Can Life Insurance Refuse To Pay Out?

As an Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I’ve heard one fear more than any other: “What if I pay my premiums for years, and then the insurance company refuses to pay my family when I’m gone?”

It is a chilling thought. You’ve done the responsible thing—you’ve budgeted for premiums while living in South Tampa, you’ve planned for your children’s education at USF, and you’ve secured a mortgage on a beautiful home in Palm Harbor. The idea that a massive corporation could simply “say no” to your beneficiaries is enough to make anyone hesitate.

But here is the reality: Life insurance companies in the Tampa-Saint Petersburg-Clearwater Metro Area actually want to pay claims. Their business model depends on a reputation for reliability. However, there are specific, legally defined circumstances where a payout can be refused. In this 2026 deep-dive analysis, we are going to explore the legal “trapdoors,” the protections offered by Florida law, and how you can ensure your policy is an ironclad guarantee for your loved ones.

The Statistical Reality: Do Claims Get Denied? Can Life Insurance Refuse To Pay Out?

Before we dive into the “why,” let’s look at the “how often.” Data for 2026 shows that more than 98% of all life insurance claims are paid in full and on time. The “refusal” that people fear is actually quite rare. When a denial does occur, it is almost always linked to one of a handful of specific issues that could have been prevented at the time of application.

For residents of the Tampa, Saint Petersburg, and Clearwater Metro Area, understanding these risks is the first step toward total financial peace of mind.

1. The 2-Year Contestability Period: Florida’s Legal Clock

If there is one thing every resident of Pinellas, Hillsborough, and Pasco counties needs to know, it is the Contestability Period.

Under Florida Statute § 627.455, every life insurance policy sold in the state must include a “Two-Year Incontestability Clause.” This is a massive consumer protection for us.

How it Works:

- The First Two Years: If the insured passes away within the first 24 months of the policy’s effective date, the insurance company has the legal right to “contest” the claim. They will re-examine the original application and medical records to ensure everything was 100% accurate.

- After Two Years: Once the policy has been in force for two years, the company cannot refuse to pay based on errors or misstatements on the application (unless they can prove deliberate, egregious fraud).

Expert Note: This means that even if you accidentally forgot to mention a minor surgery you had at BayCare three years ago, once you’ve crossed that two-year mark, your family’s payout is essentially bulletproof in the eyes of Florida law.

2. Why Life Insurance Refuses to Pay: The “Material Misrepresentation.”

The #1 reason for claim denial during that two-year window is Material Misrepresentation. This is insurance-speak for “you didn’t tell the whole truth on your application.”

What Counts as “Material”?

To refuse a payout, the insurance company must prove that the information you withheld was material to the risk. In other words, if they had known the truth, they would have either charged a much higher premium or refused to issue the policy altogether.

Common Examples in the Tampa Bay Metro:

- Undisclosed Tobacco Use: If you tell the company you are a non-smoker to get a lower rate, but you actually enjoy cigars on the golf courses in Clearwater, this is grounds for a denial.

- Health History Omissions: Failing to disclose a diagnosis of chronic high blood pressure or diabetes managed at Moffitt Cancer Center or Tampa General.

- Criminal History: Neglecting to mention a recent felony or a history of DUIs on the Howard Frankland Bridge.

Pro vs. Con: Comparing Non-Medical vs. Fully Underwritten Plans

- Non-Medical (No-Exam) Plans: Popular among Saint Petersburg residents who want speed. However, because the company has less data upfront, they may scrutinize the claim more heavily during the contestability period.

- Fully Underwritten Plans: You go through a medical exam in Largo or Brandon. Because the company has done its homework before issuing the policy, these claims are often paid faster and with fewer questions.

3. The Leading Cause of Refusal: Policy Lapse

Surprisingly, the most common reason a family in the Tampa-Saint Petersburg-Clearwater Metro Area doesn’t receive a payout isn’t fraud or suicide—it’s non-payment of premiums.

If a policyholder misses their payments and the “Grace Period” (usually 30–31 days in Florida) expires, the policy is “lapsed.” If the insured dies one day after the policy lapses, the company has no legal obligation to pay.

The Florida Protection on Lapses

Florida law provides a unique safety net for our seniors. For policyholders age 64 or older, insurers are required to provide a notice to a secondary addressee. This ensures that if a senior in Clearwater begins to experience cognitive decline and forgets to pay their bill, their daughter in St. Pete receives a notification before the policy is canceled.

4. Policy Exclusions: The “Fine Print.”

Every life insurance policy contains specific exclusions. These are circumstances where the company will refuse to pay, regardless of how long you’ve had the policy.

The Suicide Clause

Almost all policies in the Tampa, Saint Petersburg, and Clearwater Area have a two-year suicide exclusion. If the insured takes their own life within the first two years, the company will typically refund the premiums paid but will not pay the death benefit. After two years, however, most policies do cover suicide.

The “Illegal Acts” Exclusion

If a resident of Downtown Tampa passes away while committing a felony (such as an armed robbery or high-speed chase), the insurance company may refuse to pay.

High-Risk Hobbies (Avocation)

If you are an avid scuba diver in the Gulf of Mexico or you enjoy amateur racing at local tracks, you must disclose these. If you die while participating in an undisclosed “dangerous hobby,” the company may deny the claim.

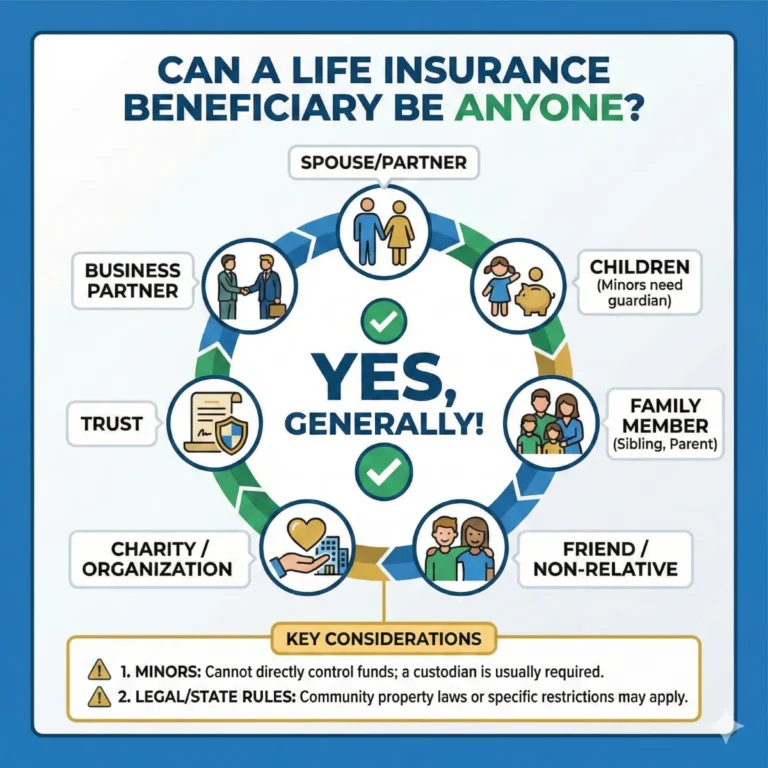

5. Beneficiary Disputes and Missing Heirs

Sometimes, the company is ready to pay, but they don’t know who to pay. This happens frequently with blended families in the Tampa Bay Metro.

- The Problem: An old policy in Saint Petersburg still lists an ex-spouse as the beneficiary.

- The Result: The current spouse and the ex-spouse both file claims. The insurance company will “interplead” the funds—meaning they hand the money over to a Florida court and let a judge decide. This can delay the payout by years.

Comparing Insurance Plans: How to Ensure a Payout

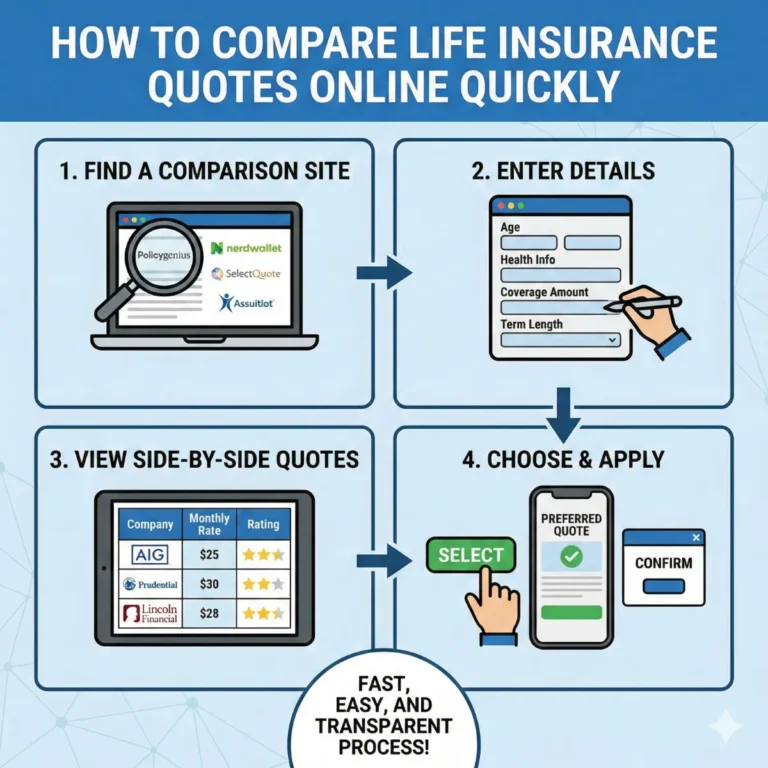

When comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, you shouldn’t just look at the premium. You must look at the carrier’s Claims-Paying Ability.

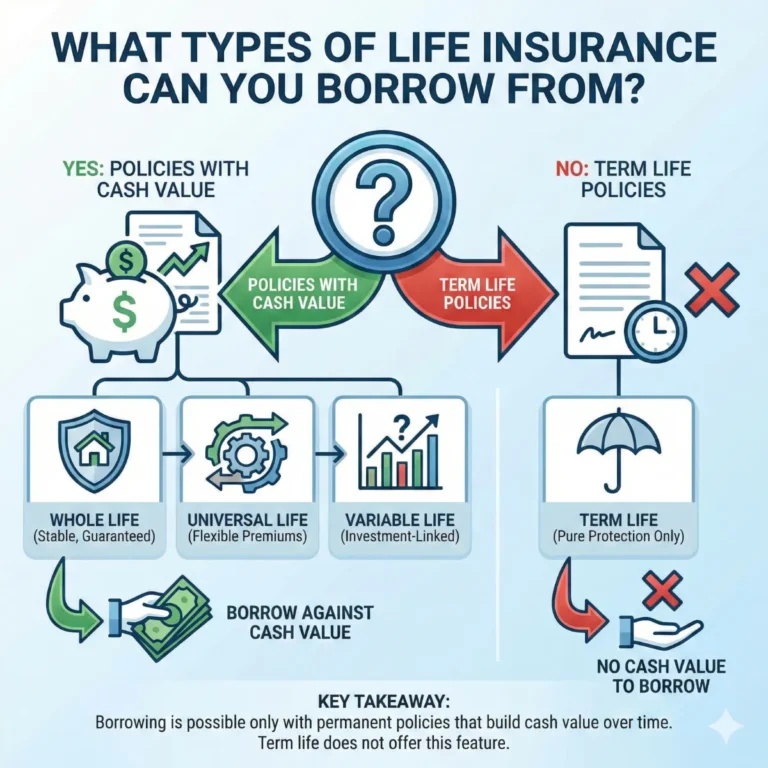

| Feature | Term Life Insurance | Whole Life Insurance |

| Payout Reliability | Very High (if in force) | Highest (permanent) |

| Risk of Refusal | Linked to lapse/non-payment | Very low (due to cash value safety net) |

| Contestability | 2 Years | 2 Years |

| Best For | Families in Clearwater on a budget | Residents in St. Pete looking for a legacy |

Top-Tier Carriers vs. Bargain Brands

In my years as an Insurance Agent and Broker, I have seen that companies like Mutual of Omaha, MassMutual, and New York Life have a much higher “Hassle-Free” payout rate than smaller, “online-only” discount carriers that may use aggressive legal tactics to contest claims.

What to Do If a Claim Is Denied in Tampa Bay

If you are a beneficiary and the insurance company has sent you a denial letter, do not panic. Residents of the Tampa-Saint Petersburg-Clearwater Metro Area have significant legal rights.

- Demand a Written Explanation: Florida law requires the insurer to provide the specific policy language and the factual basis for the denial.

- Request the “Underwriting File”: You have the right to see exactly what the company considered when it issued the policy.

- File a Complaint with the Florida DFS: The Department of Financial Services in Tallahassee monitors insurance companies. A formal complaint can often trigger a secondary review by the carrier.

- Bad Faith Lawsuits: If an insurer in Tampa denies a claim without a reasonable basis, it can be sued for “Bad Faith,” which can result in the beneficiary receiving more than the original policy limit.

SEO Insights: “Life Insurance Claims Tampa”

If you are searching for “best life insurance for seniors Clearwater” or “how to appeal a denied life insurance claim St. Petersburg,” you are looking for local protection.

In 2026, transparency is at an all-time high. The Florida Office of Insurance Regulation (OIR) now requires companies to report their claims data more frequently. This data is public, and as a broker, I use it to filter out companies that have a history of being “difficult” with our local families.

Deep Analysis: The “Lapse” Trap in 2026

With the rising costs of living in areas like Wesley Chapel and Riverview, more people are experiencing temporary financial hardship.

Expert Tip: If you can’t pay your premium, don’t just let it lapse. Many Whole Life and Universal Life policies have “Automatic Premium Loan” provisions. This allows the policy to “borrow” from its own cash value to pay the premium, keeping the coverage active for your family in Clearwater.

Frequently Asked Questions for Tampa Bay Residents

“Can they refuse to pay if I die in a hurricane?”

Absolutely not. Deaths caused by natural disasters like hurricanes in the Tampa-Saint Petersburg-Clearwater Metro Area are fully covered.

“What if I die while traveling outside of Florida?”

Life insurance is global. Whether you pass away at home in Largo or while on vacation in Europe, your policy will pay out as long as you were honest about your travel plans on the application.

“Does ‘No Medical Exam’ mean they can’t contest the claim?”

No. In fact, “No-Exam” policies often have more contestability triggers because the company didn’t have a doctor’s report to rely on at the start.

Summary of Recommendations

To make sure your life insurance never refuses to pay:

- Over-Disclose: If you aren’t sure if a medical issue is important, tell them anyway.

- Keep Receipts: Ensure your premium payments are automated and that you have a backup addressee listed.

- Review Annually: As your life changes in Tampa, Saint Petersburg, or Clearwater, make sure your beneficiaries are up to date.

- Work with an Independent Broker: We know which companies are “fair” and which ones are “litigious.”

Conclusion: Peace of Mind Is a Choice

The fear that life insurance might not pay out is common, but with the right knowledge and the right policy, it is a fear you can put to rest forever. In the Tampa-Saint Petersburg-Clearwater Metro Area, we are fortunate to have some of the strongest consumer protections in the country. By being honest on your application and diligent with your payments, you create an unbreakable shield for your family’s future.

If you have questions about a current policy or if you want to compare new plans to see which carriers have the best payout reputation in Florida, don’t navigate this alone.

Steve Turner Insurance Specialist is here to be your advocate. As an expert agent and broker who has spent years helping Tampa-Saint Petersburg-Clearwater Metro Area Residents solve their biggest financial and health care challenges, Steve understands the local market better than anyone. He takes the time to do the deep analysis, ensuring your policy is structured correctly from day one so that a payout is never in doubt.

The best part? Steve’s services are 100% free to you. Like all independent agents and brokers, he is compensated by the insurance company that you choose. You get his expertise, his research, and his localized advice at no out-of-pocket cost.

Would you like me to review your current policy and confirm whether the “Secondary Addressee” protection is enabled for your family in Tampa Bay?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

Can Life Insurance Refuse To Pay Out?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.