist with the application process. However, because agents are compensated via commissions from the insurance companies for the plans they sell, it is imperative for consumers to perform their own due diligence to ensure they are working with a reputable and trustworthy advisor.

A Consumer’s Guide to Vetting Any Insurance Advisor

The responsibility for selecting a qualified and ethical agent ultimately rests with the consumer. The following steps provide a universal framework for vetting any insurance professional in Florida, ensuring a safe and informed decision.

- Step 1: Verify Licensing and Status: The first and most crucial step is to confirm that the agent holds a valid license to sell health insurance in the state of Florida. This can be done through the official “Licensee Search” portal on the website of the Florida Department of Financial Services, Division of Insurance Agent and Agency Services. A search by the agent’s full name or license number will confirm whether their license is active and what types of insurance they are authorized to sell.

- Step 2: Check for Disciplinary Actions: The same state portal that verifies licensing also provides public access to information regarding any regulatory or disciplinary actions taken against an agent. This is a non-negotiable step in the vetting process. It reveals any formal complaints, fines, or license suspensions, providing a clear picture of the agent’s professional conduct and history.

- Step 3: Understand Compensation and Scope: It is important to understand how an agent is paid. Agents receive a commission from the insurance carrier for each plan they sell; this service comes at no direct cost to the consumer. Consumers should also ask how many different insurance companies the agent is appointed to represent. An agent who represents a wide array of carriers is better positioned to find a plan that truly fits the client’s needs, as opposed to a “captive” agent who can only offer products from a single company.

- Step 4: Seek Unbiased Reviews and Multiple Opinions: Look for reviews from a variety of independent sources to get a sense of other clients’ experiences. Furthermore, it is wise to speak with more than one agent. This allows a consumer to compare recommendations and see if the advice is consistent. If different agents recommend vastly different plans, it is a signal to ask more questions and dig deeper into the reasons behind their suggestions.

Navigating the Specific Query about Steve Turner Insurance Specialist

The request for information about a specific agent, Steve Turner of Steve Turner Insurance Specialist, provides a valuable real-world case study for this vetting process. Online reviews for this agency are overwhelmingly positive, frequently highlighting strong customer service, deep knowledge of Medicare options, and a willingness to provide personalized, easy-to-understand guidance.

However, the process of thorough due diligence sometimes uncovers complex or conflicting information. A search of public records reveals a Department of Justice press release from the U.S. Attorney’s Office for the District of Columbia, which mentions an individual named Turner in connection with a health care fraud case. It is critically important to exercise caution and precision when considering such information. It may or may not refer to the same individual, and its context is specific to a particular case in a different jurisdiction. This information is presented here not as an accusation, but as a clear and powerful demonstration of why the independent verification steps outlined above are so essential for any professional a consumer considers engaging.

Ultimately, this scenario underscores the core principle of consumer empowerment. The most effective way to navigate the private Medicare market is not to rely solely on one source of information, but to use the official state and federal tools available to verify credentials, check for regulatory history, and compare plan options independently. This approach allows a consumer to benefit from the expertise an agent may offer while retaining the final, informed authority over their own healthcare decisions.

Finding Your Trusted Advisor in the Florida Medicare Market

We have taken a very detailed look at Medicare for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Medicare in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Medicare specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Medicare plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system allows you to get free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Medicare Insurance Carriers. An expert like Steve can help you navigate the 2026 Medicare market, find the most competitively priced Medicare plans for you, and ensure you have a Medicare plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

MEDICare INSURANCE POSTS

INSURANCE OFFERINGS

Where Are Medicare Offices Located In FL?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.