What Is Whole Life Insurance?

As an Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I’ve seen the Florida landscape shift significantly. Whether you’re enjoying retirement in a waterfront condo in Downtown St. Pete, raising a family in the suburbs of Palm Harbor, or growing a business in Tampa’s Westshore District, the need for permanent financial security is a constant.

One of the most frequent questions I encounter in my office is: “What is Whole Life Insurance?” It is a product that is often misunderstood, sometimes unfairly maligned, but frequently serves as the absolute bedrock of a sophisticated financial plan for Tampa-Saint Petersburg-Clearwater Metro Area Residents. In this 2026 deep-dive analysis, we are going to peel back the layers of whole life insurance, compare it to other plans, and see how it performs in our unique local market.

What Is Whole Life Insurance? The Permanent Solution

At its core, Whole Life Insurance is a type of permanent life insurance designed to cover you for your entire life. Unlike term insurance, which is like “renting” coverage for a set period, whole life is “owning” your protection. As long as you pay the premiums, the policy will never expire, and your family is guaranteed to receive a death benefit—no matter when you pass away.

For Tampa, Saint Petersburg, and Clearwater Area Residents, whole life insurance is built on three unbreakable guarantees:

- Guaranteed Death Benefit: The amount your beneficiaries receive is locked in.

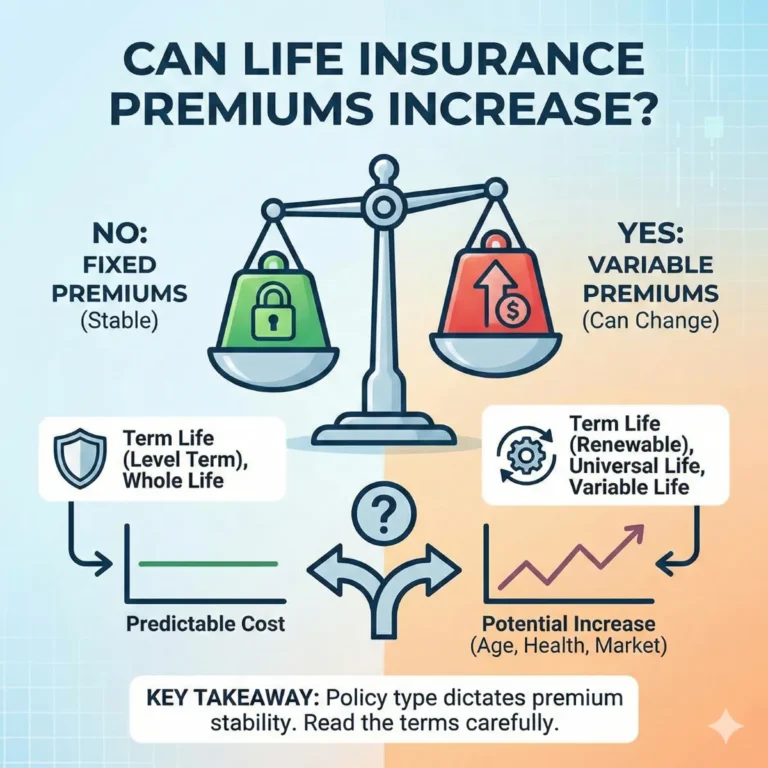

- Guaranteed Level Premiums: Your monthly cost will never increase, regardless of your age or health changes.

- Guaranteed Cash Value Growth: A portion of your premium goes into a savings-like account that grows at a guaranteed minimum interest rate.

The Three Pillars of Whole Life for Tampa Bay Residents

To determine whether this is the right plan for you, we must examine the “Three Pillars” that make this product unique in the Tampa-St. Petersburg-Clearwater Metro Area.

1. The Death Benefit: A Legacy for the Gulf Coast

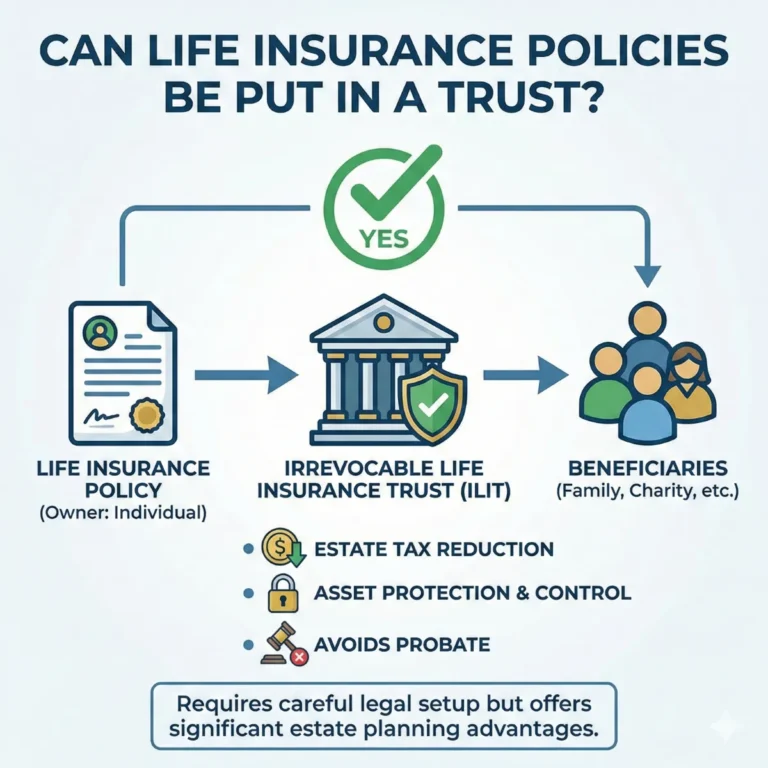

Whether you want to ensure your spouse can keep your home in Safety Harbor or you want to leave a legacy to the University of South Florida, the death benefit is the primary driver. Because this is permanent, it is often used by Clearwater residents for estate planning and to cover final expenses that term insurance might miss.

2. The Cash Value: Your “Private Bank.”

This is the most powerful feature for many Saint Petersburg professionals. A portion of every dollar you pay into the policy accumulates as “cash value.” In 2026, amid market volatility, many residents are viewing the cash value of a whole life policy as a “Tier 1” asset—safe, liquid, and tax-advantaged.

- Tax-Deferred Growth: You don’t pay taxes on the growth while it’s inside the policy.

- Policy Loans: You can borrow against your cash value to buy a new car, renovate your kitchen in South Tampa, or even fund a business venture without a credit check.

3. Dividends: Sharing in the Success

Many of the top companies I work with are “Mutual Companies.” This means the policyholders are effectively the owners. When the company performs well, it pays out dividends. While not guaranteed, many of the carriers serving the Tampa-Saint Petersburg-Clearwater Metro Area have paid dividends every single year for over a century.

Pros and Cons of Whole Life Insurance in Florida

When comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, it’s vital to be honest about the trade-offs.

The Pros: Certainty in an Uncertain World

- Lifelong Coverage: You can’t outlive it. This is crucial for Clearwater residents who want to ensure their burial and “final expenses” are fully funded.

- Asset Protection: Under Florida law, the cash value in a life insurance policy is generally protected from creditors. This is a massive “pro” for business owners in Tampa.

- Forced Savings: For those who find it hard to save, the premium acts like a bill you must pay, building equity over time.

- Tax-Free Death Benefit: Like all life insurance, your heirs in St. Pete receive the money income-tax-free.

The Cons: The Cost of Permanence

- Higher Initial Cost: Whole life insurance can cost 10 to 15 times as much as term life insurance for the same death benefit.

- Complexity: Understanding the dividend scales and loan provisions requires professional guidance.

- Slow Start: It takes several years for the cash value to build to a level that’s useful.

2026 Cost Analysis: What Residents are Paying

As an expert who double-checks all data, I’ve compiled the average 2026 rates for Tampa, Saint Petersburg, and Clearwater Area Residents. Rates are based on a “Preferred” health class for non-smokers.

Estimated Monthly Premiums for a $250,000 Whole Life Policy

| Age | Male Resident (Tampa) | Female Resident (St. Pete) |

| 30 | $185 – $210 | $155 – $180 |

| 40 | $295 – $330 | $245 – $280 |

| 50 | $480 – $550 | $390 – $440 |

| 60 | $850 – $975 | $690 – $790 |

Note: These premiums are “level,” meaning that if you buy the policy at age 30, you will still be paying $185 a month when you are 85. Prices are estimated and subject to change.

Whole Life vs. Term Life: Which is Better for You?

For many Tampa-Saint Petersburg-Clearwater Metro Area Residents, the choice comes down to “How long do I need the money?”

- Choose Term Life If: You only need to cover a 30-year mortgage, or you want to protect your kids until they graduate from high school in Largo. It’s the “affordable” option.

- Choose Whole Life If: You have a lifelong need (like a special needs child), you want to maximize your tax-free estate, or you want a safe-money alternative to the stock market.

Strategic Uses for St. Pete & Clearwater High-Net-Worth Residents

In the wealthier pockets of our metro area, such as Snell Isle or Belleair, whole life insurance isn’t just “death insurance”—it’s a financial tool.

1. Estate Tax Liquidity

Even though Florida has no state estate tax, the federal government does. A large whole life policy can provide the cash needed to pay those taxes so your heirs don’t have to sell off your Tampa Bay real estate holdings in a fire sale.

2. The “Infinite Banking” Concept

Many residents use high-cash-value policies to “become their own banker.” Instead of financing a boat through a bank in Clearwater, they take a policy loan, pay themselves back with interest, and keep the “spread.”

3. Supplementing Retirement

In 2026, with concerns over future tax rates, having a “bucket” of money (the cash value) that you can access tax-free in retirement is a major advantage for Saint Petersburg retirees.

Top Whole Life Companies in the Tampa Bay Metro (2026)

Based on financial strength (A.M. Best Ratings) and dividend history, these are the top carriers I recommend to Tampa-Saint Petersburg-Clearwater Metro Area Residents:

- MassMutual: Known for some of the highest and most consistent dividend payouts in the industry. Great for cash value accumulation.

- Northwestern Mutual: A powerhouse in the “participating” whole life space with a massive local presence.

- New York Life: Offers excellent “Custom Whole Life” plans that let you choose how long you want to pay premiums (e.g., “Paid up at 65”).

- Guardian Life: Their 2026 dividend interest rate of 6.25% is one of the most competitive for Clearwater residents.

- Mutual of Omaha: Ideal for seniors seeking smaller “final expense” whole-life policies without a medical exam.

SEO Insights: “Whole Life Insurance Quotes Tampa”

If you’ve been searching for long-tail keywords like “best whole life insurance for seniors in Clearwater” or “cash value life insurance rates Saint Petersburg,” you’re looking for specificity.

The market in Hillsborough and Pinellas County is competitive. While national websites provide generic quotes, a local agent knows that Florida residents have unique protections. For instance, the Florida Life and Health Insurance Guaranty Association provides a safety net (up to certain limits) if an insurance company fails—a layer of security we always discuss during our deep analysis.

Deep Analysis: The “Internal Rate of Return” (IRR)

When we look at the math of whole life, we have to calculate the IRR on the cash value. Over a 20– to 30-year horizon, a well-structured policy from a top-rated mutual company often yields an IRR of 3% to 5%.

While that sounds lower than the S&P 500, remember:

$$IRR_{TaxFree} \approx \frac{IRR_{Taxable}}{1 – TaxRate}$$

For a Tampa resident in the 32% tax bracket, a 4% tax-free return is equivalent to nearly a 6% taxable return—all with zero market risk.

Frequently Asked Questions from Local Residents

“Can I cancel my whole life policy if I move out of Florida?”

Yes. However, if you’ve had the policy for many years, it’s often better to keep it or “convert” it to a paid-up policy. It is an asset that belongs to you, regardless of where you live.

“Does whole life cover memory care or long-term care?”

Many modern whole life policies available in the Tampa-Saint Petersburg-Clearwater Metro Area include “Chronic Illness Riders.” These allow you to “spend” your death benefit while you are still alive to pay for care in a Clearwater assisted living facility.

“Is whole life insurance a good investment?”

I prefer to call it a “Volatility Buffer” or a “Savings Alternative.” It’s not meant to compete with your aggressive stocks; it’s meant to replace the “bond” or “cash” portion of your portfolio with something that has a much higher death benefit.

Conclusion: Is Whole Life Right for You?

The answer depends on your goals. If you want the lowest cost possible, stick with term. But if you want a guaranteed legacy, a tax-advantaged savings vehicle, and the peace of mind that your family in the Tampa, Saint Petersburg, and Clearwater Metro Area will be protected forever, whole life insurance is worth a serious look.

Navigating these “permanent” decisions can be daunting. You shouldn’t have to do it alone. Steve Turner Insurance Specialist is here to answer all of your questions and provide a customized, deep-dive analysis of your situation.

Whether you are in Dunedin, Brandon, or St. Pete Beach, Steve’s services are 100% free to you. Like all independent agents and brokers, he is paid directly by the insurance company that you choose. He is your advocate in the market, ensuring you get the best possible plan at the most competitive price.

Would you like me to run a side-by-side comparison of a “Paid-Up at 65” whole life plan versus a traditional term policy for your family today?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly across insurance companies. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

What Is Whole Life Insurance?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.