Can I Have Medicare And Private Insurance

Can I Have Medicare And Private Insurance

Can I Have Medicare And Private Insurance? A Comprehensive Guide to Dual Coverage

Section 1: The Dual Coverage Landscape: An Introduction

The intersection of federal health benefits and private insurance coverage represents one of the most complex and consequential financial decisions for Americans approaching retirement. The question of whether an individual can have both Medicare and private insurance is common, and the answer, while simple, opens the door to a labyrinth of regulations, strategic choices, and potential pitfalls. This report serves as a definitive guide to navigating this landscape, providing the detailed analysis necessary to architect a health coverage strategy that maximizes benefits, minimizes costs, and avoids punitive penalties.

1.1 The Definitive Answer and Its Complexities

The direct answer to the central question is an unequivocal yes. An individual can, and very often does, have both Medicare and a private health insurance plan simultaneously. This arrangement is commonly referred to as having “dual coverage.” However, this simple affirmative is where the simplicity ends. The two systems of coverage do not merely stack benefits on top of one another. Instead, their interaction is governed by a meticulous and legally binding set of federal rules that determine which insurance entity is responsible for paying a medical claim first.

This process is officially known as the “Coordination of Benefits” (COB). The COB framework ensures that when a person is covered by more than one health plan, the total payment does not exceed 100% of the cost of the service. More importantly, it establishes a clear hierarchy of payment responsibility. The insurer designated to pay first is called the “primary payer,” and the insurer that pays second is the “secondary payer”. Understanding which of your plans is primary and which is secondary is not an academic exercise; it is the single most critical factor in determining the effectiveness of your coverage and is the foundational concept upon which all subsequent decisions must be based.

1.2 The Building Blocks: Understanding Your Coverage Options

To navigate the dual coverage landscape, one must first have a clear understanding of the distinct components of both the federal Medicare program and the various forms of private insurance. A frequent source of confusion is the failure to distinguish between different types of private plans, as a policy from an employer functions in a fundamentally different way than a policy designed specifically to supplement Medicare.

Medicare: The Federal Foundation

Medicare is a federal health insurance program primarily for individuals aged 65 or older, as well as for certain younger people with disabilities, End-Stage Renal Disease (ESRD), or Amyotrophic Lateral Sclerosis (ALS). It is composed of several distinct parts:

- Part A (Hospital Insurance): This part covers costs associated with inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. For the vast majority of Americans who have worked and paid Medicare taxes for at least 10 years (or whose spouse has), Part A is premium-free.

- Part B (Medical Insurance): This part covers a wide range of outpatient services, including doctor visits, preventive care, medical supplies, and ambulance services. Unlike Part A, Part B requires a monthly premium, which is typically deducted from Social Security benefits.

- Part D (Prescription Drug Coverage): Original Medicare (Parts A and B) does not cover most outpatient prescription drugs. Part D provides this coverage through private insurance plans that are approved and regulated by Medicare. Enrollment is optional, but delaying enrollment without having other “creditable” drug coverage can result in a permanent late enrollment penalty.

- Part C (Medicare Advantage): These are private, Medicare-approved plans offered as an alternative to Original Medicare. A Medicare Advantage plan bundles Part A, Part B, and usually Part D benefits into a single plan, often with additional benefits like dental or vision coverage. When an individual enrolls in a Part C plan, they are still in the Medicare program, but their benefits are administered by a private insurance company.

Private Insurance: The Coexisting Layer

The term “private insurance” encompasses several distinct types of coverage, each with a unique relationship to Medicare:

- Employer Group Health Plans (GHP): This is health insurance offered by an employer or union to current employees and their families. This is the most common scenario where dual coverage with Medicare occurs, particularly for those who continue to work past age 65.

- Retiree Health Plans: This is health coverage offered by a former employer to its retirees. A critical distinction is that retiree coverage is not considered coverage based on current employment, a fact that has profound implications for its coordination with Medicare.

- COBRA: The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows individuals to temporarily continue their GHP coverage after their employment ends. Like retiree coverage, COBRA is not based on current employment and has very specific and often misunderstood rules when it intersects with Medicare.

- Medicare Supplement (Medigap): These are private insurance policies sold specifically to fill the “gaps” in Original Medicare, such as deductibles and coinsurance. A Medigap policy works with Original Medicare and is always the secondary payer. It is fundamentally different from a GHP, which may be the primary payer. An individual cannot have both a Medigap plan and a Medicare Advantage plan.

1.3 The Language of Cost: A Financial Primer

A strategic evaluation of health insurance options is impossible without a firm grasp of the financial terminology used by all insurers.

- Premium: This is the fixed amount, typically paid monthly, required to keep an insurance policy active. This fee is paid regardless of whether any medical services are used.

- Deductible: This is the amount of money an individual must pay out-of-pocket for covered health care services before their insurance plan begins to pay. For example, if a plan has a $1,000 deductible, the member pays the first $1,000 of covered services themselves.

- Coinsurance: After the deductible is met, coinsurance is the percentage of the cost of a covered service that the individual is responsible for. Medicare Part B, for instance, generally has a 20% coinsurance, meaning Medicare pays 80% of the approved amount and the beneficiary pays 20%.

- Copayment (Copay): This is a fixed dollar amount paid for a specific service, such as a $30 copay for a doctor’s visit or a $15 copay for a generic prescription. The copay is typically paid at the time of service.

- Out-of-Pocket Maximum: This is a crucial protective feature that limits the total amount an individual has to pay in deductibles, coinsurance, and copayments for covered services in a plan year. Once this limit is reached, the insurance plan pays 100% of covered costs. It is essential to note that Original Medicare (Parts A and B) has no annual out-of-pocket maximum. This lack of a financial safety net is a primary reason why most beneficiaries seek some form of supplemental coverage.

Section 2: The Rules of the Road: How Medicare and Private Insurance Work Together

The coordination between Medicare and private insurance is not arbitrary; it is dictated by a robust legal and regulatory framework designed to create a predictable and consistent payment hierarchy. Understanding this framework is essential for anyone with dual coverage.

2.1 The Payer Hierarchy: Primary vs. Secondary Explained

When a medical claim is submitted for a dually covered individual, the “coordination of benefits” process begins. The rules determine which plan is the “primary payer” and which is the “secondary payer”.

- The primary payer is the insurer that has the first responsibility to pay a claim. It processes the claim according to the terms of its policy—applying its own deductibles, copays, and coinsurance—and pays up to its coverage limits.

- The secondary payer receives the claim after the primary payer has paid its portion. It then reviews the remaining balance and may cover some or all of the costs that the primary insurer did not cover. However, the secondary payer will not pay more than its policy allows for that service, and the combined payments from both insurers will not exceed the total allowed charge for the service.

For example, if the primary plan has a large deductible that has not yet been met, it may pay nothing on a claim. The secondary plan would then process the claim and could potentially pay for the services, effectively helping to cover the primary plan’s deductible.

2.2 The Law of the Land: Medicare Secondary Payer (MSP) Regulations

The rules that establish this payer hierarchy are known collectively as the Medicare Secondary Payer (MSP) provisions. These are not merely insurance industry guidelines; they are federal laws that have been enacted by Congress over several decades.

The MSP program was initiated with the Omnibus Budget Reconciliation Act of 1980. The primary goal was to shift health care costs from the taxpayer-funded Medicare program to the appropriate private insurance sources, thereby preserving the financial stability of the Medicare Trust Funds. The law essentially prohibits Medicare from making a primary payment for services when another insurer has the responsibility to do so.

A critical aspect of MSP law is its supremacy. Federal MSP regulations take precedence over any conflicting state laws or provisions within a private insurance contract. This means that even if a private insurance policy document states that it is always secondary to Medicare, federal law will determine the true primary payer based on the beneficiary’s specific circumstances.

2.3 Critical Factors: Employment Status and Employer Size

For the majority of individuals with dual coverage through an employer, the determination of primary versus secondary status hinges on two key questions:

- Is the private insurance a Group Health Plan (GHP) based on the current employment of the individual or their spouse?

- What is the size of the employer providing that GHP?

The answers to these questions trigger specific MSP rules:

- For Individuals Age 65 or Older: The critical threshold is 20 employees.

- If the employer has 20 or more employees, the GHP is the primary payer, and Medicare is the secondary payer.

- If the employer has fewer than 20 employees, Medicare is the primary payer, and the GHP is the secondary payer.

- For Individuals Under Age 65 with a Disability: The threshold is higher, at 100 employees.

- If the employer has 100 or more employees, the Large Group Health Plan (LGHP) is primary, and Medicare is secondary.

- If the employer has fewer than 100 employees, Medicare is primary, and the LGHP is secondary.

- For Individuals with End-Stage Renal Disease (ESRD): The rules are different and are not based on age or disability. The GHP is the primary payer for a 30-month coordination period that begins when the individual becomes eligible for Medicare due to ESRD. This rule applies regardless of the employer’s size. After this 30-month period, Medicare becomes the primary payer.

These rules create a clear but unforgiving system. Misunderstanding one’s status—for example, an employee at a 15-person company assuming their employer plan is primary—can lead to a denial of claims and significant personal financial liability.

Table 1: Medicare Payer Status Decision Matrix

To distill these complex rules into a practical, at-a-glance tool, the following matrix outlines the most common scenarios and the resulting payer hierarchy. The final column highlights the most critical action required regarding Medicare Part B enrollment—a decision with permanent financial consequences if made incorrectly.

| Your Situation | Employer Size | Primary Payer | Secondary Payer | Critical Action for Medicare Part B |

| Age 65+, Actively Working | 20 or more employees | Employer GHP | Medicare | Enrollment can likely be delayed penalty-free. |

| Age 65+, Actively Working | Fewer than 20 employees | Medicare | Employer GHP | Enrollment is essential to avoid coverage gaps. |

| Age 65+, Covered by Spouse’s Active Employment | 20 or more employees | Spouse’s GHP | Medicare | Enrollment can likely be delayed penalty-free. |

| Age 65+, Covered by Spouse’s Active Employment | Fewer than 20 employees | Medicare | Spouse’s GHP | Enrollment is essential to avoid coverage gaps. |

| Under 65 (Disability), Active Employment | 100 or more employees | Employer LGHP | Medicare | Enrollment can likely be delayed. |

| Under 65 (Disability), Active Employment | Fewer than 100 employees | Medicare | Employer LGHP | Enrollment is essential. |

| Any Age, Retiree Coverage | Any size | Medicare | Retiree Plan | Enrollment is essential. |

| Any Age, COBRA Coverage (Medicare eligible first) | Any size | Medicare | COBRA | Enrollment is essential. |

| Any Age, ESRD (first 30 months) | Any size | Employer GHP/COBRA | Medicare | GHP is primary during this period. |

Section 3: Real-World Scenarios: Applying the Rules to Your Life

The abstract rules of Medicare Secondary Payer take on tangible significance when applied to the real-life situations individuals face as they approach and move through retirement. This section translates the regulatory framework into practical guidance for these common scenarios.

3.1 The Active Employee Dilemma (Working Past 65)

A growing number of individuals continue to work past the traditional retirement age of 65, creating a common dual coverage scenario. The correct course of action depends entirely on the size of the employer.

Scenario A: Large Employer (20 or more employees)

When working for an employer with 20 or more employees, the Group Health Plan (GHP) is the primary payer. This provides the employee with a significant degree of flexibility. Because they have primary coverage that is considered “creditable” by Medicare, they have a legitimate choice to delay enrolling in Medicare Part B to avoid paying the monthly premium.

Should they choose this path, they will be eligible for a Special Enrollment Period (SEP) to sign up for Part B later without facing a late enrollment penalty. This SEP is available for up to eight months after the month the employment ends or the GHP coverage ends, whichever occurs first.

Even if delaying Part B, it is often advisable for these individuals to enroll in premium-free Part A when they turn 65. Because Medicare would be the secondary payer, Part A can sometimes help cover the inpatient hospital deductible of the primary GHP, potentially reducing out-of-pocket costs during a hospital stay.

Scenario B: Small Employer (fewer than 20 employees)

The situation for an employee at a small company is fundamentally different and carries significant financial risk if misunderstood. For employers with fewer than 20 employees, Medicare is the primary payer by law.

This is not a choice; it is a federal mandate. If an individual in this situation fails to enroll in both Medicare Part A and Part B when they first become eligible, they will effectively be without primary insurance. When they seek medical care, their provider will bill their employer GHP. The GHP, knowing it is the secondary payer under MSP rules, will process the claim as if Medicare had already paid its primary share. Since the individual does not have Part B, Medicare pays nothing. This leaves the person responsible for the 80% of the bill that Medicare would have covered, in addition to any deductibles or copays.

In this scenario, the GHP functions only as a supplemental plan to Medicare. The employee must enroll in Medicare Parts A and B to be fully insured. Their decision then becomes whether the additional premium for the small group plan is worth the secondary benefits it provides.

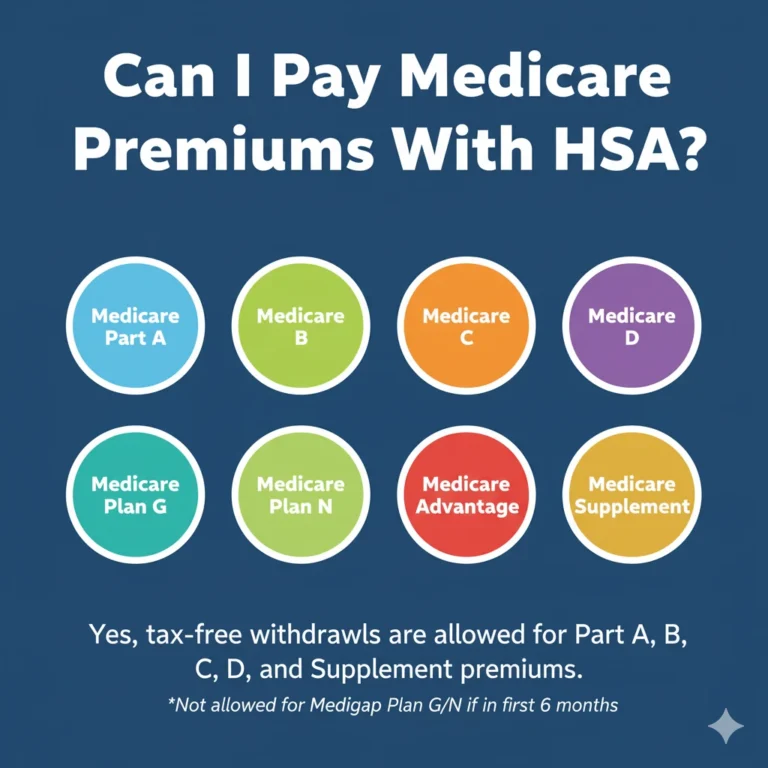

Special Consideration: The Health Savings Account (HSA) Conflict

For those with a high-deductible health plan (HDHP) and a Health Savings Account (HSA), a critical conflict arises with Medicare. Federal rules explicitly prohibit an individual from contributing to an HSA once their Medicare coverage begins—this includes Part A or Part B.

This rule is complicated by a provision that makes premium-free Part A coverage retroactive for up to six months from the date of application, but no earlier than the first month of eligibility. This creates a potential tax trap. To avoid a tax penalty for improper contributions, an individual must stop all contributions to their HSA at least six months before they apply for Medicare or Social Security benefits. This is a frequently overlooked detail that can result in unexpected tax liabilities.

3.2 The Retirement Transition

The moment an individual’s status changes from “active employee” to “retiree” or “unemployed,” the MSP rules can shift dramatically and counter-intuitively. This transition period is fraught with the highest risk of making a costly coverage mistake.

Coordinating Medicare with a Retiree Health Plan

When an individual retires and is offered a retiree health plan from their former employer, the payer hierarchy almost always flips. Retiree coverage is not based on current employment, and therefore, Medicare becomes the primary payer.

For the retiree plan to provide its intended benefits, the retiree must be enrolled in both Medicare Part A and Part B. Many retiree plans are specifically designed to coordinate with Medicare, covering deductibles and coinsurance. However, plan structures vary widely; some may have their own large deductibles that must be met before they pay anything.

Prescription drug coverage is also a key consideration. Retiree plans are required to send an annual notice to their members stating whether their drug coverage is “creditable,” meaning it is at least as good as a standard Medicare Part D plan. If the coverage is creditable, the retiree can delay enrolling in a separate Part D plan without penalty. If it is not, they must enroll in Part D during their enrollment period to avoid a future penalty.

The COBRA Trap: A Detailed Warning

COBRA coverage presents one of the most significant and commonly misunderstood hazards in the Medicare landscape. While marketed as a seamless continuation of employer coverage, its interaction with Medicare is governed by strict timing rules that can lead to financial disaster if ignored.

The coordination depends entirely on which coverage came first:

- If you have COBRA coverage before becoming eligible for Medicare: The moment you become eligible for Medicare (e.g., on your 65th birthday), your COBRA coverage may be terminated by the employer plan. You must enroll in Medicare during your Initial Enrollment Period. Relying on COBRA as a substitute for Medicare is a grave error. COBRA is not considered coverage from current employment, and therefore it does not grant a Special Enrollment Period to delay Part B. If you miss your Initial Enrollment Period, you will face a gap in coverage and a permanent late enrollment penalty for Part B.

- If you are enrolled in Medicare before you elect COBRA: In this situation, you are permitted to have both. Medicare will be the primary payer, and COBRA will be the secondary payer. COBRA may help cover Medicare’s cost-sharing, but since COBRA premiums are typically very high (102% of the full cost of the plan), this is often not a cost-effective option.

The critical takeaway is that the transition from active employment to unemployment triggers an immediate need for a Medicare decision. The 8-month Special Enrollment Period for Part B begins the day employment ends, not when COBRA coverage ends. Waiting until COBRA expires to enroll in Medicare will result in penalties and coverage gaps.

3.3 Other Coverage Situations

While employer-based plans are the most common form of dual coverage, Medicare also coordinates with several other types of insurance:

- TRICARE: This is the health care program for military personnel, retirees, and their families. For retirees to keep their TRICARE for Life coverage, they are required to enroll in both Medicare Part A and Part B when they first become eligible. TRICARE for Life then acts as a secondary payer, wrapping around Medicare.

- Department of Veterans Affairs (VA) Benefits: VA health care and Medicare are two separate systems that do not coordinate with each other. A veteran can have both but must choose which benefit to use each time they receive care. A veteran cannot use VA benefits to pay for Medicare copayments, and vice versa. It is important to note that having VA coverage does not grant an exception to the Part B late enrollment penalty. If a veteran delays Part B and later decides they need it, they will likely face a penalty.

- Workers’ Compensation, No-Fault, and Liability Insurance: In cases of a work-related injury or an accident, these types of insurance are always the primary payer for services related to that specific incident. Medicare acts as the secondary payer. If the primary insurer denies a claim or does not pay promptly, Medicare may make a “conditional payment” to ensure care is not delayed, but it will seek to recover that payment from the primary insurer later.

Section 4: Strategic Decision-Making: A Pros and Cons Analysis

Understanding the rules of coordination is the first step. The second, more personal step is to conduct a strategic analysis of the available options to determine the most effective and efficient coverage arrangement. This is not a one-size-fits-all decision but a calculation of total cost versus total risk based on an individual’s health, finances, and family situation.

4.1 The “Yes” Case: The Benefits and Drawbacks of Dual Coverage

Maintaining both Medicare and a private insurance plan, such as a GHP from a large employer, can be a powerful strategy. However, it comes with its own set of pros and cons.

Pros of Dual Coverage

- Enhanced Financial Protection: The most significant advantage is the potential for comprehensive coverage. A secondary plan can cover Medicare’s cost-sharing obligations, such as the Part A hospital deductible and the 20% coinsurance for Part B services, resulting in significantly lower out-of-pocket costs for medical care.

- Broader Benefits: Employer plans frequently offer benefits for services that Original Medicare does not cover. These can include routine dental care, vision exams and eyeglasses, hearing aids, and private-duty nursing. For individuals who anticipate needing these services, this can represent substantial value.

- Coverage for Dependents: This is a crucial consideration for many. Medicare is an individual insurance program; it does not cover a spouse or dependents. An employer GHP, in contrast, typically offers family coverage. Maintaining the GHP may be the only viable way to keep a non-Medicare-eligible spouse or dependent children insured.

- Potentially Better Drug Coverage: While variable, some employer-sponsored prescription drug plans have more generous formularies (lists of covered drugs) and lower cost-sharing than a standard Medicare Part D plan.

Cons of Dual Coverage

- Higher Total Premiums: The most obvious drawback is the cost. An individual with dual coverage will be paying the monthly premium for Medicare Part B in addition to whatever premium contribution is required for their private plan. The combined cost can be substantial.

- Administrative Complexity: Managing two separate insurance plans can be challenging. It requires understanding the rules of both, ensuring providers bill the correct insurer first, and tracking claims and Explanations of Benefits (EOBs) from two different sources. This can be a confusing and time-consuming process.

- Network Restrictions: If the private plan is a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO), the beneficiary is often restricted to a specific network of doctors and hospitals. Using an out-of-network provider can result in higher costs or no coverage at all, limiting the freedom of choice that Original Medicare typically provides.

- Potential for Redundant Coverage: In some instances, the benefits of the two plans may overlap significantly. This can lead to a situation where an individual is paying a high premium for a secondary plan that provides little additional value beyond what could be obtained from a less expensive Medigap policy.

4.2 The “No” Case: The Benefits and Drawbacks of a Single-Payer Approach

For some individuals, simplifying their coverage by choosing a single primary payer is the better path. This can mean relying solely on Medicare (with a supplement) or, in limited circumstances, relying solely on a private plan.

Scenario A: Choosing Medicare Only (Dropping Private Insurance)

An individual may decide to drop their employer or retiree coverage and rely on Medicare as their sole insurer.

- Pros: This approach offers simplicity in administration, as there is only one set of rules and one insurer to deal with for medical claims. It also eliminates the private plan premium, potentially lowering total monthly costs. With Original Medicare, there is broad freedom to see any doctor or visit any hospital in the country that accepts Medicare.

- Cons: The primary and most significant drawback is the direct exposure to Original Medicare’s unlimited cost-sharing. The 20% coinsurance on Part B services has no annual cap, meaning a serious illness or injury could lead to catastrophic out-of-pocket costs. Furthermore, this approach leaves gaps in coverage for services like dental, vision, and most long-term care.

- The Medigap Solution: This high-risk “Medicare Only” scenario is rarely advisable. The standard solution is to pair Original Medicare with a Medicare Supplement (Medigap) policy and a standalone Part D plan. A Medigap plan is private insurance designed to cover some or all of Medicare’s cost-sharing. This combination creates a highly predictable and comprehensive coverage structure. While it involves premiums for Part B, Part D, and the Medigap plan, the total cost is often less than maintaining an employer plan, and it provides a firm cap on out-of-pocket medical expenses.

Scenario B: Choosing Private Insurance Only (Delaying Medicare)

This strategy involves actively choosing to delay enrollment in Medicare, particularly Part B, and relying solely on a private plan.

- Pros: The main benefit is avoiding the Medicare Part B premium. It also allows for a seamless continuation of a familiar health plan and provides coverage for non-Medicare-eligible dependents.

- Cons: This is a viable and safe strategy only under one specific condition: the private insurance is a GHP from a current employer (or spouse’s current employer) with 20 or more employees. In this case, the GHP is the primary payer, and delaying Part B is permissible. Attempting to use this strategy in any other situation—with a small employer plan, a retiree plan, or COBRA—is a recipe for financial disaster, as it would leave the individual without a primary payer and subject them to future late enrollment penalties. The risk of misunderstanding the rules and making a catastrophic error is extremely high.

Section 5: Putting Your Plan into Action

After analyzing the rules and weighing the strategic options, the final phase involves taking concrete steps to enroll in the chosen coverage and seek professional guidance where necessary.

5.1 The Official Channel: Enrolling in Medicare Directly

It is a common misconception that one enrolls in Medicare through the Centers for Medicare & Medicaid Services (CMS). In fact, the enrollment process for Medicare Part A and Part B is managed by the Social Security Administration (SSA).

There are several ways to enroll:

- Online: The fastest and most convenient method is through the official SSA website at SSA.gov.

- By Phone: Individuals can call the SSA’s national toll-free number to apply.

- In Person: An appointment can be made to apply at a local SSA office.

Timely enrollment is critical to avoid penalties. The key enrollment periods include:

- Initial Enrollment Period (IEP): A seven-month window surrounding an individual’s 65th birthday (the three months before, the month of, and the three months after).

- Special Enrollment Period (SEP): Available to those who delayed Part B because they had creditable coverage from a large employer GHP. This period lasts for eight months after the employment or coverage ends.

- General Enrollment Period (GEP): For those who missed their IEP and do not qualify for an SEP, the GEP runs from January 1 to March 31 each year, with coverage beginning July 1. Enrolling during the GEP will likely result in a late enrollment penalty.

5.2 Seeking Expert Guidance: The Role of a Licensed Agent

While the federal government provides Original Medicare, the crucial supplemental components of a comprehensive coverage strategy—Medicare Advantage (Part C), Prescription Drug Plans (Part D), and Medigap policies—are all offered by private insurance companies. The sheer number of available plans, each with different premiums, networks, cost-sharing structures, and drug formularies, can be overwhelming.

This is where a qualified, licensed, and independent insurance agent can provide immense value. Unlike a “captive” agent who works for a single insurance company, an independent agent represents multiple carriers. This allows them to provide an objective analysis of the marketplace and help a consumer compare a wide range of options to find the plan that best fits their specific health needs and financial situation. An agent’s role is to translate complex policy details into clear, understandable choices, assisting with everything from plan comparison to the final enrollment application.

5.3 A Local Resource: Steve Turner Insurance Specialist (Florida)

For individuals in Florida seeking this type of expert guidance, the user query specifically mentioned Steve Turner of Steve Turner Insurance Specialist. Based on available information, this entity is a specialized resource for navigating the complexities of Medicare and health insurance in the Tampa area.

It is important to distinguish this specialized practice from other similarly named firms in the region that focus on different lines of insurance, such as property, casualty, or commercial insurance. Steve Turner Insurance Specialist is identified as focusing on the health and Medicare sector.

Services and Approach

The services offered by Steve Turner Insurance Specialist are described as highly personalized and client-focused. The approach involves simplifying the often-confusing process of selecting the right coverage by providing clear, thorough explanations of different plans. This ensures clients feel well-informed and confident in their decisions. The practice is noted for its deep knowledge of Medicare options, exceptional customer service, and responsiveness, positioning the agent not just as a salesperson but as a “reliable partner” in health care planning.

How to Engage

A consumer in Florida could engage with a specialist like Steve Turner to:

- Receive a personalized consultation to review their unique situation, such as working past 65, transitioning from an employer plan to retirement, or assessing the needs of a spouse.

- Conduct a detailed comparison of the specific Medicare Advantage, Medigap, and Part D plans available in their local service area.

- Analyze the costs (premiums, deductibles, out-of-pocket maximums) and benefits (provider networks, drug formularies, extra perks) of each option.

- Receive hands-on assistance with the plan application and enrollment process.

According to public information, Steve Turner Insurance Specialist can be contacted at 14502 N Dale Mabry Hwy Suite 200, Tampa, FL 33618, or by phone at +1 813-388-8373.

Conclusion: Architecting Your Personal Health Coverage Strategy

The ability to combine Medicare with private insurance offers a powerful opportunity to create a robust and comprehensive health coverage portfolio. However, this is not a passive process. It requires a proactive and deeply informed strategy, grounded in a firm understanding of the federal regulations that govern the payment hierarchy.

The central pillars of a successful strategy are the accurate determination of primary versus secondary payer status—a determination driven almost entirely by current employment status and employer size—and the avoidance of common but costly pitfalls, most notably the COBRA trap. The decision of whether to maintain dual coverage or to opt for a streamlined Medicare-centric package is not a simple choice but a complex cost-benefit analysis that must be tailored to one’s individual health needs, financial resources, and family obligations.

To move forward with confidence, individuals approaching this critical life stage should seek definitive answers to a core set of questions. By presenting these questions to their employer’s human resources department, their benefits administrator, or a licensed insurance specialist, they can gather the specific information needed to build their optimal coverage plan.

Finding Your Trusted Advisor in the Florida Medicare Market

We have taken a very detailed look at Medicare for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Medicare in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Medicare specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Medicare plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system allows you to get free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Medicare Insurance Carriers. An expert like Steve can help you navigate the 2026 Medicare market, find the most competitively priced Medicare plans for you, and ensure you have a Medicare plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

MEDICare INSURANCE POSTS

INSURANCE OFFERINGS

Can I Have Medicare And Private Insurance?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.