2026 Medicare Changes

2026 Medicare Changes

2026 Medicare Changes

Welcome! If you’re approaching your 65th birthday or helping a loved one prepare for theirs, you’ve come to the right place. Thinking about Medicare can feel like learning a whole new language, filled with strange new terms, confusing rules, and big decisions. But don’t worry. This guide is designed to be your friendly translator, turning complex information into simple, clear concepts. We’re going to walk through everything you need to know about the Medicare landscape in 2026, including some exciting new changes that could make healthcare more affordable and manageable for millions of Americans. Our goal is to empower you with knowledge so you can confidently choose the perfect healthcare path for your retirement years. [2026 Medicare Changes]

So, let’s start at the very beginning. What is Medicare? At its core, Medicare is the federal health insurance program for people who are 65 or older. Think of it as a national healthcare club for our country’s seniors. You can also join this “club” before age 65 if you have been receiving Social Security Disability benefits for two years or if you have certain serious health conditions, such as End-Stage Renal Disease (ESRD) or ALS (Lou Gehrig’s disease). [2026 Medicare Changes]

For most people getting ready for 2026, the most important deadline to know is your Initial Enrollment Period, or IEP. This is your personal 7-month window to sign up for Medicare without penalties. This window opens 3 months before the month you turn 65, includes the month you turn 65, and closes 3 months after the month you turn 65. For instance, if your 65th birthday is on July 20, 2026, your enrollment window opens on April 1, 2026, and closes on October 31, 2026. Signing up during this time is crucial. Missing this deadline can lead to lifelong penalties on your monthly premiums, so marking it on your calendar is one of the smartest first steps you can take. [2026 Medicare Changes]

The Original Medicare Puzzle Pieces: Parts A & B

Original Medicare is the foundation of your coverage, run directly by the federal government. It’s made up of two main parts, Part A and Part B, which cover different types of healthcare services. [2026 Medicare Changes]

Medicare Part A (Hospital Insurance)

Think of Part A as your hospital insurance. It’s the part that helps pay for the big, expensive costs when you’re formally admitted to a hospital or another type of inpatient facility. [2026 Medicare Changes]

What Does Part A Cover?

- Inpatient Hospital Stays: This covers the cost of your semi-private room, meals, nursing care, and medications you receive while you’re a patient in the hospital. [2026 Medicare Changes]

- Skilled Nursing Facility (SNF) Care: This is not for long-term nursing home stays. It’s for short-term, rehabilitative care that you get after a qualifying hospital stay. For example, if you have a knee replacement, spend a few days in the hospital, and then need to go to a facility for physical therapy, Part A helps cover this specialized care. [2026 Medicare Changes]

- Hospice Care: For patients with a terminal illness, Part A covers care focused on providing comfort and support. [2026 Medicare Changes]

- Home Health Care: If you are homebound and require skilled nursing care or therapy, Part A can cover these services. [2026 Medicare Changes]

Part A Costs: What’s Changing in 2026?

The great news for most people is that Part A is premium-free. As long as you or your spouse worked and paid Medicare taxes for at least 10 years, you won’t pay a monthly bill for your hospital insurance. [2026 Medicare Changes]

However, using Part A does have costs, and these are expected to increase slightly in 2026 due to inflation in healthcare.

- The Part A Deductible: This is what you pay out-of-pocket when you are admitted to the hospital for each “benefit period.”

- In 2025, the deductible was $1,676.

- For 2026, this is projected to increase to approximately $1,716. While the official number won’t be released until late 2025, a small increase is typical. This means your initial cost for a hospital stay in 2026 will be about $44 higher than it was in 2025.

- Hospital Coinsurance: After you pay your deductible, Medicare covers the first 60 days of a hospital stay in full. For longer stays, you pay a daily coinsurance.

- In 2025, the coinsurance for days 61-90 was $419 per day.

- For 2026, this is projected to rise to about $429 per day. This highlights the significant financial risk of extended hospital stays if you only have Original Medicare.

Medicare Part B (Medical Insurance)

If Part A is the hospital room, Part B is the medical insurance that covers the doctors, services, and supplies you need to treat your condition. It covers a vast range of outpatient services. [2026 Medicare Changes]

What Does Part B Cover?

- Doctor Visits: Covers appointments with your primary care doctor and specialists. [2026 Medicare Changes]

- Outpatient Care: Includes emergency room visits, outpatient surgery, chemotherapy, and diagnostic tests like X-rays and MRIs.

- Preventive Care: Part B strongly emphasizes staying healthy. It covers annual wellness visits, flu shots, and many important health screenings, often at no cost to you. [2026 Medicare Changes]

- Durable Medical Equipment (DME): Medically necessary equipment like walkers, wheelchairs, and oxygen.

- Ambulance Services and Mental Health Services.

Part B Costs: What’s Changing in 2026?

Unlike Part A, everyone pays a monthly premium for Part B. These costs are also expected to rise in 2026. [2026 Medicare Changes]

- The Part B Premium: This is the monthly bill for your medical insurance, usually deducted from your Social Security check. [2026 Medicare Changes]

- In 2025, the standard premium was $185.00 per month.

- For 2026, the premium is projected to increase to around $206.50 per month. This increase is tied to overall healthcare spending and inflation. People with higher incomes will continue to pay a higher premium through the Income-Related Monthly Adjustment Amount (IRMAA).

- Medicare Part B premiums vary based on income. Those with higher incomes pay an additional amount called the Income-Related Monthly Adjustment Amount, or IRMAA. These amounts are set annually, with the IRMAA for a given year determined by your modified adjusted gross income (MAGI) from two years prior.

- Here’s the official IRMAA chart for 2025:

The official 2026 Medicare Part B premium has not been released yet, but the Medicare Trustees Report provides projections. The final figures are typically announced in October. These projections are based on factors like inflation and healthcare cost trends. The IRMAA for 2026 would be based on your 2024 tax return.

Here is a projected IRMAA chart for 2026 based on recent estimates:

- The Part B Deductible: This is the small amount you must pay for your medical services each year before Part B starts to pay its share. [2026 Medicare Changes]

- In 2025, the annual deductible was $257.

- For 2026, it’s expected to rise to approximately $288.

- The 20% Coinsurance: This is the most critical cost to understand, and it is not changing in 2026. After your deductible is met, you are responsible for 20% of the cost of most medical services. While 20% of a $150 doctor’s visit is manageable, 20% of a $50,000 surgery is $10,000. Under Original Medicare, there is no cap or limit on this 20% share. This unlimited financial risk is the primary reason why almost no one sticks with just Original Medicare. [2026 Medicare Changes]

Big News in Prescription Drugs: Medicare Part D in 2026

One of the biggest areas of change in Medicare is prescription drug coverage, known as Part D. Original Medicare does not cover the medications you pick up from the pharmacy, so you need to buy a separate Part D plan from a private insurance company.

Recap of the Huge 2025 Change

To understand 2026, we must first examine the significant improvements that took effect in 2025. Thanks to the Inflation Reduction Act, a $2,000 annual cap was placed on out-of-pocket prescription drug costs for Medicare Part D beneficiaries. This was a revolutionary change, building on previous reforms to the program’s structure and protecting seniors from catastrophic drug expenses. If a beneficiary’s total spending on covered drugs reaches the annual cap, they will pay nothing more for their prescriptions for the rest of the year.

In addition, the Inflation Reduction Act created the Medicare Prescription Payment Plan, a new, voluntary program that allows beneficiaries to pay their out-of-pocket costs in monthly installments instead of all at once. This program helps manage the financial burden of high-cost prescriptions, especially for those who hit the spending cap early in the year. While it doesn’t lower total drug costs, it can make them more predictable and manageable throughout the year. This cap is set to increase to $2,100 in 2026 and will be adjusted annually thereafter.

How does it work?

Previously, if you needed a costly specialty drug, you could hit your $2,000 out-of-pocket cap in a single month, forcing you to pay a huge bill all at once. The new 2026 payment plan fixes this problem. [2026 Medicare Changes]

Starting in 2026, you will have the option to spread your prescription drug costs out over the entire year in equal monthly payments. Instead of facing a massive bill in January or February, you can elect to have your costs divided by the number of remaining months in the year and pay that predictable amount each month. [2026 Medicare Changes]

Let’s look at an example:

Imagine Robert needs a specialty drug for his arthritis. In January 2026, the copay for his first fill is $1,900.

- Without the payment plan: Robert would have to pay the full $1,900 at the pharmacy in January. This would be a huge financial burden for most people on a fixed income.

- With the new 2026 payment plan: Robert can tell his Part D plan he wants to opt-in. The plan will take his estimated annual costs (up to the $2,000 cap) and divide them by 12. He would pay roughly $167 per month at the pharmacy instead of the huge upfront cost. His monthly bill cannot exceed a certain limit, making his drug expenses stable and predictable all year long. [2026 Medicare Changes]

This new feature is a game-changer for people who rely on expensive medications, providing significant financial relief and peace of mind. [2026 Medicare Changes]

What’s New and Different in 2026? The “Medicare Prescription Payment Plan”

Navigating Medicare can be complex, and staying informed about changes is crucial. The year 2026 brings a new set of rules for Medicare Part D prescription drug plans, largely as a result of the Inflation Reduction Act of 2022 (IRA). These changes are designed to provide financial relief and stability for beneficiaries, particularly those with high prescription drug costs.

A New Out-of-Pocket Cap

The most impactful change for 2026 is the new $2,100 annual out-of-pocket cap on Part D prescription drugs. This is an increase from the $2,000 cap that went into effect in 2025. This cap ensures that once your total out-of-pocket spending on covered medications reaches $2,100, your copayments and coinsurance for the rest of the year will drop to $0. This is a significant relief for those who face high drug costs, as it eliminates the “catastrophic coverage” phase where beneficiaries previously paid a small percentage of their drug costs indefinitely.

Medicare’s First Negotiated Drug Prices Take Effect

Another landmark change for 2026 is the start of the Medicare Drug Price Negotiation Program. For the first time, the Centers for Medicare & Medicaid Services (CMS) has negotiated prices for a select list of high-cost Part D drugs. The negotiated prices for the first 10 drugs, including common medications like Eliquis, Januvia, and Jardiance, will take effect on January 1, 2026. This is expected to lead to lower costs for beneficiaries who use these specific drugs, as well as significant savings for the Medicare program.

Other Key Changes for 2026

- Part D Deductible: The maximum annual deductible for Part D will increase to $615 in 2026, up from $590 in 2025. However, it’s important to remember that not all plans have a deductible, and many have a lower one.

- Insulin and Vaccine Costs: The $35 monthly cap on out-of-pocket insulin costs remains in effect, regardless of whether a beneficiary has met their deductible. Additionally, adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP), such as the shingles shot, continue to have no cost-sharing.

- Medicare Prescription Payment Plan (MPPP): This program, introduced in 2025, allows beneficiaries to pay their out-of-pocket prescription costs in monthly installments. For 2026, participation in this plan will automatically renew, so you don’t need to re-enroll if you want to continue using it.

These changes are aimed at making prescription drugs more affordable and predictable for Medicare beneficiaries. However, individual costs can still vary significantly based on the specific plan you choose, so it’s always a good idea to review your options during the annual Medicare Open Enrollment Period.

Your Two Main Paths: How to Cover the Gaps in 2026

With the costs and risks of Original Medicare in mind, you have to make a choice. How will you protect yourself from the deductibles, the 20% coinsurance, and the other gaps? There are two main paths you can take. [2026 Medicare Changes]

Path #1: The Freedom Path (Original Medicare + Medigap + Part D)

This path is for people who want the most freedom and flexibility in their healthcare. You keep Original Medicare (Part A and B) as your primary insurance and then add a Medicare Supplement Insurance plan, also known as Medigap.

What is Medigap?

A Medigap plan is sold by private insurance companies and is designed to pay for the costs that Original Medicare leaves behind. It’s like a financial shield that covers your deductibles and, most importantly, that unlimited 20% coinsurance. [2026 Medicare Changes]

How does it work?

You go to the doctor and show your Medicare card and your Medigap card. Medicare pays its 80% share, and the Medigap plan automatically pays the remaining 20%. You are often left with a bill for $0. [2026 Medicare Changes]

Popular Medigap Plans and 2026 Changes

Medigap plans are standardized, meaning a “Medicare Plan G” from one company has the same benefits as a Plan G from another. For new enrollees in 2026, the most popular choices will continue to be Plan G and Medicare Plan N. [2026 Medicare Changes]

- Plan G: This is the most comprehensive option. It covers your 20% coinsurance completely and pays for your Part A hospital deductible. The only out-of-pocket cost you have for medical services all year is the small annual Part B deductible (projected to be around $288 in 2026). After that, you have 100% coverage. [2026 Medicare Changes]

- Plan N: This plan offers a lower monthly premium in exchange for some small, predictable costs. You might pay a copay of up to $20 for a doctor’s visit and $50 for an ER visit. [2026 Medicare Changes]

What’s Changing for Medigap in 2026?

The benefits of Medigap plans themselves do not change. However, their value increases as Medicare’s costs go up. Since the Part A deductible is projected to be higher in 2026, Plan G’s benefit of covering that deductible becomes even more valuable. The monthly premiums for Medigap plans will also likely see a small inflationary increase in 2026, typically 3-6% depending on the company. [2026 Medicare Changes]

Summary of the Freedom Path:

- Pros:

- Total Freedom: You can see any doctor or visit any hospital in the entire country that accepts Medicare. There are no networks and no referrals needed.

- Predictable Costs: With a plan like Plan G, you have virtually no unexpected medical bills, which makes budgeting simple.

- Nationwide Coverage: Ideal for individuals who travel frequently or are seasonal residents. [2026 Medicare Changes]

- Cons:

- Higher Premiums: You will pay three separate monthly premiums (Part B, Medigap, and Part D), which usually results in a higher total monthly cost.

- No Extra Benefits: Medigap plans do not include routine dental, vision, or hearing coverage. [2026 Medicare Changes]

Path #2: The All-in-One Path (Medicare Advantage / Part C)

This path is for people who prefer convenience, lower monthly premiums, and bundled extra benefits. With this option, you get your Medicare benefits from a private insurance company instead of directly from the government. [2026 Medicare Changes]

How does Medicare Advantage work?

These plans bundle your Part A, Part B, and usually your Part D prescription drug coverage into a single, convenient plan. You use one card from a private insurer (like Humana, UnitedHealthcare, or Florida Blue) for all your healthcare needs. [2026 Medicare Changes]

Medicare Advantage Changes in 2026

The world of Medicare Advantage is highly competitive, and plans change every single year. Here’s what to look for in 2026: [2026 Medicare Changes]

- Out-of-Pocket Maximum (MOOP): Every Advantage plan has a yearly cap on your medical spending.

- In 2025, the maximum allowable MOOP was $9,350.

- For 2026, this limit is expected to rise slightly, potentially to over $9,200. However, insurance companies will continue to compete by offering plans with much lower maximums, often in the $4,000 to $7,000 range. A key change to watch for is how plans structure this protection.

- Plan Payments: The financial health of Medicare Advantage (MA) plans is directly tied to the payments they receive from the federal government. For 2026, the Centers for Medicare & Medicaid Services (CMS) has finalized a payment rate that will lead to a significant increase in funding for MA plans.

- Increased Payments and Potential for Richer Benefits

- Payment Increase: CMS projects an average payment increase of over 5% for Medicare Advantage plans in 2026. This increase, which is more substantial than in recent years, is largely driven by a projected rise in the effective growth rate of spending in Original Medicare, which serves as the benchmark for MA plan payments.

- Benefit Enhancements: With more federal dollars per enrollee, MA plans may be in a stronger position to enhance their offerings. This could lead to a variety of improvements, such as:

- Lower Premiums: Some plans may be able to offer lower or even $0 monthly premiums.

- Expanded Supplemental Benefits: Plans may use the additional funds to broaden their supplemental benefits, such as more generous allowances for dental, vision, and hearing care, or to add new benefits to their portfolios.

- Lower Cost-Sharing: Plans could reduce member copayments and coinsurance for doctor visits, hospital stays, and prescription drugs.

- Market Consolidation and Plan Withdrawals

- Not a Universal Trend: While the average payment to plans is increasing, it’s not a guarantee that every plan will thrive. The MA market is highly competitive, and plans operate on very thin margins.

- Insurers Leaving Markets: Despite the overall payment increase, some insurers, including large national carriers, are reportedly pulling out of certain counties or states for 2026. This can be driven by several factors, including:

- Rising Medical Costs: Insurers are facing higher medical costs and utilization rates, which can make it difficult to maintain profitability, even with increased government payments.

- Competitive Pressure: In some regions, the competition is so fierce that plans may not be able to offer a compelling package of benefits and a sustainable premium without losing money.

- Regulatory Changes: New CMS rules, such as those related to prior authorization and Star Ratings, may affect a plan’s financial model and lead some to reconsider their market participation.

- Impact on Beneficiaries

- This dynamic landscape means that while many beneficiaries may see a robust selection of plans with improved benefits, those in areas where plans are withdrawing may have to re-evaluate their coverage.

- Re-evaluating Options: If a beneficiary’s plan is no longer offered in 2026, they will need to choose a new plan during the Annual Enrollment Period (AEP). This requires a careful review of available plans to ensure their new coverage meets their health and financial needs.

- Market-Specific Experience: A beneficiary’s experience with Medicare Advantage in 2026 will be highly dependent on their specific location. Those in competitive markets will likely benefit from the increased payments in the form of richer benefits, while those in consolidating markets may face more limited choices.

- This dynamic landscape means that while many beneficiaries may see a robust selection of plans with improved benefits, those in areas where plans are withdrawing may have to re-evaluate their coverage.

- Prior Authorization: In a major step to reduce administrative burden and improve continuity of care, new rules for 2026 will prevent Medicare Advantage plans from retroactively denying a previously approved inpatient prior authorization. This change addresses a long-standing issue where MA plans would approve an inpatient admission but later conduct a “post-service” review and determine the stay was not medically necessary, thereby refusing to pay the hospital.

- Here’s what this new rule means in practice:

- Approvals Are Final: Once an MA plan gives a prior authorization for an inpatient hospital admission, that approval must be honored for the duration of the patient’s stay, up to the point of discharge.

- Protection Against Retroactive Denials: The rule specifically prohibits plans from using post-discharge medical reviews to deny payment for a stay that was pre-approved. The only exceptions are in cases of fraud or “obvious error.”

- Reduced Administrative Burden: This change is a significant win for healthcare providers, as it reduces the need for them to go through a lengthy and complex appeals process to be paid for a service that was already authorized. It also provides greater certainty to hospitals regarding payment.

- Improved Patient Experience: For beneficiaries, this change means less risk of being caught in the middle of a billing dispute between their provider and their insurance plan. It ensures that once they receive an inpatient prior authorization, they can focus on their recovery without the fear of a later denial.

- This policy is part of a broader effort by CMS to strengthen oversight of Medicare Advantage plans and ensure that beneficiaries receive the same medically necessary care they would under Original Medicare. It aligns with other recent regulatory actions aimed at streamlining the prior authorization process, promoting transparency, and protecting patient access to care.

- Special Supplemental Benefits: There will be new rules and a non-exhaustive list of non-allowable supplemental benefits that cannot be offered under the Special Supplemental Benefits for the Chronically Ill (SSBCI) category. This includes items like tobacco, alcohol, and cosmetic surgery.

- Dual-Eligible Plans: The primary focus of the new requirements is on Dual-Eligible Special Needs Plans (D-SNPs), a type of Medicare Advantage plan specifically for dual-eligible individuals meaning they have both Medicare and Medicaid.

- Integrated Care: The most significant change is the push for greater integration between a member’s Medicare and Medicaid benefits. CMS is implementing new requirements for Highly Integrated D-SNPs (HIDE-SNPs) and Fully Integrated D-SNPs (FIDE-SNPs). The goal is to move beyond simple coordination and toward a more seamless experience where all benefits are managed under one health plan.

- Monthly Special Enrollment Period (SEP): The previous quarterly enrollment period for dual-eligible individuals is being replaced with a monthly Special Enrollment Period (SEP). This allows people with full Medicaid benefits to switch to an integrated D-SNP from the same parent company that manages their Medicaid. This gives them more flexibility to choose a plan that better aligns with both their Medicare and Medicaid benefits.

- Integrated Identification Cards: Starting in 2027, certain integrated D-SNPs will be required to have a single, integrated ID card that serves as the card for both the Medicare and Medicaid plans. This small but impactful change is intended to reduce confusion and streamline the process of accessing care.

- Health Risk Assessments: New rules also codify timeframes for D-SNPs to conduct Health Risk Assessments (HRAs) and create individualized care plans. This ensures plans are proactively assessing the needs of their members and developing personalized care strategies to address them.

- Chronic Condition Requirement: Starting in 2026, many of the extra benefits that were available to all dual-eligible members—like a credit for healthy foods or utilities—will now be available only to those who have a qualifying chronic condition, such as diabetes or cardiovascular disease.

- Verification: To access these benefits, the D-SNP may need to verify a member’s chronic condition through claims data or by having a doctor complete a form. This is due to the end of a previous federal program (the Value-Based Insurance Design, or VBID, model) that allowed these benefits to be offered more broadly.

- Increased Payments and Potential for Richer Benefits

- Network Adjustments: This is a constant. The biggest “change” every year is that doctor and hospital networks are adjusted. It will be critical for anyone choosing an Advantage plan for 2026 to verify that their preferred doctors and hospitals are still in the network.

- Star Ratings: Each fall, Medicare releases its Star Ratings for Advantage plans The ratings for 2026 plans (which come out in October 2025) will be the most up-to-date measure of a plan’s quality and customer satisfaction. [2026 Medicare Changes]

Summary of the All-in-One Path:

- Pros:

- Low Premiums: Many plans are available with a $0 monthly premium (though you must still pay your Part B premium).

- Convenience: One plan, one card, and one company for all your healthcare needs.

- Extra Benefits: Bundled dental, vision, hearing, and fitness benefits can save you money.

- Financial Protection: The out-of-pocket maximum provides a solid safety net against catastrophic medical costs.

- Cons:

- Network Restrictions: You must use doctors and hospitals within the plan’s network (usually an HMO or PPO).

- Referrals and Prior Authorizations: Care can be delayed while waiting for plan approval for certain tests or procedures.

- Plans Change Yearly: Your benefits, costs, and network can change every single year, requiring you to review your plan carefully each fall.

Making the Best Choice for You in 2026

The right path depends entirely on your personal situation. Let’s look at a few examples of people turning 65 in 2026. [2026 Medicare Changes]

- Meet “Healthy Helen”: Helen is in great health, loves to travel the country in her RV, and wants to keep her monthly premiums low. However, she worries about a sudden, major accident.

- A $0 premium PPO-style Medicare Advantage plan could be a great fit. It would give her a low monthly cost and the flexibility to see out-of-network doctors (at a higher cost) when she travels. The plan’s out-of-pocket maximum would protect her from catastrophic costs in a worst-case scenario.

- Meet “Chronic-Condition Charles”: Charles has a heart condition and diabetes. He has a team of specialists he has trusted for years, and he wants to continue seeing them without any hassle. He also wants his healthcare costs to be as predictable as possible.

- Original Medicare, combined with a Medigap Plan G and a separate Part D plan, would be the ideal choice for Charles. It would give him the freedom to continue seeing his trusted specialists without needing referrals. With Plan G, his medical costs would be almost entirely covered after he pays his small Part B deductible, giving him incredible financial peace of mind. [2026 Medicare Changes]

- Meet “Budget-Conscious Barbara”: Barbara is on a tight, fixed income. Her top priority is keeping her monthly expenses low and predictable. She is generally healthy and doesn’t mind staying within a local network of doctors. [2026 Medicare Changes]

- A $0 premium HMO-style Medicare Advantage plan would likely be her best option. It would eliminate the extra premium for a Medigap plan and bundle her drug coverage. The included dental and vision benefits would also save her hundreds of dollars a year. The out-of-pocket maximum would protect her if she did get sick. [2026 Medicare Changes]

What Medicare Still Won’t Cover in 2026

Even with all the improvements, it’s vital to remember the things Medicare does not cover. These gaps are not expected to change in 2026. [2026 Medicare Changes]

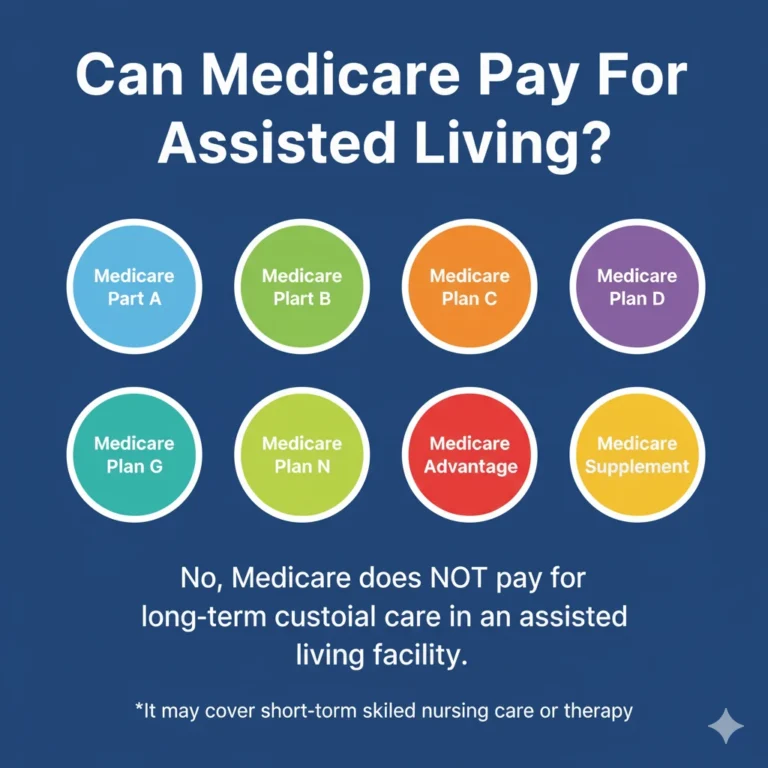

- Long-Term Custodial Care: This is the single biggest gap. Medicare does not pay for long-term stays in a nursing home or assisted living facility, which can cost thousands of dollars per month. [2026 Medicare Changes]

- Most Dental, Vision, and Hearing Services: Outside of the benefits offered in some Medicare Advantage plans, Original Medicare does not cover routine dental care, eyeglasses, or hearing aids. [2026 Medicare Changes]

- Healthcare Outside the U.S.: Original Medicare provides no coverage when you are traveling abroad. Some Medigap and Advantage plans offer limited emergency travel benefits. [2026 Medicare Changes]

Your Best Resource: Working with a Professional

Navigating the world of Medicare is one of the most important financial and health-related decisions you will make in your life. The rules are complex, the options are numerous, and the changes for 2026, like the new Prescription Payment Plan, add another layer to consider. Making the wrong choice during your enrollment window can have long-lasting consequences.

You don’t have to do it alone. The best way to ensure you make the right choice is to work with an independent, licensed insurance agent who specializes in Medicare. Think of an agent as your personal guide and advocate. They are experts who can explain all of this information in a way that makes sense for you. They can compare all the different plans available in your specific area from various insurance companies.

It’s also important to understand how they are paid. A licensed insurance agent’s services are provided at no extra cost to you. When you sign up for a plan through an agent, the insurance company pays them a commission. The price you pay for your plan is exactly the same whether you use an agent or sign up directly with the company. This system allows you to get free, unbiased, and expert advice tailored to your unique needs.

Given the stakes, it is usually best to use a licensed insurance agent, such as Steve Turner of SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Medicare Insurance Carriers. An expert like Steve can help you understand the 2026 changes, analyze your personal health and financial situation, and guide you to the Medicare path that will provide you with the best coverage, the most security, and true peace of mind for many years to come.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

MEDICare INSURANCE POSTS

INSURANCE OFFERINGS

2026 Medicare Changes

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.