Can Medicare Pay For Assisted Living

Can Medicare Pay For Assisted Living

Can Medicare Pay For Assisted Living?

If you’re weighing a move (for yourself or a loved one) to assisted living, a natural, urgent question is: “Will Medicare pay for it?” The short, definitive answer is no—Medicare does not pay for room and board in an assisted living facility. But that’s not the whole story. Medicare does cover many medical services you’ll still use while living in assisted living, and there are programs—especially Medicaid and PACE—that can help with long-term support needs for those who qualify. Below you’ll find an expert walkthrough of what’s covered, what isn’t, where people actually get help with assisted living costs, Florida-specific pathways, the full set of FAQs people ask, and practical next steps (including how to enroll in Medicare directly or work with a licensed Florida agent like Steve Turner of Steve Turner Insurance Specialist).

The One-Sentence Answer

Medicare does not cover non-medical “custodial” care or the room-and-board costs of assisted living. Medicare is a health insurance program focused on medically necessary care. Daily help with activities of daily living (ADLs) like bathing, dressing, or eating—core services of assisted living—is considered long-term custodial care, which Medicare does not pay for.

What Medicare Does Cover (Even If You Live in Assisted Living)

Even in an assisted living community, Medicare continues covering your medical benefits:

- Hospital care (Part A), doctor visits and outpatient services (Part B), and preventive care.

- Skilled Nursing Facility (SNF) care for a limited period after a qualifying event—up to 100 days per benefit period when eligibility rules are met. The traditional “3-day inpatient hospital stay” requirement can be waived in certain programs (e.g., some ACOs) and sometimes by Medicare Advantage plans.

- Home health services when you meet Medicare’s criteria.

- Hospice for those who qualify.

- Prescription drugs via Part D (stand-alone) or Medicare Advantage plans that include drug coverage.

Important distinction: Assisted living = custodial support environment; SNF = short-term, skilled medical rehab. Medicare may cover the latter, not the former.

What Assisted Living Actually Costs (and Why It Matters)

Assisted living is usually private-pay unless you qualify for Medicaid or another program. Recent market data shows the national median assisted living cost reached about $70,800 per year in 2024 (roughly $5,900/month), up around 10% from 2023. Budgeting realistically means planning for increases over time.

So Who Does Help Pay For Assisted Living?

- Medicaid (primary public payer of long-term services and supports nationally). States can fund home- and community-based services (HCBS) and sometimes services in assisted living for eligible people. Coverage, waiting lists, and benefits vary by state.

- PACE (Program of All-Inclusive Care for the Elderly). For people who meet a nursing-home level of care, PACE blends Medicare and Medicaid (for dual-eligibles) to deliver comprehensive medical and long-term services—often enabling people to remain in the community. If you have Medicaid, you usually pay no premium for the long-term care part.

- Medicare Advantage (Part C) supplemental benefits. Some MA plans may offer non-medical supplemental benefits (e.g., in-home support, caregiver support, transportation, meals) for certain enrollees—particularly under SSBCI rules for the chronically ill. These benefits do not pay assisted living room-and-board, but they can offset related costs/services. Benefits and availability vary by plan and year.

- Private options: long-term care insurance, personal savings, VA benefits (e.g., Aid & Attendance), family support, or life insurance conversions.

Florida-Specific: Medicaid Help With Assisted Living

Florida delivers long-term care services through the Statewide Medicaid Managed Care (SMMC) Long-Term Care (LTC) program, administered by the Agency for Health Care Administration (AHCA), with DCF handling financial eligibility and DOEA handling clinical screening and the LTC waitlist. Eligible Floridians may receive services in assisted living or at home. Availability is limited; waitlists are released by need and frailty score—not “first-come.”

Florida publishes updated contract exhibits and coverage policies confirming that the LTC program uses person-centered care planning, allows assisted living placements that meet HCBS settings rules, and requires ongoing case management standards.

Florida also provides SSI-related Medicaid guidance and fact sheets explaining patient responsibility calculations and applicability to programs like SMMC-LTC and PACE.

Frequently Asked Questions About “Can Medicare Pay For Assisted Living?”

1) Does Medicare pay for assisted living?

No. Medicare doesn’t cover room and board or custodial care in assisted living. It focuses on medical services.

2) If Medicare doesn’t pay for assisted living, what does it pay for in that setting?

Your regular Medicare benefits continue—hospital, doctor, preventive, Part D drugs, potentially home health if you qualify, and hospice if needed. The assisted living provider’s daily supportive services and rent remain not covered.

3) Will Medicare pay for a nursing home if assisted living isn’t enough?

Short-term only—Medicare can cover up to 100 days of Skilled Nursing Facility care per benefit period after a qualifying event, usually following an inpatient hospital stay (with some waivers in certain models and some Medicare Advantage plans). Long-term custodial nursing home care is not covered.

4) What about Medicare Advantage—can a Part C plan pay for assisted living?

MA plans may offer limited supplemental “non-medical” benefits (e.g., in-home support services) for specific populations (not rent), and designs vary by plan and year. Always check your plan’s Evidence of Coverage.

5) Who actually pays for assisted living if not Medicare?

Primarily private-pay, long-term care insurance, Medicaid (if eligible), PACE (for those meeting criteria), and sometimes veterans’ programs. National data consistently show Medicaid is the primary public payer for long-term services and supports.

6) How much does assisted living cost today?

The 2024 national median was about $70,800 per year, and costs have been rising. Local markets vary widely; Florida metro areas can be higher or lower than the national median.

7) What is PACE and why should I care?

PACE is a comprehensive program that coordinates all Medicare and Medicaid benefits and long-term services for people who meet nursing-home level of care but want to live in the community. If you have Medicaid, you typically pay no premium for the long-term care portion. PACE can reduce or delay nursing home placement by providing wraparound supports.

8) How do Florida’s Medicaid long-term care services work with assisted living?

Florida’s SMMC-LTC program delivers long-term services in homes and assisted living settings for eligible members. There’s a waitlist managed by DOEA and the ADRCs, with releases based on frailty scores, not time waiting.

9) Is there any momentum to make Medicare cover long-term care at home or assisted living?

From time to time, national proposals surface to expand Medicare’s role in long-term care, especially home-based care. These are proposals—not current policy—and coverage would depend on legislation and rulemaking. Always verify current law before planning.

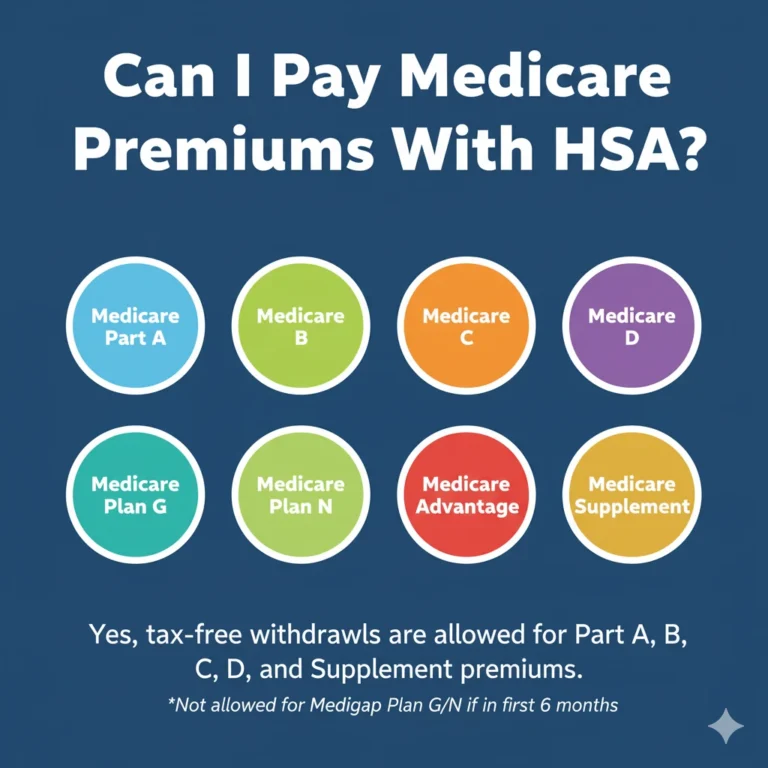

10) Do Medigap (Medicare Supplement) plans help with assisted living costs?

No. Medigap only helps pay Medicare cost-sharing (e.g., Part A/B coinsurance/deductibles). It does not cover assisted living room-and-board. The best time to buy Medigap is within your 6-month Medigap Open Enrollment (starts when you’re 65+ and enrolled in Part B).

11) What’s the difference between assisted living and a nursing home in Medicare’s eyes?

Assisted living provides custodial support with ADLs in a residential setting—not covered by Medicare. A Skilled Nursing Facility provides medically necessary, short-term rehab/skilled care—may be covered by Medicare for up to 100 days, if you qualify.

12) If I move to assisted living, do I lose my Medicare coverage?

No. Your Medicare stays the same; you just need to ensure your doctors, pharmacies, and plans are workable from your new address and facility. (If you have Medicare Advantage/Part D, confirm your plan’s service area and network.)

13) What if I can’t afford assisted living without help?

Explore Florida’s SMMC-LTC, PACE, and VA benefits (if eligible). Also consider aging-services networks (e.g., ADRCs, Area Agencies on Aging, and ACL resources) for caregiver support, counseling, and community services.

Pros & Cons: If the Answer Were “Yes” vs. “No”

Because the factual answer today is “No, Medicare does not pay for assisted living,” it’s useful to examine the practical pros and cons of both outcomes—what you gain and what you lose under “yes” or “no.”

If the Answer Were “Yes” (Hypothetically or via Future Policy Change)

Pros

- Simplicity. One federal program would coordinate both medical care and room-and-board support, reducing the maze of payers.

- Predictability. Premium-style financing could replace open-ended private-pay bills, aiding families’ long-term budgeting.

- Access equity. More consistent support regardless of state residency.

- Care integration. Leveraging Medicare’s national scale could align medical care with daily support, improving outcomes.

Cons

- Higher federal costs and trade-offs. Funding assisted living nationally would require new revenues, benefit cuts elsewhere, or both.

- Utilization controls. Wider coverage usually brings prior authorization, networks, and benefit limits—not everyone would get any facility at any price.

- Market effects. Provider participation rules, rates, and quality oversight would shape which facilities take Medicare, with potential access constraints in some regions.

With Today’s Reality—The Answer Is “No”

Pros

- Flexibility of choice when paying privately: fewer network restrictions and broader range of communities, amenities, and room types.

- Tailored Medicaid/HCBS models (e.g., Florida’s SMMC-LTC, PACE) that can closely target high-need individuals and emphasize community living.

Cons

- High out-of-pocket burden. Median costs near $70,800/year challenge most households and can rapidly deplete savings.

- Patchwork access. Eligibility, waitlists, and benefits vary by state and program; Florida uses a frailty-scored waitlist for SMMC-LTC releases.

- Planning complexity. Families must align Medicare, Medicaid, long-term care insurance, and facility contracts—each with separate rules.

A Clear Decision Path (Florida-Focused)

- Confirm what you need right now.

- Assisted living (custodial help) vs. short-term rehab (SNF) vs. hospice vs. home-based services. Medicare may cover some of the medical elements—but not assisted living rent.

- Price your local options realistically.

- Start with current market medians (~$70.8k/year nationally) and then get quotes from communities in your Florida metro area.

- Check for Florida public-program pathways.

- SMMC-LTC (Florida Medicaid LTC): eligibility (financial + functional), screening via DOEA/ADRC, waitlist based on need/frailty.

- PACE (if available in your county): nursing-home level of care, integrated Medicare/Medicaid services, no long-term care premium if you have Medicaid.

- Review your Medicare coverage mechanics.

- If you need SNF after a hospitalization, confirm 3-day stay requirement (or whether a waiver applies) and your coinsurance obligations past day 20.

- If you’re in (or considering) Medicare Advantage, see if the plan offers supplemental home- and community-based supports that can help you remain at home longer—though they won’t pay assisted living rent.

- Fill the funding gap.

- Consider long-term care insurance, VA benefits (if applicable), family cost-sharing, or personal funds.

- Talk with a knowledgeable local agent about the interplay of Medicare coverage, Medigap, Part D, and MA options to minimize medical out-of-pocket costs while you self-fund room and board.

Key Enrollment Timelines & How to Buy Medicare (Direct or With an Agent)

Original Medicare (Part A & Part B)

- How to sign up directly: Most people enroll via Social Security—online, by phone, or local office. If you’re already drawing Social Security before 65, enrollment may be automatic.

- Initial Enrollment Period (IEP): 7 months around your 65th birthday month. Coverage start dates depend on when you enroll in that window.

- General Enrollment Period (GEP): Jan 1–Mar 31 annually, if you missed your IEP and don’t qualify for a Special Enrollment Period.

- Special Enrollment Periods (SEP): If you had creditable employer coverage and delayed Part B, you can add Part B later without penalty by submitting the proper forms (CMS-L564, CMS-40B) to Social Security.

Part D (Prescription Drug Plans) and Medicare Advantage (Part C)

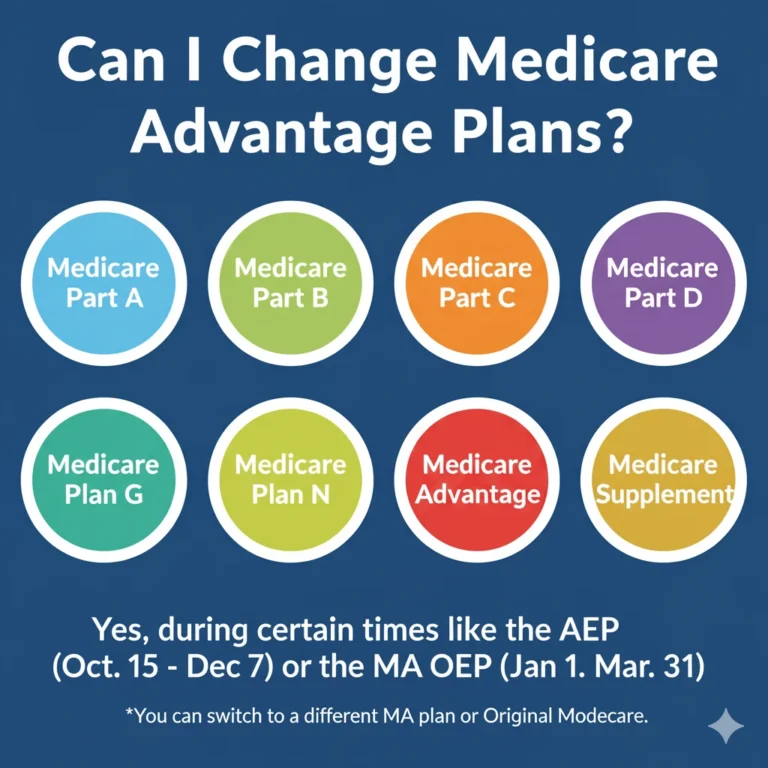

- Annual Open Enrollment (AEP): Oct 15–Dec 7 each year—join, drop, or switch MA or Part D; changes take effect Jan 1.

- MA Open Enrollment Period (OEP): Jan 1–Mar 31—one switch if you’re already in an MA plan.

Medigap (Medicare Supplement Insurance)

- One-time Medigap Open Enrollment: 6 months starting the month you’re 65+ and enrolled in Part B. During this window you can buy any plan sold in your state with no health underwriting. Outside of this window, underwriting may apply unless you have a guaranteed-issue right.

Quick reality check: Neither Medigap nor Part D pays for assisted living room-and-board. Their role is to control your medical out-of-pocket costs.

Practical Examples

- Scenario A: Post-hospital rehab. You’re discharged to a Skilled Nursing Facility for rehab. Medicare Part A may cover up to 100 days—first 20 days at $0 coinsurance, then per-day coinsurance up to day 100 (amounts vary by year), provided qualifying rules are met or waived by your program/plan. After that, costs become private pay or Medicaid (if eligible).

- Scenario B: Assisted living move for help with ADLs. Medicare continues for your medical needs, but you pay the ALF (or use Medicaid LTC/PACE if eligible). A Medicare Advantage plan might offer in-home support services—useful if you’re still at home and trying to delay the move.

- Scenario C: Florida resident, limited funds. Contact your ADRC for SMMC-LTC screening; understand there’s a waitlist based on frailty score. Explore PACE if available in your area. Meanwhile, compare MA/Part D options that keep medical costs predictable while you plan for room-and-board.

The Bottom Line

- Medicare will not pay for assisted living rent or custodial care. It will still cover hospital, doctor, preventive, and qualifying SNF/home health/hospice services.

- Medicaid and PACE are the leading public pathways for long-term support with ADLs (including assisted living in many cases), subject to eligibility and availability.

- Plan early for costs hovering around $70,800/year, and expect variation by market and level of care.

How to Purchase Medicare Directly—and How a Licensed Florida Agent Like Steve Turner Can Help

You have two complementary routes:

1) Buy/Enroll Directly

- Enroll in Part A & Part B through Social Security (online, phone, or local office). If you’re drawing Social Security before 65, enrollment may be automatic; otherwise, apply during your IEP or a valid SEP.

- Each fall (Oct 15–Dec 7), use Medicare.gov to compare and join/switch Medicare Advantage and Part D plans. You can also use the MA OEP (Jan 1–Mar 31) for a one-time change if you’re already in MA.

- If you want Medigap, act within your 6-month one-time window after Part B begins. This is when you have the strongest protections.

2) Work With a Licensed Florida Insurance Agent (e.g., Steve Turner, Steve Turner Insurance Specialist)

A seasoned Florida agent can:

- Explain Florida-specific market nuances (plan networks, service areas, star ratings, drug formularies).

- Compare Medicare Advantage and Part D options that match your doctors, hospitals, and meds.

- Help you time Medigap purchases and explain underwriting rules outside your open enrollment.

- Coordinate with your assisted living or home-care plans so your medical coverage is optimized, while you pursue SMMC-LTC or PACE if you may qualify.

Important: Agents can help you choose and enroll in private Medicare plans (Medicare Advantage, Part D, Medigap). The federal Part A & B enrollment itself is always via Social Security/Medicare. Many Floridians combine both approaches—apply for A & B online, then consult an agent to fine-tune MA/Part D/Medigap choices.

Final Takeaways

- Medicare: crucial for medical bills, not for assisted living rent.

- Medicaid/Florida SMMC-LTC & PACE: the main public tools for ADL support and assisted living help—if you qualify.

- Act early: Get clinically screened (Florida), understand waitlists,

Finding Your Trusted Advisor in the Florida Medicare Market

We have taken a very detailed look at Medicare for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Medicare in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Medicare specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Medicare plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system allows you to get free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Medicare Insurance Carriers. An expert like Steve can help you navigate the 2026 Medicare market, find the most competitively priced Medicare plans for you, and ensure you have a Medicare plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

MEDICare INSURANCE POSTS

INSURANCE OFFERINGS

Can Medicare Pay For Assisted Living?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.