How Can I Compare Life Insurance Quotes Online Quickly?

As an Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I know that your time is just as valuable as your financial security.

In 2026, the digital world has made it possible to order a pizza, buy a car, and even close on a house in Downtown Tampa with just a few clicks. Naturally, people ask: “How can I compare life insurance quotes online quickly?” For residents of the Tampa-Saint Petersburg-Clearwater Metro Area, the answer is a mix of high-speed technology and local expertise. While anyone can generate a “quote” in 60 seconds, getting an accurate quote that actually leads to a policy is a different story. In this deep-dive analysis, we will explore the best tools, the potential pitfalls of “instant” pricing, and how to navigate the Florida insurance market like a pro.

The 2026 Digital Landscape for Tampa Bay Residents

The Tampa-Saint Petersburg-Clearwater Metro Area has become a tech hub, and our insurance market reflects that. Whether you are at your office in Westshore, a coffee shop in Edge District, or at home in Safety Harbor, you have access to “aggregator” sites that promise to scan dozens of companies at once.

However, Florida has unique insurance regulations. Rates for residents in Hillsborough and Pinellas counties are filed with the state, meaning that while the process can be fast, the underwriting—the part where they decide if you’re healthy enough—is still the gatekeeper.

Step-by-Step: How to Compare Life Insurance Quotes Online Quickly

To get the most accurate results in the shortest amount of time, follow this professional “battle plan” designed specifically for our local residents.

1. Gather Your Vital Stats

The speed of a quote depends on how much data you have ready. Before you open a browser, have the following details for everyone in your Clearwater or St. Pete household who needs coverage:

- Height and Weight: Be honest! This is the #1 reason quotes change during the application.

- Medical History: Specifically, any prescriptions you take for blood pressure or cholesterol.

- Family History: Did your parents have heart disease or cancer before age 60?

- Driving Record: In the Tampa Bay Metro, insurers look closely at DUIs and major speeding tickets from the last 3-5 years.

2. Use a “Multi-Carrier” Aggregator

Instead of visiting MetLife, Prudential, and State Farm individually, use a platform that “scrapes” all of them at once. In 2026, top-tier online marketplaces allow Tampa-Saint Petersburg-Clearwater Metro Area Residents to see side-by-side comparisons in under two minutes.

3. Focus on “Accelerated Underwriting.”

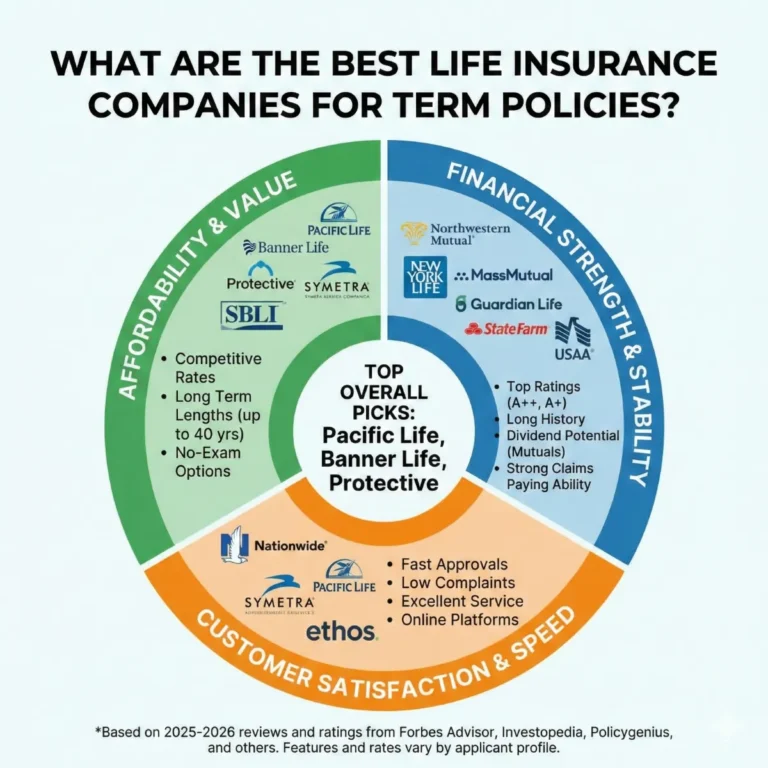

If speed is your priority, look for keywords like “No-Exam,” “Fluidless,” or “Instant Decision.” Carriers like Pacific Life, Banner Life, and Symetra now offer policies up to $2,000,000 or $3,000,000 for healthy residents of Tampa and Clearwater without requiring a nurse to visit your home.

Comparing Different Insurance Plans: Pros and Cons

When you are looking at quotes online, you aren’t just comparing prices—you are comparing structures. Here is the breakdown of what you’ll see in the Tampa Bay market.

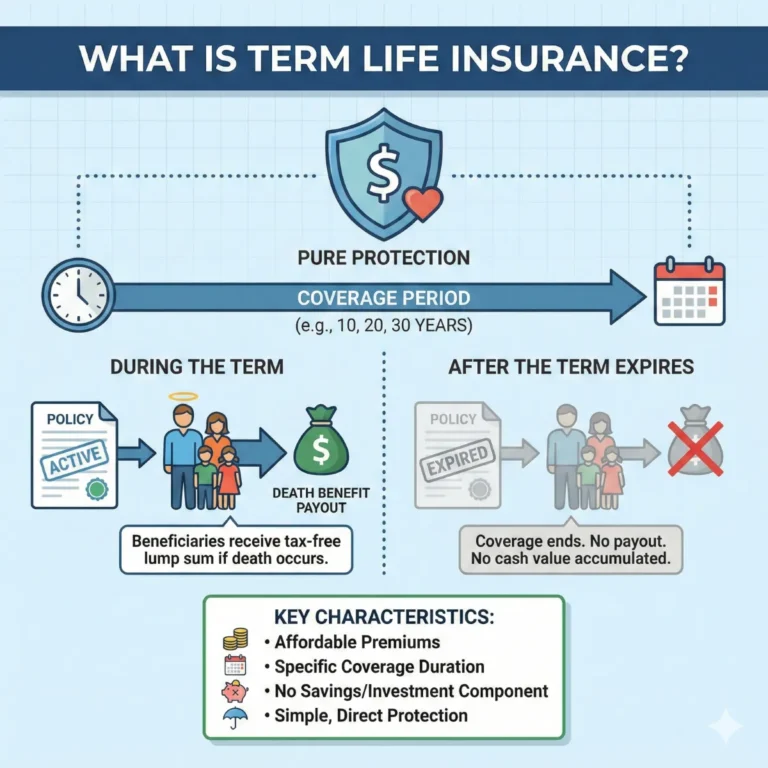

Plan Type: Term Life Insurance

- Pros: The fastest to quote and buy. It is the most affordable option for young families in Largo or Palm Harbor.

- Cons: It’s temporary. If you outlive the 20 or 30-year term, you have nothing to show for your premiums.

- 2026 Pricing Note: A healthy 35-year-old male in Tampa can often find a $500,000 policy for roughly $30–$35 per month.

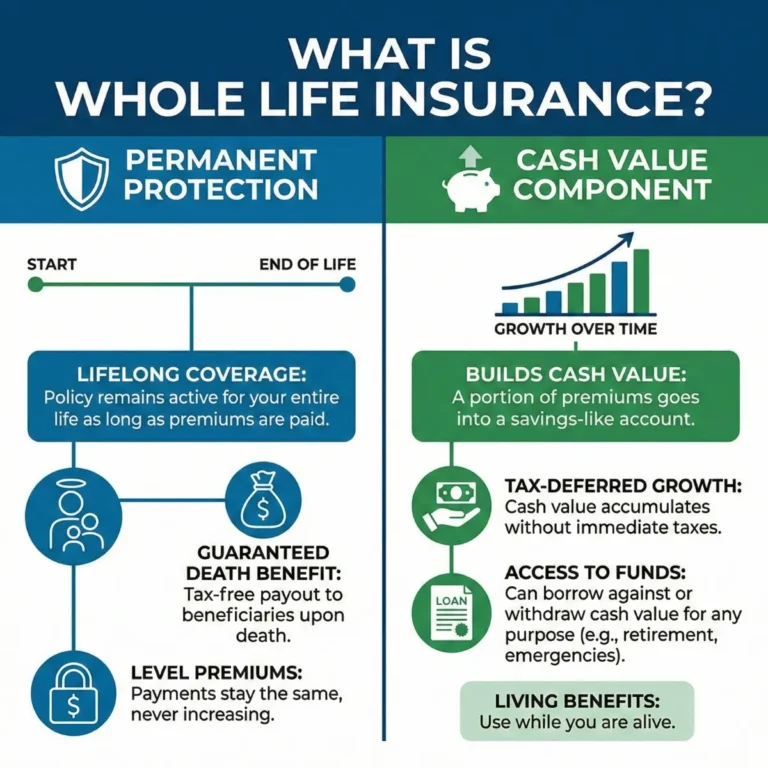

Plan Type: Whole Life Insurance

- Pros: It’s permanent. It builds “cash value” that you can borrow against to fund a renovation in Old Northeast or help with a grandchild’s tuition at USF.

- Cons: Much slower to quote accurately. It can be 10x to 15x more expensive than term.

- 2026 Pricing Note: That same 35-year-old might pay $400+ per month for the same death benefit.

Plan Type: “No-Exam” (Simplified Issue)

- Pros: You can be covered by the time you finish your morning coffee in Clearwater. No needles, no doctors.

- Cons: If you have health issues, the “algorithm” might decline you instantly, whereas a human underwriter might have approved you.

- Pros/Cons Analysis: It’s best for people in “Standard” or better health.

2026 Price Comparison Table: Term Life for Tampa Bay Residents

To give you an idea of what to expect when you compare quotes online, here are the average monthly premiums for a $500,000 20-Year Term Policy in our metro area.

| Age | Male (Tampa) | Female (St. Pete) |

| 25 | $28.00 | $22.00 |

| 35 | $36.00 | $29.00 |

| 45 | $84.00 | $66.00 |

| 55 | $201.00 | $143.00 |

| 65 | $515.00 | $385.00 |

Data reflects 2026 market averages for non-smokers in “Standard Plus” health. Prices are estimates and subject to change.

The Pitfalls of “Instant” Online Quotes

As an Insurance Agent and Broker, I have to warn my neighbors in the Tampa-Saint Petersburg-Clearwater Metro Area about the “Quote Bait” tactic.

1. The “Starting At” Price

Many online tools will show you a price of $15 a month. This price is almost always reserved for a 22-year-old marathon runner with perfect DNA. If you are a 45-year-old living in South Tampa with a high-stress job and a few extra pounds, your actual price will be higher.

2. The Data Sell

When you enter your phone number into a generic “compare quotes” site, your information is often sold to dozens of call centers. You might start getting 20 calls a day from agents in other states who don’t understand the Florida Homestead laws or the specifics of our local health systems.

3. Missing the “Fine Print.”

Quick online quotes often leave out “riders.” For example, a Living Benefits rider allows you to access your death benefit if you are diagnosed with a chronic illness while living in Clearwater. Many “cheap” online quotes strip these away to make the price look lower.

SEO Long-Tail Keywords: What to Search For

If you are looking for the best life insurance in Tampa, your search terms matter. Avoid generic terms and use “long-tail” phrases that reflect your actual needs:

- “No-exam life insurance Clearwater, FL for seniors.”

- “Term life insurance quotes for smokers in Saint Petersburg”

- “Affordable mortgage protection insurance Tampa Bay area”

- “Life insurance companies with living benefits, Florida 2026.”

By using these specific terms, you bypass the “junk” sites and find specialized resources designed for the Tampa-Saint Petersburg-Clearwater Metro Area.

The Local Advantage: Why a Broker Wins Over an Algorithm

While technology is great for a “quick look,” it cannot replace the deep analysis that a local expert provides.

Local Health Underwriting

Did you know that some insurance companies treat “Florida-specific” health issues differently? If you’ve had a history of non-melanoma skin cancer (very common in Clearwater), some “quick” online tools will automatically “rate” you as high risk. A local broker knows which companies are “skin-cancer friendly” and will give you the same rate as someone who stays indoors all day.

Coordination with Local Professionals

If you are working with an estate attorney in Downtown St. Pete or a financial planner in Tampa, your insurance needs to be part of that larger puzzle. An online “bot” won’t talk to your CPA; a broker will.

Deep Analysis: The Cost of Waiting

In the Tampa-Saint Petersburg-Clearwater Metro Area, we are seeing a trend where residents wait too long to secure their “Final Quote.”

Mathematically, life insurance premiums increase by roughly 5% to 8% every year you wait. But there is a bigger risk: the “Health Event.”

Scenario: A 40-year-old in St. Pete looks for a quote in January but “thinks about it.” In June, they are diagnosed with high blood pressure. Their “Quick Quote” just jumped by 30% for the rest of their life.

Frequently Asked Questions for Tampa Bay Residents

“Can I really get a policy without a medical exam in Tampa?”

Yes. In 2026, roughly 60% of my clients in the Tampa-Saint Petersburg-Clearwater Metro Area qualify for “Accelerated Underwriting.” If your medical records (which are now mostly digital) show you are in good standing, the exam is waived.

“Are online quotes higher or lower than agent quotes?”

They are exactly the same. Life insurance rates are filed with the Florida Office of Insurance Regulation. Whether you buy it from a website or a local broker in Saint Petersburg, the price for a specific policy from a specific company is identical.

“What is the best term length for a mortgage in Clearwater?”

Most residents choose a 20 or 30-year term to match their mortgage. However, with the rapid appreciation of homes in Hillsborough and Pinellas, many are opting for a “Ladder” strategy—having a large policy for the first 15 years and a smaller one thereafter.

Conclusion: Speed Meets Strategy

Comparing life insurance quotes online quickly is a fantastic way to start your journey. It gives you a “ballpark” figure and helps you understand the different plans available to Tampa, Saint Petersburg, and Clearwater Area Residents.

However, don’t let the pursuit of speed lead you to a sub-par policy. You want a plan that actually pays out when your family in Tampa Bay needs it most. You want a plan that considers your local needs, your health nuances, and your long-term goals.

Steve Turner Insurance Specialist is here to ensure you get the best of both worlds. He uses the fastest digital tools in the industry to provide you with a high-speed comparison, but he backs it up with the deep analysis and “double-checking” that only an expert with years of experience can provide.

The best part? Steve’s services are 100% free to you. Like all independent agents and brokers, he is compensated by the insurance company that you choose. You get a local advocate, a policy expert, and a deep-dive analysis without ever seeing a bill from his office.

Would you like me to run a “Top 5” side-by-side comparison of the most affordable term life quotes currently available for your age and zip code in the Tampa Bay area?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

How Can I Compare Life Insurance Quotes Online Quickly?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.