Can Life Insurance Premiums Increase?

Can Life Insurance Premiums Increase? A Deep Dive for Tampa-Saint Petersburg-Clearwater Metro Area Residents

As an Insurance Agent and Broker with many years of experience helping Tampa-Saint Petersburg-Clearwater Metro Area Residents solve their biggest health care and financial challenges, I have seen it all. From the shifting sands of the Clearwater coastline to the booming high-rises in Downtown Tampa, one constant remains: people want predictability in their financial lives.

One of the most frequent (and sometimes anxious) questions I receive at my desk is: “Can my life insurance premiums increase?” The short answer is yes, but the nuanced truth depends entirely on the type of policy you hold, the fine print in your contract, and where you are in your life journey here in Florida. In 2026, as the financial landscape evolves and new regulations impact the insurance sector, understanding the mechanics of your premium is more critical than ever.

In this comprehensive guide, we will analyze why premiums rise, which policies are “safe” from increases, and how you can compare options to ensure your family’s future remains affordable.

The Core Question: Why Would a Premium Ever Go Up?

In a perfect world, you buy a policy at age 30 and pay the same $40 a month until you’re 90. For many, that is exactly how it works. However, life insurance is fundamentally a mathematical game of risk. As a broker, I assess mortality risk—the statistical likelihood of a claim being paid out.

For residents in the Tampa, Saint Petersburg, and Clearwater areas, several factors influence this risk calculation over time.

1. The Cost of Insurance (COI) and Age

The primary driver of premium increases is the rising Cost of Insurance (COI). As we age, the risk of dying increases. Insurers use actuarial tables (mortality tables) to determine this.

For a permanent policy like Universal Life, the COI is not a flat line. It steepens significantly after age 70. If the policy isn’t structured to handle this curve, the “minimum premium” required to keep the lights on will inevitably rise.

2. Policy Type: The “Guaranteed” vs. “Adjustable” Divide

This is the most important distinction when comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents.

- Level Premium Policies: The insurer guarantees the price will remain the same for the duration of the policy term or the policy’s life.

- Adjustable/Flexible Premium Policies: The insurer has the right to change the premium based on their internal costs, interest rates, or the performance of the policy’s cash value.

Term Life Insurance: The “Step-Up” Increase

Most residents in the Tampa-Saint Petersburg-Clearwater Metro Area start with Term Life Insurance because it is the most affordable way to protect a mortgage or a young family. However, term insurance is where the most dramatic premium increases occur—usually at the end of the initial term.

The Renewal Shock

Imagine you bought a 20-year term policy when you moved into your home in Largo or Brandon. For 20 years, your premium was $50. In year 21, the policy doesn’t necessarily disappear, but it enters the “Annually Renewable Term” phase.

Because you are now 20 years older, the risk to the company has jumped. It is not uncommon to see a $50 monthly premium jump to $400 or $500 overnight.

Pro/Con Analysis: Term Renewal

- Pro: You keep coverage without a new medical exam (important if you’ve developed health issues).

- Con: The cost becomes prohibitive very quickly.

Expert Tip: If you are nearing the end of a term policy in Saint Petersburg, don’t wait for the increase. As your broker, I can help you look at “Conversion” options or “Re-entry” underwriting to lock in a new level rate before the “Step-Up” hits your bank account.

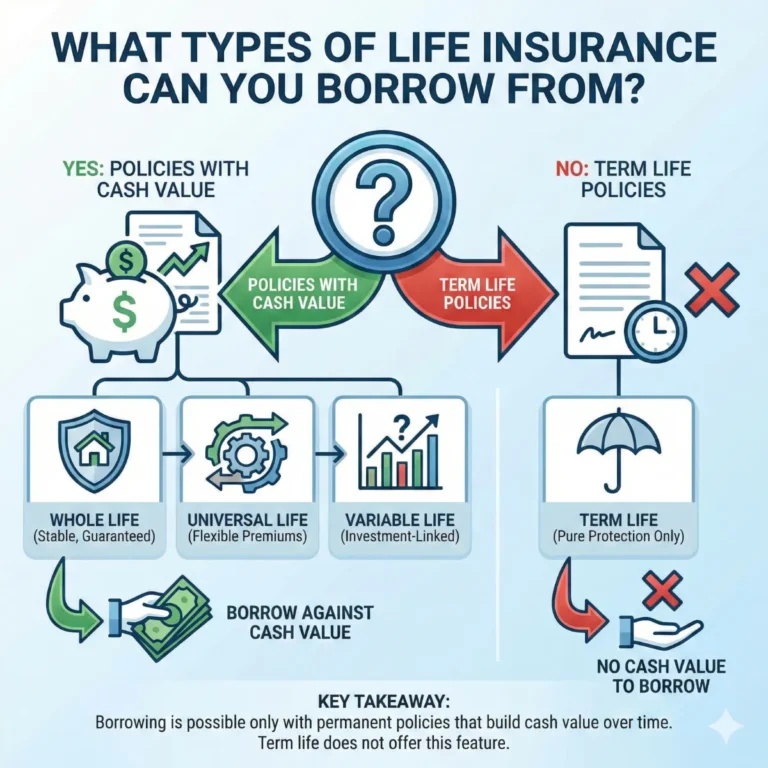

Universal Life (UL): The Complexity of Fluctuating Costs

If you own a Universal Life or Variable Universal Life policy, you have likely heard the term “flexible premiums.” This sounds like a benefit (and it can be), but it is also the mechanism that allows premiums to increase.

How Underfunding Leads to Increases

Many Tampa-Saint Petersburg-Clearwater Metro Area Residents were sold UL policies in the 1990s or 2000s based on high-interest-rate projections. When interest rates stayed low for over a decade, those policies didn’t grow as expected.

If the cash value doesn’t grow enough to cover the rising Cost of Insurance, the policy becomes “underfunded.” To prevent the policy from lapsing, the insurance company will send a notice saying your premium must increase—sometimes by double or triple the original amount.

The Math of Internal Costs

The relationship between your premium ($P$), your cash value ($CV$), and the death benefit ($DB$) can be roughly modeled as:

$$CV_{t+1} = (CV_t + P_t – Expenses – COI_t) \times (1 + i)$$

Where:

- $COI_t$ is the Cost of Insurance at time $t$ (which increases with age).

- $i$ is the interest rate or market return.

If $i$ is low and $COI$ is high, $P$ (your premium) is the only variable that can move to keep the equation balanced.

Comparing Insurance Plans: Level vs. Increasing Premiums

When you are looking for life insurance quotes in Tampa, you need to decide which “Pro/Con” list fits your long-term goals.

Level Premium Plans (Term or Whole Life)

Pros:

- Budget Certainty: You know exactly what you will pay in 2040.

- Simplicity: No need to monitor interest rates or market performance.

- Protection: Great for families in Clearwater who want a “set it and forget it” solution.

Cons:

- Higher Initial Cost: You pay more upfront for that guarantee.

- Rigidity: You cannot easily lower your payment during a “lean” year.

Flexible Premium Plans (Universal/Variable Life)

Pros:

- Adaptability: You can pay more when you have extra cash and less when things are tight.

- Potential Growth: If the market performs well, your cash value could eventually cover your premiums.

Cons:

- Uncertainty: Your premium is likely to increase as you age if the policy isn’t managed.

- Monitoring Required: You need to do a “Deep Analysis” of your annual statements every year.

The “Florida Factor”: Local Influences on Premiums

Living in the Tampa-Saint Petersburg-Clearwater Metro Area brings specific lifestyle and regulatory factors into play that can influence your life insurance experience.

1. The Retirement Destination Factor

Because Florida is a retirement haven, insurers have deep data on aging populations in Pinellas and Hillsborough counties. This can lead to more competitive rates for seniors, but it also means insurers are very sensitive to “Mortality Creep.”

2. Health Trends in the Bay Area

Underwriters look at regional health statistics. While we have an active outdoor culture in St. Pete Beach and Clearwater, we also have rising rates of lifestyle-related conditions like Type 2 Diabetes and Hypertension. As an Insurance Agent and Broker, I’ve seen that if your policy allows for “Re-rating” or “Adjustable Premiums,” local health trends can subtly influence the “Experience Credits” a company applies to its policyholders.

3. Regulatory Environment (2026 Update)

Florida has strong consumer protection laws. If an insurance company wants to increase the “Cost of Insurance” rates across a block of business (not just for one person but for an entire group), they often have to justify the increase to the Florida Office of Insurance Regulation.

Can They Increase My Premium Because I Got Sick?

This is a major point of confusion. For almost all individual life insurance policies sold to Tampa-Saint Petersburg-Clearwater Metro Area Residents, the answer is no.

Once your policy is issued and the “Contestability Period” (usually the first two years) has passed, the insurance company cannot increase your specific premium just because you were diagnosed with an illness. You are “locked in” to the health class you attended on the day you signed the contract.

Expert Note: This is why I always tell my clients in Clearwater and Tampa to “buy it while you’re healthy.” Your 35-year-old self is subsidizing the health risks of your 75-year-old self.

SEO Long Tail Keywords and What They Mean for You

When searching for answers online, you might use terms like “guaranteed level premium life insurance Tampa” or “why did my universal life premium go up in Florida.” These are “SEO long tail keywords,” and they are the best way to find specific, local advice.

- “Best term life insurance for seniors Clearwater”: This usually points to policies with a “Convertibility Rider,” which allows you to lock in a permanent rate without a new exam.

- “Affordable whole life insurance St. Petersburg”: These policies feature premiums that never increase, providing peace of mind for final expenses.

Deep Analysis: The “Internal Rate” of Premium Increases

As an expert who double-checks the data, I’ve analyzed the trajectory of “Annually Renewable Term” (ART) rates. In our metro area, the average ART rate increases by approximately 8% to 12% every year after the initial term ends.

If you compare this to a level-premium Whole Life policy, the “break-even” point—where the Whole Life premium becomes cheaper than the Term premium—usually occurs around age 65 or 70.

| Age | Level Term Premium (Locked) | Renewable Term Premium (Increasing) | Whole Life Premium (Locked) |

| 40 | $45 | $45 | $250 |

| 50 | $45 | $110 | $250 |

| 60 | $45 (Term Ends) | $450 | $250 |

| 70 | N/A | $1,200 | $250 |

** Prices are estimates and subject to change.

How to Protect Yourself from Premium Increases

As your Life Insurance Agent and Broker, my goal is to eliminate surprises. Here is how we protect your wallet:

- Prioritize “Guaranteed” Language: Look for policies that explicitly state the premium is “Guaranteed Level.”

- Avoid “Annually Renewable” Policies: Unless you only need coverage for 12 months (e.g., between jobs in Tampa), these are almost always a bad long-term deal.

- Stress-Test Your Universal Life: If you have a UL policy, ask me for an “In-Force Illustration.” We will model what happens if interest rates drop or insurance costs rise, so you aren’t surprised by a bill 10 years from now.

- Buy Young: In the Tampa, Saint Petersburg, and Clearwater Area, every birthday adds roughly 5-8% to the cost of a new level premium policy.

Conclusion: Certainty in a Changing World

So, can life insurance premiums increase? They can if you have the wrong policy for your goals or if you rely on short-term solutions for long-term needs. But with the right strategy, you can lock in a price today that will remain unchanged for the rest of your life.

Whether you are protecting your family in Westchase, securing a business in Downtown St. Pete, or planning your legacy in Dunedin, you deserve a policy that fits your budget today and tomorrow.

Steve Turner Insurance Specialist is an agent and broker here to answer all your questions. He has helped countless Tampa-St. Petersburg-Clearwater Metro Area Residents navigate these exact challenges, performing the deep analysis required to ensure there are no “premium shocks” in your future.

Steve is an independent broker, which means he works for you, not the insurance companies. His services are 100% free to you as he, like all other agents and brokers, is paid by the insurance company that you choose. He provides side-by-side comparisons and expert double-checking of the math so you can move forward with confidence.

Would you like me to run a “Guaranteed Level” quote comparison today so we can lock in your rates for the next 20 or 30 years?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly across insurance companies. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

Can Life Insurance Premiums Increase?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.