Can Life Insurance Policies Be Put In A Trust?

As an Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I’ve found that the most important conversations often happen after the policy is issued.

In my time serving neighbors across the Bay Area—from the quiet waterfronts of Safety Harbor to the high-rises of Downtown Tampa—one question has become increasingly common among families looking to secure their legacy: “Can life insurance policies be put in a trust?”

The short answer is a resounding yes. But as anyone who has dealt with the complexities of Florida probate or federal estate tax knows, the how and the why are where the real value lies. In 2026, the intersection of life insurance and trust planning has never been more relevant for Tampa-Saint Petersburg-Clearwater Metro Area Residents. With shifting tax laws and the unique asset protection afforded by Florida statutes, placing a policy in a trust is a strategic move that can shield your family from unnecessary legal headaches and financial loss.

Can Life Insurance Policies Be Put In A Trust?

In this deep-dive analysis, we will explore the nuances of life insurance trusts in Florida, compare the different types of insurance plans suitable for trust funding, and discuss the specific pros and cons for residents of our vibrant metro area.

What Is a Life Insurance Trust? The Basics for Tampa Bay Residents

Before we get into the “deep water,” we need to understand the vessel. A trust is essentially a legal arrangement where a third party (the trustee) holds assets on behalf of a beneficiary. When we talk about placing a life insurance policy in a trust, we usually mean an Irrevocable Life Insurance Trust (ILIT).

How an ILIT Works

In a typical family scenario in Saint Petersburg, you create the trust, and the trust itself becomes the owner and beneficiary of the life insurance policy.

- The Grantor: You (the person whose life is insured).

- The Trustee: A trusted individual or professional entity that manages the trust.

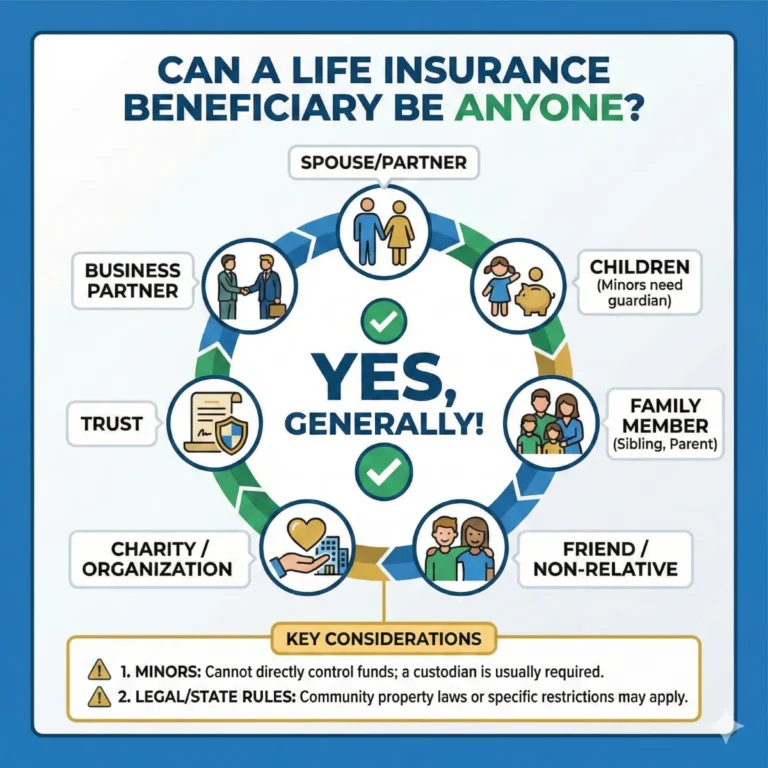

- The Beneficiary: Your spouse, children, or a charity in Clearwater.

Because you no longer own the policy, it is no longer considered part of your “estate” in the eyes of the IRS. This simple shift in ownership is the key that unlocks a treasure chest of legal and tax benefits.

Why Put Life Insurance in a Trust? The “Tampa Bay Advantage”

Why do so many of my clients in Hillsborough and Pinellas County choose this route? It comes down to three primary factors: Control, Protection, and Tax Efficiency.

1. Avoiding the Florida Probate Slow-Down

Florida’s probate courts are notoriously slow. If you name your “Estate” as your beneficiary, the life insurance proceeds could be tied up in the Pinellas or Hillsborough County probate courts for months.

Expert Note: By putting the policy in a trust, the funds bypass probate entirely. The trustee can access the death benefit immediately to pay for funeral costs, debts, or to provide an immediate income stream for your family in Tampa.

2. Strategic Asset Protection

Florida is known for its debtor-friendly laws, but those protections have limits. If you name an individual as a beneficiary, that money is vulnerable to their creditors once they receive it.

By keeping the money inside a trust, you can include “Spendthrift Provisions.” This means if your beneficiary in Clearwater is sued or goes through a divorce, the life insurance proceeds held within the trust are generally shielded from those claims.

3. Mitigating Federal Estate Taxes (The 2026 Shift)

While Florida has no state estate tax, the Federal Estate Tax is a looming concern for many wealthy families in South Tampa and Belleair. In 2026, the federal exemption levels have shifted. If your total estate (including your home, investments, and life insurance) exceeds the exemption limit, the government could take up to 40% of the excess.

By moving a $2,000,000 or $5,000,000 policy into an ILIT, you effectively remove that entire amount from your taxable estate, potentially saving your heirs millions of dollars.

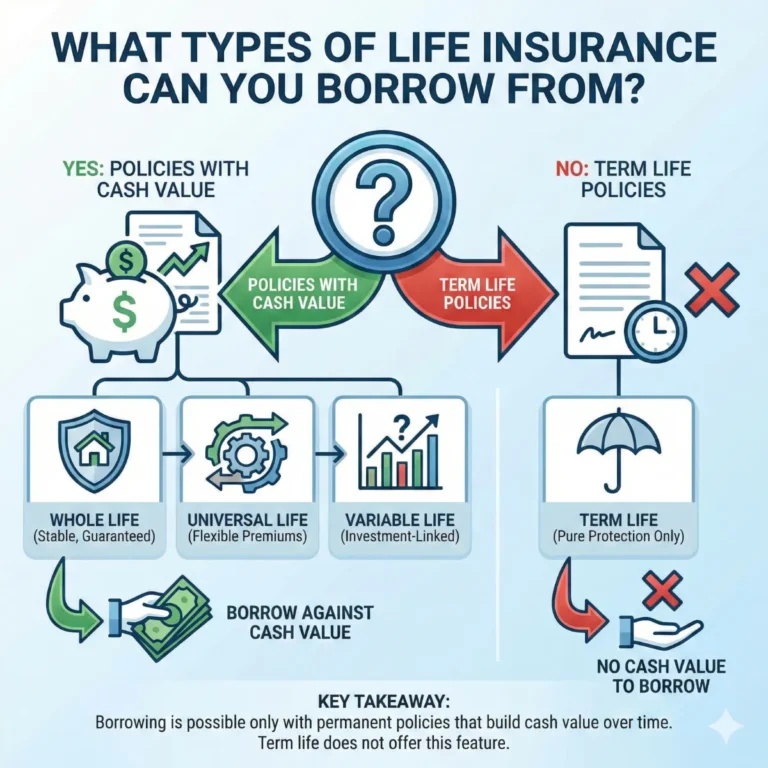

Comparing Insurance Plans: Which Ones Belong in a Trust?

When comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, it’s important to realize that not all policies are created equal for trust funding.

Term Life Insurance in a Trust

- The Setup: You might put a 30-year term policy in a trust to cover a mortgage on a home in Wesley Chapel.

- Pros: Extremely affordable; provides high liquidity for a set period.

- Cons: If you outlive the term, the trust becomes empty. You’ve paid for a structure with no asset left inside.

Whole Life and Universal Life (Permanent Insurance)

This is the “gold standard” for trust planning in the Tampa-Saint Petersburg-Clearwater Metro Area.

- Pros: Guaranteed to pay out (as long as premiums are paid); builds cash value that the trust can potentially use; provides a permanent legacy.

- Cons: Higher premiums; requires more diligent “Crummey” notices (more on that below).

Survivorship (Second-to-Die) Policies

As an Insurance Agent and Broker, I frequently recommend these for married couples in St. Pete Beach. These policies only pay out when the second spouse passes away.

- Why it works for trusts: Since estate taxes are usually deferred until the second spouse dies, this policy provides the exact amount of cash needed to pay the tax bill precisely when it’s due.

Deep Analysis: The Pros and Cons of Life Insurance Trusts

Choosing a trust is a significant commitment. Let’s look at the balance sheet for a typical Tampa Bay resident.

The Pros:

- Ultimate Distribution Control: You can dictate exactly how the money is spent. You can say, “Pay for my grandkids’ tuition at USF, but don’t give them a lump sum until they turn 30.”

- Liquidity for Illiquid Estates: If your wealth is tied up in a family business in Tampa or real estate in Clearwater, the trust provides the cash to pay taxes without forcing a “fire sale” of your assets.

- Privacy: Unlike a will, which becomes a public record in Pinellas County, a trust is a private document. Your neighbors won’t know the size of your legacy.

The Cons:

- Irrevocability: Once you move a policy into an ILIT, you cannot “take it back.” You lose the ability to change the beneficiary or borrow against the cash value yourself. You are giving up control to gain protection.

- Administrative Complexity: You must follow strict IRS rules, including sending “Crummey Letters” to beneficiaries every time you pay a premium.

- Setup Costs: You will need a qualified Florida estate attorney to draft the document, which typically costs between $2,000 and $5,000.

The “Crummey” Rule: Keeping Uncle Sam Away

If you live in Tampa, Saint Petersburg, or Clearwater, you’ve likely heard this odd term. To make sure the money you put into the trust to pay premiums isn’t taxed as a gift, you must give your beneficiaries a “present interest” in that money.

This is done by sending a Crummey Notice, giving them a short window (usually 30 days) to withdraw the gift. They almost never do, but the right to do so is what satisfies the IRS.

How to Put a Life Insurance Policy in a Trust: A Step-by-Step Guide

As an expert who has assisted many Tampa-Saint Petersburg-Clearwater Metro Area Residents through this process, I follow a specific “Roadmap to Security.”

Step 1: Deep Analysis of Your Needs

We sit down and look at your total estate. Are you worried about taxes? Spendthrift children? Protecting a special needs child in Largo? This determines the type of trust and the policy’s size.

Step 2: Drafting the Trust

You work with a local attorney to create the ILIT. It must be a standalone legal entity with its own Tax ID number.

Step 3: Acquiring the Policy

- Method A (The Best Way): The trust applies for and buys a new policy. This avoids the “3-Year Rule.”

- Method B: You transfer an existing policy to the trust.

Warning: Under IRS rules, if you transfer an existing policy and die within three years, the money is “clawed back” into your taxable estate. This is a critical risk for my older clients in Clearwater.

Step 4: Funding the Premiums

You write a check to the trust, the trustee sends out the Crummey notices, and then the trustee pays the insurance company (like Mutual of Omaha or MassMutual).

Comparing the Best Life Insurance Companies for Trusts (2026)

In the Tampa-Saint Petersburg-Clearwater Metro Area, we are lucky to have access to top-tier carriers. When I do a deep analysis for a trust-owned policy, I look for carriers with high “Financial Strength” ratings (A+ or better from A.M. Best).

| Carrier | Best For… | Why We Like Them for Tampa Residents |

| Mutual of Omaha | Seniors & Guaranteed Payouts | Excellent customer service and straightforward claims for local families. |

| MassMutual | Cash Value & Dividends | Their long history of paying dividends can help the trust become “self-funding” over time. |

| Nationwide | Long-Term Care Riders | Great for residents who want the trust to also handle potential health care costs. |

| Prudential | Large Death Benefits | Very competitive for high-net-worth estates in South Tampa. |

The “Florida Factor”: Homestead and Special Needs

For residents of the Tampa-Saint Petersburg-Clearwater Metro Area, two local nuances often come into play:

1. The Homestead Conflict

Your Florida home is already highly protected from creditors. However, if you are forced to sell your home to pay estate taxes, you lose that protection. A life insurance trust provides the “tax-paying cash” so your family can keep the protected homestead.

2. Special Needs Trusts (SNT)

If you have a loved one in St. Pete receiving government benefits (like SSI or Medicaid), a direct life insurance payout could disqualify them. By directing the life insurance into a Third-Party Special Needs Trust, you can provide for their “quality of life” without hurting their eligibility for essential services.

SEO Insights: Finding the Right Expert Locally

When you search for “life insurance trust attorney Tampa” or “best life insurance for estate planning Saint Petersburg,” you are taking the first step. But remember, an attorney writes the trust; an Insurance Agent and Broker finds the engine that powers it.

In 2026, the market is filled with “automated” solutions, but none can replace a deep-dive analysis into your family’s health and financial history. A local expert knows that a family in Clearwater has different needs and local costs than a family in Miami or Orlando.

Frequently Asked Questions from Bay Area Residents

“Can I be the trustee of my own life insurance trust?”

No. To get the tax and asset protection benefits, you must not have “incidents of ownership.” Most of my clients in Tampa name a sibling, an adult child, or a professional trust company.

“Is it too late to put my policy in a trust?”

It’s never too late, but the “3-year rule” mentioned earlier is a significant factor. If you are in your 70s or 80s in Clearwater, we often look at buying a new policy within a new trust to avoid that risk.

“What happens if I want to cancel the trust?”

Because it is Irrevocable, you cannot simply “cancel” it. However, you can stop funding it. If the premiums aren’t paid, the policy will lapse, and the trust will effectively become a “shell.”

Conclusion: Securing the “Forever” Promise

Putting a life insurance policy in a trust is one of the most sophisticated moves a resident of the Tampa, Saint Petersburg, and Clearwater Metro Area can make. It transforms a simple insurance contract into a robust, protected, and tax-efficient financial fortress. It ensures that the “Florida Dream” you’ve worked so hard to build is passed down exactly as you intended, without the interference of creditors, the tax man, or the probate court.

However, a trust is only as strong as the life insurance policy that funds it. You need a policy that is competitively priced, financially stable, and structured to meet your specific goals.

Steve Turner, Insurance Specialist, is here to guide you through this process. As an expert agent and broker who has spent many years helping Tampa-Saint Petersburg-Clearwater Metro Area Residents solve their biggest health care and financial challenges, Steve understands the local landscape. He conducts the deep analysis required to align your trust’s goals with the right insurance carrier.

The best part? Steve’s services are 100% free to you. Like all independent agents and brokers, he is paid by the insurance company that you choose. This means you get expert, unbiased advice and a deep-dive comparison of all available plans in the Tampa Bay Metro at no out-of-pocket cost.

Would you like me to provide a customized breakdown of which permanent life insurance carriers are currently offering the best ‘trust-owned’ pricing for residents in your age bracket?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly across insurance companies. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

Can Life Insurance Policies Be Put In A Trust?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.