What Is Term Life Insurance?

As an Insurance Agent and Broker with many years of experience helping Tampa, Saint Petersburg, and Clearwater Area Residents solve their biggest health care and financial challenges, I have sat at many kitchen tables across the Bay Area. From the historic bungalows of Old Northeast to the growing communities in Riverview and the beachfront condos of Clearwater, the goal is always the same: protecting what matters most.

When people ask me, “What is term life insurance?” they aren’t just looking for a dictionary definition. They are asking how it fits into their specific lives here in Florida. In 2026, the financial landscape has changed, but the fundamental need for security has not. This article is a deep-dive analysis into the mechanics, costs, and strategic value of term life insurance for our local metro area residents.

What Is Term Life Insurance? The Foundation

At its simplest level, term life insurance is a contract between you and an insurance carrier that provides a death benefit for a specific “term” or period of years. If you pass away during that term, the insurance company pays a tax-free lump sum to your beneficiaries. If you outlive the term, the policy simply expires.

For Tampa-Saint Petersburg-Clearwater Metro Area Residents, this is often the “entry-level” insurance that provides the highest amount of coverage for the lowest possible cost. Think of it like renting protection rather than owning it. You pay for the coverage you need during the years when your financial risks are the highest—such as while you are raising children in Palm Harbor or paying off a mortgage on a home in South Tampa.

How It Differs from Permanent Insurance

Unlike Whole Life or Universal Life insurance, term life does not have a “cash value” component. You aren’t building an investment account inside the policy. Because of this simplicity, term life insurance rates in Tampa are significantly more affordable than permanent options, allowing families to buy the large death benefits they actually need to replace their income.

The Strategic Importance for Tampa Bay Families

Why is this specific type of insurance so vital for residents of the Tampa, Saint Petersburg, and Clearwater Metro Area?

- High Cost of Living Protection: While Florida is a tax-friendly state, the cost of housing and homeowners’ insurance in the Bay Area has risen. Term life provides the liquidity to ensure a surviving spouse can keep the home.

- Income Replacement: If a primary earner at a major local employer like Raymond James, Publix, or BayCare were to pass away, the loss of income could be catastrophic.

- Debt Erasure: From car loans to student debt, term life covers these obligations so they don’t fall on your survivors.

Pros and Cons of Term Life Insurance

When comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, it is essential to weigh the benefits against the limitations.

The Pros: Why It’s Often the Right Choice

- Affordability: You can often secure a $1,000,000 policy for the price of a few meals at a nice restaurant in Downtown St. Pete.

- Flexibility: You can choose terms of 10, 15, 20, 25, or 30 years to match your specific needs (e.g., until the kids graduate from USF).

- Simplicity: The contracts are straightforward. There are no complex investment sub-accounts to manage.

- Convertibility: Most high-quality term policies in Florida include a conversion rider, allowing you to turn your term policy into a permanent one later without a new medical exam.

The Cons: What to Watch Out For

- Temporary Nature: Once the term ends, you are uninsured. If you still need coverage at age 70, buying a new policy will be much more expensive.

- No ROI: If you don’t die during the term, you don’t get your premiums back (unless you buy a specific “Return of Premium” rider).

- Health Requirements: While no-exam life insurance in Clearwater is becoming more common, the best rates still require you to be in good health.

Deep Analysis: Comparing Term Life Insurance Plans in 2026

As an independent broker, I don’t work for one company; I work for you. Here is how the different types of term plans stack up for local residents.

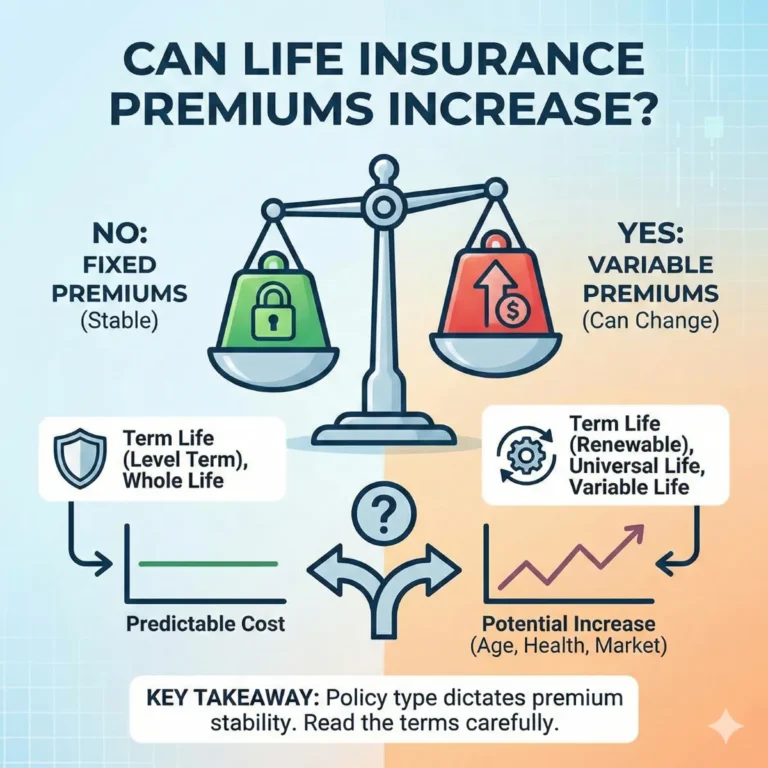

1. Level Term Insurance

The most common type. Your premium and death benefit remain exactly the same throughout the duration. Whether you are in year 1 or year 19 of a 20-year term, your cost remains locked in.

2. Decreasing Term (Mortgage Protection)

Often used by Tampa Bay homeowners, the death benefit decreases over time, usually in line with your mortgage balance. While cheaper, it offers less flexibility than a level term.

3. Return of Premium (ROP) Term

If you outlive the term, the insurance company cuts you a check for every cent you paid in premiums.

- Pro: It’s essentially a forced savings plan.

- Con: The monthly cost is significantly higher—often 2x to 3x the cost of a standard term.

2026 Pricing Data for Tampa-Saint Petersburg-Clearwater Residents

To provide a truly deep analysis, we must look at the numbers. Based on current market data for 2026, here is what a $500,000 20-Year Level Term Policy looks like for healthy, non-smokers in our metro area.

| Age | Monthly Premium (Male) | Monthly Premium (Female) |

| 25 | $24.50 | $20.75 |

| 35 | $31.00 | $26.50 |

| 45 | $62.00 | $49.00 |

| 55 | $145.00 | $108.00 |

Note: Rates are estimates and subject to medical underwriting. Residents in high-risk occupations or with certain health histories may see different pricing. Prices are estimates and subject to change.

Identifying the Best Term Life Insurance for Seniors in Tampa

A common misconception is that term life is only for the young. However, I frequently help seniors in Clearwater and St. Petersburg secure 10-year terms to cover the “gap” years before their pension or Social Security fully kicks in for a surviving spouse.

The Challenge of Aging and Underwriting

As we age, our health history becomes more complex. Many residents in the Tampa-Saint Petersburg-Clearwater Metro Area struggle with “standard” issues like high blood pressure or cholesterol.

Expert Tip: Not all carriers treat health issues the same. One company might “rate” you (charge more) for a history of skin cancer, while another carrier—familiar with the Florida sun—might offer you their best “Preferred” rate. This is why using a broker is critical.

Finding Affordable 20-Year Term Life Rates in Clearwater

When searching for the best life insurance in Clearwater, you have to look beyond just the monthly price. You must look at the “Financial Strength” of the company. In our region, we look for companies with an A.M. Best Rating of A or A++.

Leading Carriers in the Tampa Bay Market:

- Banner Life (Legal & General): Often the price leader for healthy individuals.

- Mutual of Omaha: Excellent for those with slightly more complex health histories.

- Prudential: A “go-to” for residents who use tobacco or have certain chronic conditions.

- Pacific Life: Known for high-limit policies without requiring a full medical exam.

The “Living Benefits” Revolution

One of the biggest shifts I’ve seen in my years as an Insurance Agent and Broker is the inclusion of Accelerated Death Benefit Riders. For residents of the Tampa-Saint Petersburg-Clearwater Metro Area, this is a game-changer.

If you are diagnosed with a terminal or chronic illness (like many of our local families face), these riders allow you to access a portion of your death benefit while you are still alive. This money can be used to pay for specialized care at facilities like Moffitt Cancer Center or to modify your home for accessibility.

Is Term Life Insurance Worth It for St. Petersburg Families?

To answer this, we look at the “Opportunity Cost.” If you are a 35-year-old parent in St. Petersburg with two kids and a mortgage, the risk of “self-insuring” is immense.

To save up $500,000 to replace your income, you would need to save roughly $1,388 every month for 30 years (assuming no interest). Or, you could spend $31 a month on a term policy and have that $500,000 protection active the moment your first premium is paid.

Mathematically, the “Expected Value” ($E$) of a life insurance policy can be calculated as:

$$E = (P \times DB) – Premiums$$

Where $P$ is the probability of death during the term and $DB$ is the Death Benefit. For a family, this isn’t just a math problem; it’s a “catastrophe avoidance” strategy.

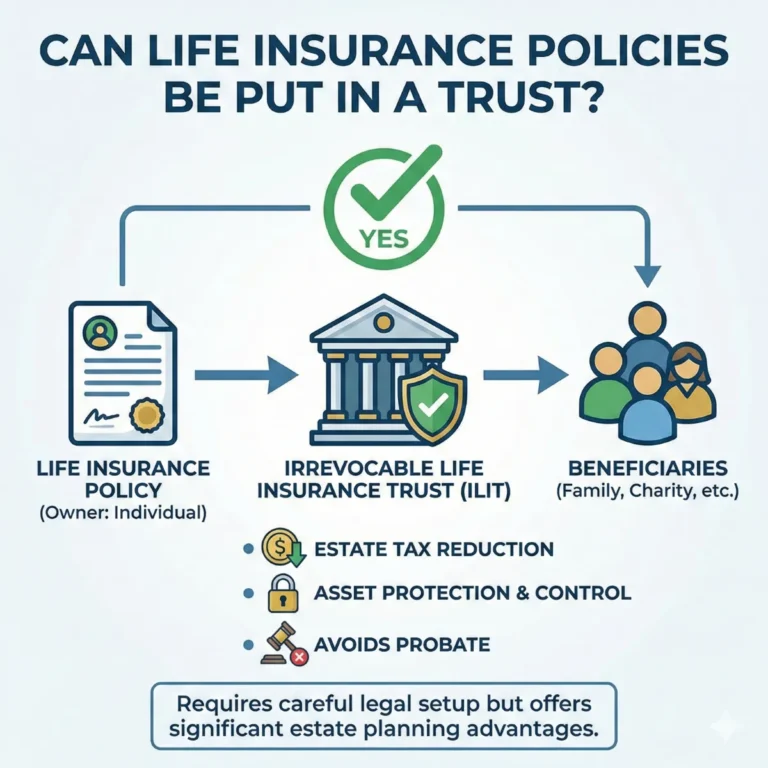

Converting Term to Permanent Life Insurance in Florida

Many residents start with term insurance because it’s what they can afford now. But as your wealth grows—perhaps through the booming real estate in Downtown Tampa—you may want the estate planning benefits of a permanent policy.

The Conversion Privilege

Most policies I sell in the Tampa, Saint Petersburg, and Clearwater areas include a “Conversion Window.” This allows you to trade in your term policy for a permanent one (like Whole Life), regardless of your health. Even if you developed a serious illness during your term, the insurance company must give you the new policy at a rate based on your original health class.

Navigating the Local Underwriting Process

In the Tampa-Saint Petersburg-Clearwater Metro Area, the medical exam process is easier than ever. Most carriers use local mobile examiners who will come to your home in Largo or your office in Westshore to take a quick blood sample and blood pressure reading.

What They Look For:

- Nicotine/Cotinine: With the rise of vaping, insurers are testing more strictly.

- Cholesterol/HGL Ratios: Important for heart health.

- Blood Sugar (A1C): A critical metric for our residents with diabetes.

- Driving Record: Yes, your “Florida Man” driving habits (speeding tickets/DUIs) can affect your life insurance rates!

Frequently Asked Questions from Local Residents

“Can I have more than one policy?”

Absolutely. Many of my clients in Clearwater use a “laddering” strategy. They have a 30-year mortgage term and a 10-year term until they retire.

“What happens if I move out of the Tampa Bay area?”

Your policy is portable. As long as you keep paying the premiums, your coverage follows you anywhere in the U.S. (and usually internationally).

“Is the death benefit taxable in Florida?”

No. Under current federal and Florida state law, life insurance death benefits are generally received by beneficiaries 100% tax-free.

Summary of Key Takeaways for Tampa Bay Residents

- Term life is for “If”: If you die prematurely, your family is protected.

- Permanent life is for “When”: It provides a benefit whenever you pass away.

- The Metro Area is Unique: High property values and medical costs make high-limit term policies a necessity, not a luxury.

- Lock it in Early: Every birthday you celebrate in the Tampa, Saint Petersburg, and Clearwater Area makes your next policy slightly more expensive.

Closing: Your Local Partner in Financial Security

Choosing a life insurance policy shouldn’t feel like a high-stakes gamble. You deserve clear, honest, and expert advice from someone who understands the local landscape and the specific challenges faced by residents of the Tampa-St. Petersburg-Clearwater Metro Area.

Steve Turner Insurance Specialist is here to be your partner. As an independent agent and broker, Steve has spent years helping families just like yours navigate the complexities of term life insurance. He takes the time to do a deep analysis, comparing dozens of carriers to ensure you get the best possible rate and the most robust coverage.

The best part? Steve’s services are 100% free to you. Like all independent brokers, he is compensated by the insurance company that you choose. This means you receive his years of expertise, customized quotes, and personalized guidance without ever being billed by his office.

Would you like me to generate a personalized quote comparison for 10-, 20-, and 30-year term policies based on your current age and coverage needs?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

What Is Term Life Insurance?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.