Can Life Insurance Beneficiary Be Anyone?

As an Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I’ve found that the “who” is often just as important as the “how much.”

When you purchase a life insurance policy, you are making a promise to the future. But for that promise to be kept, the bridge between the insurance company and your loved ones must be built correctly. The question “Can a life insurance beneficiary be anyone?” is one I hear frequently in our local offices. While the short answer is often “yes,” the legal and financial realities for residents of the Tampa, St. Petersburg, Clearwater Metro Area are filled with nuances that can mean the difference between a seamless transition of wealth and a years-long battle in a Florida probate court.

Can Life Insurance Beneficiary Be Anyone?

In this deep-dive analysis, we will explore the rules of beneficiary designation, the legal frameworks specific to Florida, and how to compare different insurance plans to ensure your legacy lands exactly where you intend.

The Core Concept: Beneficiary vs. Insurable Interest

To understand if a beneficiary can be “anyone,” we must first distinguish between two critical legal concepts in the Tampa, Saint Petersburg, and Clearwater Metro Area.

1. The Right to Designate (The “Who”)

Under Florida Statute § 627.404, if you are the one purchasing a policy on your own life, you have the absolute right to name any person or entity as your beneficiary. This includes family, friends, charities, or even your business in Downtown Tampa.

2. The Requirement of Insurable Interest (The “Why”)

If someone else—say, a business partner or a distant relative—wants to buy a policy on your life, they must prove an insurable interest. This means they would suffer a genuine financial loss if you were to pass away.

Expert Insight: In the Tampa Bay Metro, we often see business partners in the tech sector or construction industry using “Buy-Sell” agreements. In these cases, the “insurable interest” is clear: the survival of the business.

Who Can You Name? A Breakdown for Local Residents

When we compare the insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, the flexibility of beneficiary designations is a major “pro.”

Family Members (The Most Common Choice)

Most residents in Hillsborough and Pinellas County name a spouse or children.

- Pros: Provides immediate liquidity to pay off mortgages or maintain the “Florida lifestyle.”

- Cons: Naming minors directly is a significant mistake (see below).

Friends and Unmarried Partners

Can a life insurance beneficiary be a friend? Yes. For the vibrant community of unmarried couples and close-knit friends in St. Petersburg, life insurance is often the only way to ensure a partner is taken care of, as they do not have the same automatic inheritance rights as a legal spouse under Florida law.

Charities and Non-Profits

You can name a local organization—perhaps a favorite charity in Clearwater or a research fund at USF—as a beneficiary. This is an excellent way to leave a lasting impact on the Tampa-Saint Petersburg-Clearwater Metro Area.

Trusts and Estates

You can name your “Estate,” but as an experienced broker, I generally advise against it.

- The Probate Trap: Naming your estate forces the life insurance money into probate court. This makes the funds accessible to your creditors and delays the payout to your family by months or even years.

Comparing Plan Types: How Beneficiary Rules Vary

The type of policy you choose in the Tampa-Saint Petersburg-Clearwater Metro Area can impact how you manage your beneficiaries.

| Policy Type | Beneficiary Flexibility | Best For… |

| Term Life Insurance | High | Young families in Largo or Brandon needing high coverage for low cost. |

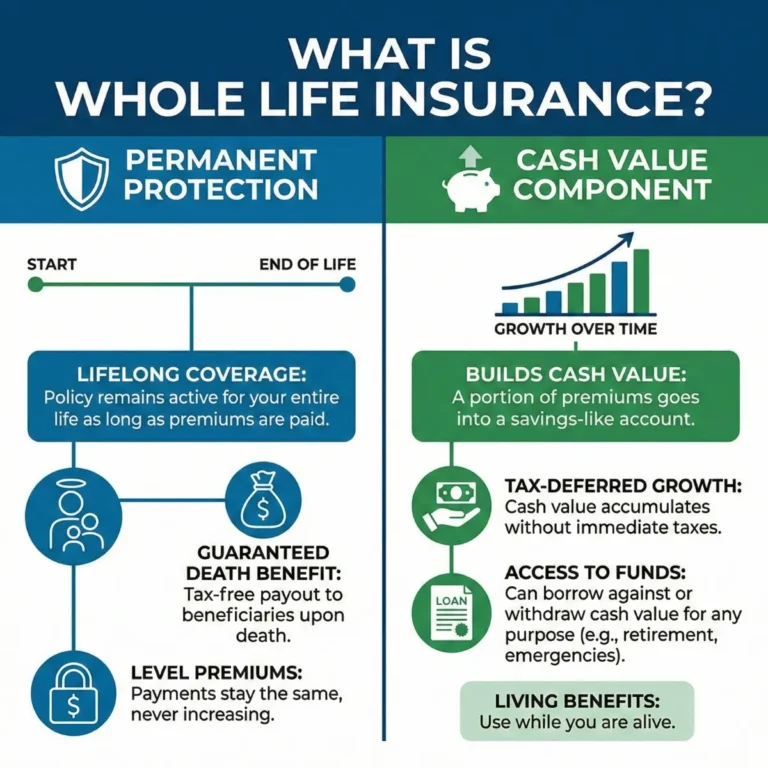

| Whole Life Insurance | High + Cash Value Access | Residents looking for permanent legacy and tax-free growth. |

| Hybrid LTC Policies | Specific (LTC vs. Death) | Seniors in Clearwater who want to protect their assets from nursing home costs. |

Critical Legal Warnings for Florida Residents

Florida law has specific “tripwires” that Tampa, Saint Petersburg, and Clearwater Area Residents must understand.

1. The “Divorce Trap.”

In many states, if you forget to remove an ex-spouse from your policy, they still get the money. However, Florida Statute § 732.703 generally automatically voids a beneficiary designation to an ex-spouse upon divorce.

- The Risk: If you actually want your ex-spouse to remain the beneficiary (perhaps to cover alimony), you must redesignate them after the divorce is final, or obtain a court order stating so.

2. Naming Minors as Beneficiaries

Insurance companies in the Tampa Bay Metro will not cut a check to a 10-year-old. If a minor is named as a direct beneficiary, the court will appoint a guardian to manage the money until they turn 18.

- The Solution: Most of my clients in Saint Petersburg set up a Revocable Living Trust and name the trust as the beneficiary. This allows you to dictate exactly how and when the money is spent (e.g., for college at Hillsborough Community College).

3. Creditor Protection

One of the greatest “pros” of life insurance for Tampa-Saint Petersburg-Clearwater Metro Area Residents is that the death benefit is generally exempt from the claims of the deceased’s creditors, provided it is paid to a named beneficiary (not the estate).

SEO Insights: “Life Insurance Beneficiary Rules Florida”

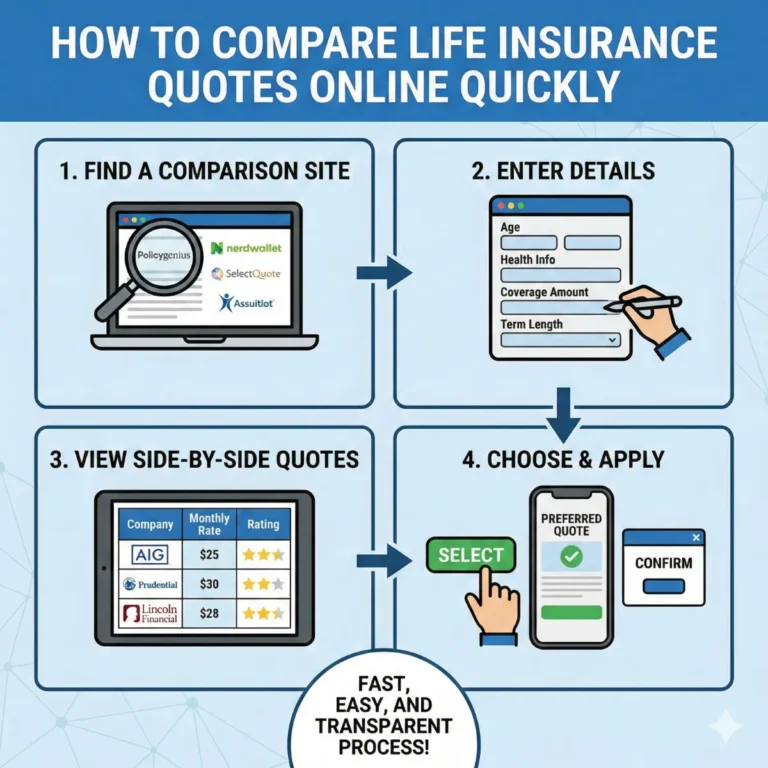

If you are searching for the “best life insurance companies in Tampa” or “how to change a life insurance beneficiary in Florida,” you are likely looking for a way to maximize your control.

When comparing different insurance plans, look for companies that allow for easy, digital beneficiary updates. In 2026, top carriers like Mutual of Omaha, MassMutual, and Transamerica allow residents of Clearwater and St. Pete to update their beneficiaries in minutes through a secure portal.

Strategic Advice: Per Stirpes vs. Per Capita

When naming multiple beneficiaries—say, your three children—you must decide on the “distribution logic.”

- Per Capita (By Head): If one child passes away before you, the money is split between the two surviving children.

- Per Stirpes (By Branch): If one child dies before you, their share passes to their children (your grandchildren).

For families in the Tampa-Saint Petersburg-Clearwater Metro Area with deep roots and multiple generations, Per Stirpes is often the preferred choice to ensure the wealth stays within each branch of the family.

Pricing and Company Analysis for Tampa Bay Residents

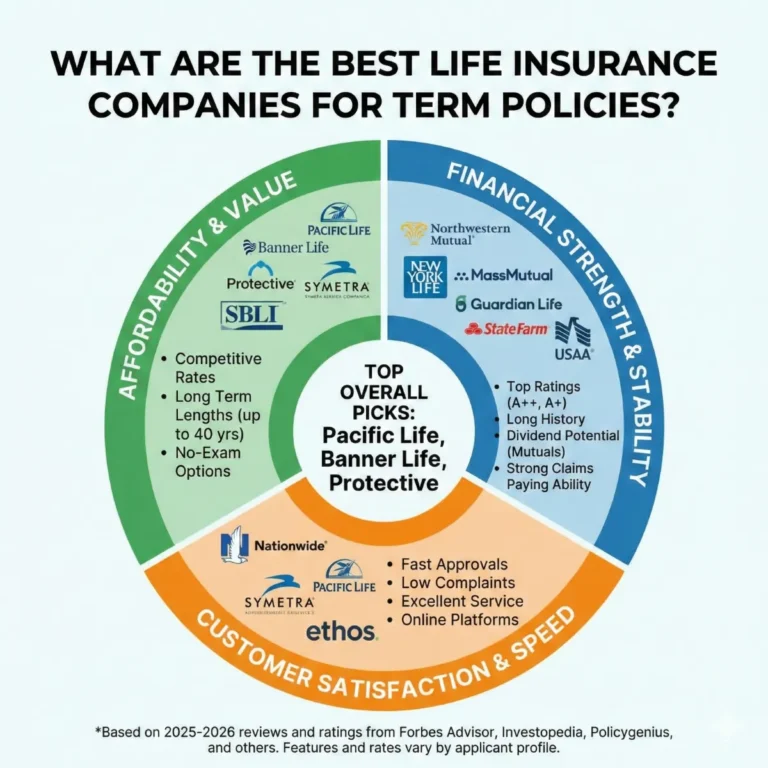

The cost of your policy is rarely affected by the beneficiary, but it is heavily influenced by the company’s financial strength and underwriting.

Leading Carriers in our Metro Area:

- Mutual of Omaha: Highly recommended for seniors in Clearwater due to their ease of use and strong reputation.

- MassMutual: Often the best choice for high-net-worth individuals in South Tampa looking for robust dividend-paying whole life policies.

- Transamerica: Consistently offers the cheapest term life insurance in Tampa for healthy young families.

Deep Analysis: Can You Name a Pet?

Technically, no. A pet is considered property in the eyes of the law in the Tampa, Saint Petersburg, and Clearwater Metro Area.

- The Professional Workaround: You can name a Pet Trust as the beneficiary. You designate a trustee (a person) to manage the funds specifically for the care of your animals. This ensures your golden retriever continues to enjoy their life in St. Pete even if you aren’t there.

Conclusion: Don’t Leave Your Legacy to Chance

The answer to “Can a life insurance beneficiary be anyone?” is a resounding yes—but with significant “fine print” that varies based on your specific life situation in Florida. Whether you are protecting a business in Downtown Tampa, a family in Clearwater, or a partner in Saint Petersburg, your beneficiary designation is the final word on your financial life.

Navigating these choices requires a deep analysis of your goals, your family structure, and the current legal landscape. This is where professional guidance becomes invaluable.

Steve Turner Insurance Specialist is an expert agent and broker here to answer all your questions. Whether you are curious about naming a trust, worried about the impacts of a recent divorce, or simply want to compare the best rates available in the Tampa-Saint Petersburg-Clearwater Metro Area, Steve is your local resource.

The best part? His services are 100% free to you. Like all independent agents and brokers, he is paid by the insurance company that you choose. You get his years of experience, his deep knowledge of the Florida market, and his personalized service at no out-of-pocket cost.

Would you like me to provide a checklist of the information you need to gather before naming a trust as your life insurance beneficiary?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

Can Life Insurance Beneficiary Be Anyone?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.