Can I Get Life Insurance On My Parents?

As an Insurance Agent and Broker with many years of experience helping Tampa-Saint Petersburg-Clearwater Metro Area Residents solve their biggest health care and financial challenges, I’ve found that the conversation often shifts from our own needs to those of our aging parents.

In the vibrant communities of Tampa, Saint Petersburg, and Clearwater, many adult children are stepping into caregiving roles. As our parents age, the reality of end-of-life costs becomes more than just a thought—it becomes a financial priority. The question I hear most often in my office is: “Can I get life insurance on my parents?”

The short answer is yes, you can. However, as any resident of the Tampa-Saint Petersburg-Clearwater Metro Area knows, the process involves navigating specific Florida legal requirements, such as “insurable interest” and “informed consent.” In this 2026 deep-dive analysis, we will explore the nuances of buying coverage for your parents, the best plans available in our local market, and the pros and cons of each strategy.

The Two Golden Rules for Insuring a Parent in Florida

In the Tampa-Saint Petersburg-Clearwater Metro Area, you cannot simply buy a policy on anyone you choose. Florida law (and the insurance carriers we work with) requires two fundamental criteria to be met:

1. Insurable Interest

You must prove that you would suffer a financial loss upon your parent’s death. For most Tampa Bay Residents, this is easily demonstrated. If you are responsible for their future funeral costs, if you have co-signed a mortgage on a home in South Tampa, or if you are providing for their long-term care in a Clearwater facility, you have a clear “insurable interest.”

2. Informed Consent

You cannot take out a policy on your parents without their knowledge. Your parent must participate in the application process, answer health questions, and—most importantly—sign the final contract. If a parent is suffering from advanced dementia or is no longer legally competent to sign documents, obtaining a new policy becomes significantly more difficult, often requiring a court-appointed guardianship.

Why Tampa Bay Residents Are Buying Life Insurance for Parents

The economic landscape of the Tampa-Saint Petersburg-Clearwater Metro Area has changed rapidly. In 2026, the costs associated with a parent’s passing are higher than ever, and adult children in Hillsborough and Pinellas counties are using life insurance as a strategic tool to manage these risks.

- Funeral and Burial Costs: A traditional burial in the Tampa Bay Metro now frequently exceeds $10,000.

- Medical Debt: Many seniors in Clearwater leave behind unpaid medical bills from specialists or hospital stays at BayCare or Tampa General.

- Legacy and Inheritance: Some children buy a policy to ensure a “tax-free” legacy, even if the parent has spent their savings on long-term care.

Comparing Insurance Plans: Which Is Best for Your Parents?

When comparing different insurance plans available to Tampa, Saint Petersburg, and Clearwater Area Residents, we generally look at three primary categories based on the parents’ age and health.

1. Final Expense (Burial Insurance)

This is the most popular choice for parents over age 65. These are small whole life policies, typically ranging from $5,000 to $25,000.

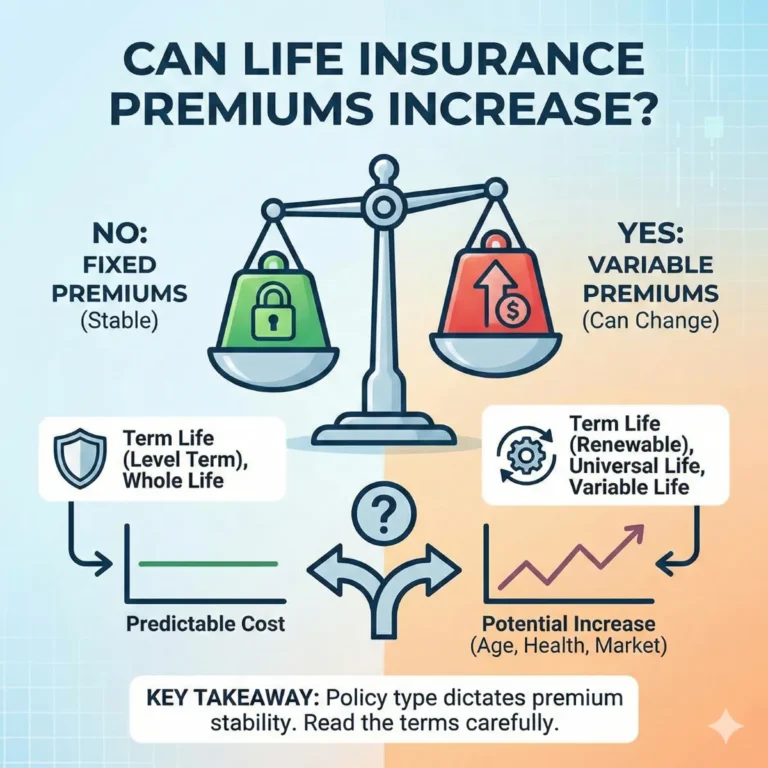

- Pros: No medical exam required (only health questions); permanent coverage that never expires; premiums stay level for life.

- Cons: Higher cost per thousand of coverage than term life.

- Best For: Parents in St. Pete or Clearwater with moderate health issues who just need to cover funeral costs.

2. Term Life Insurance

If your parents are younger (under age 70) and in excellent health, term insurance might be an option.

- Pros: Much higher death benefits (e.g., $100,000+) for a lower premium.

- Cons: It is temporary. If your parent lives past the term (usually age 80 or 85), the policy expires and you have nothing to show for the premiums.

- Best For: Protecting a specific debt, like a mortgage on a vacation home in Clearwater Beach.

3. Guaranteed Issue Life Insurance

For parents with severe health challenges (history of heart attack, stroke, or cancer), this is the “safety net” policy.

- Pros: No health questions at all. Everyone is approved.

- Cons: Most have a 2-year waiting period. If the parent dies of natural causes in the first 24 months, the company only returns your premiums plus interest.

- Best For: Parents in Tampa who have been declined for traditional coverage.

2026 Pricing Analysis: What to Expect

As an expert who double-checks data, I’ve analyzed the average 2026 rates for Tampa, Saint Petersburg, and the Clearwater Area. These rates are estimated monthly premiums for a $10,000 Final Expense Policy.

| Parent’s Age | Male Premium (Non-Smoker) | Female Premium (Non-Smoker) |

| 60 | $43 – $57 | $32 – $43 |

| 70 | $69 – $85 | $52 – $65 |

| 80 | $136 – $170 | $101 – $125 |

**Prices are estimates and subject to change.

Strategic Advice: Who Should Own the Policy?

This is a critical decision for Tampa-Saint Petersburg-Clearwater Metro Area Residents.

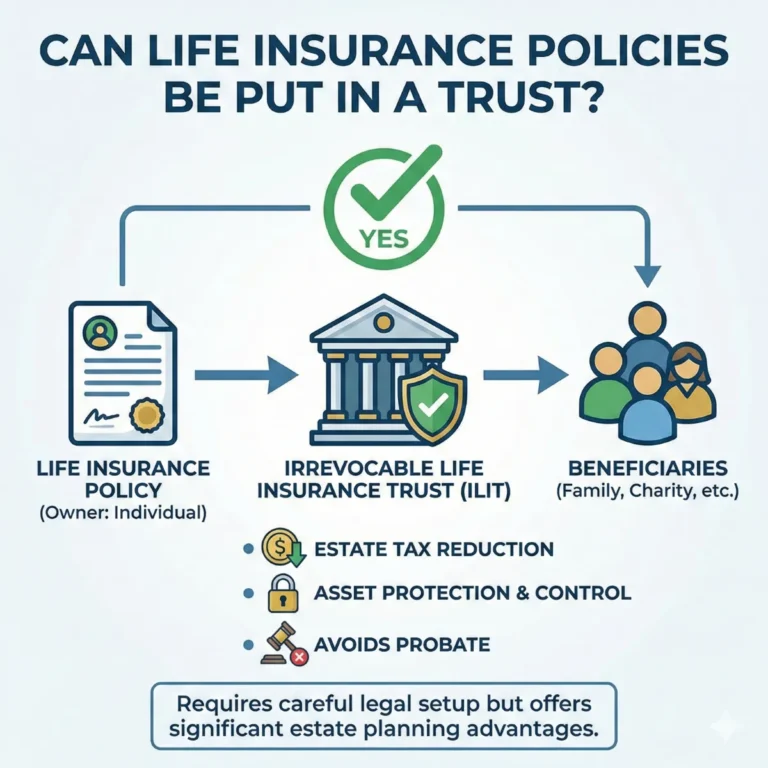

- Option A: The Child Owns the Policy. If you pay the premiums and are the owner, you have total control. You receive the billing notices at your home in Largo and ensure the policy doesn’t lapse.

- Option B: The Parent Owns the Policy. If the parent owns it, the cash value could potentially affect their eligibility for Medicaid if they ever need nursing home care. In Florida, a policy with a “face value” over $2,500 may be counted as an asset.

Expert Broker Tip: For my clients in Clearwater and St. Pete, I usually recommend that the adult child be the owner and the payor. This prevents the parent from accidentally cancelling the policy and keeps the asset off the parent’s ledger for Medicaid planning.

SEO Long Tail Keywords for Tampa Bay Residents

If you are searching for the “best life insurance for seniors in Clearwater” or “affordable burial insurance Tampa,” you are looking for specific, localized solutions.

- “How to buy life insurance for elderly parents in Florida.”

- “No exam life insurance for seniors, St. Petersburg, FL”

- “Final expense insurance quotes for Clearwater residents”

- “Life insurance for parents over 70 Tampa Bay area”

These “long tail keywords” help you bypass the generic national websites and find an agent who understands the specific costs and regulations in Pinellas and Hillsborough County.

The “Florida Factor”: Protecting Our Seniors

In 2026, Florida will have some of the strongest consumer protections in the nation for seniors.

- Secondary Addressee: Under Florida law, for any policy covering someone 64 or older, the insurer must allow the applicant to name a “secondary addressee.” If a premium is missed, the company must notify that second person (usually you, the child) before the policy can lapse.

- Grace Period: Florida mandates a 30-day grace period for life insurance, giving you time to catch up on a payment if things get tight.

Pros and Cons: A Final Summary

The Pros:

- Financial Peace of Mind: You won’t be forced to dip into your own retirement savings or children’s college fund to pay for a parent’s funeral.

- Asset Protection: Life insurance payouts are generally received income tax-free in Florida.

- Control: As the owner, you ensure the bill is paid, and the death benefit is there when you need it.

The Cons:

- Cost: Life insurance for parents in their 70s or 80s is significantly more expensive than for younger people.

- The Waiting Period: If you choose a “Guaranteed Issue” plan, you have to hope the parent lives for at least two more years to get the full payout.

- The “Consent” Conversation: Talking to your parents about their mortality can be emotionally difficult.

Frequently Asked Questions from Local Residents

“Can I get insurance for my parent if they live in a nursing home?”

Yes. Many carriers in the Tampa-Saint Petersburg-Clearwater Metro Area offer specialized plans for residents of skilled nursing or assisted living facilities, though you may be limited to “Guaranteed Issue” options.

“What happens if I move out of Florida?”

Your policy is portable. As long as you keep paying the premiums, it doesn’t matter if you move to Georgia or California; the coverage stays in force.

“Does the insurance company check my health or my parents’?”

Only the insured person (the parent). Your child’s health is irrelevant to the cost of the policy.

Conclusion: Acting While You Still Have Options

The answer to “Can I get life insurance on my parents?” is a firm yes, but the window of opportunity is always shrinking. As we age in the Tampa, Saint Petersburg, and Clearwater Metro Area, premiums rise, and health challenges can limit our choices.

The best time to secure a policy for your parents was yesterday; the second-best time is today. You deserve an expert who will perform a deep analysis of your parents’ health, your financial goals, and the dozens of carriers serving the Florida market.

Steve Turner Insurance Specialist is here to be your guide and advocate. As an expert agent and broker who has spent many years helping Tampa-Saint Petersburg-Clearwater Metro Area Residents solve their biggest financial and health care challenges, Steve understands that this is about more than just a policy—it’s about protecting your family’s future.

Steve is an independent broker, meaning he doesn’t work for one insurance company; he works for you. He will answer all of your questions, double-check every carrier’s rates, and help you find the absolute best plan for your budget.

The best part? Steve’s services are 100% free to you. Like all other agents and brokers, he is paid by the insurance company that “you choose.” This means you get expert advice and a personalized deep-dive analysis at no out-of-pocket cost.

Would you like me to run a customized premium comparison for your parents based on their current age and health status today?

Finding Your Trusted Advisor in the Florida Health Insurance Market

We have taken a very detailed look at the Tampa-Saint Petersburg-Clearwater metro area, the Health Insurance Market for 2026. We’ve seen how its clever design offers a modern solution for today’s retirees. We’ve also seen that while the plan’s benefits are stable and reliable, its monthly cost can vary significantly from one insurance company to another. Choosing the right company at the right price is the key to maximizing the value of Health Insurance in 2026.

This is where the guidance of an independent, licensed insurance agent becomes invaluable. A Health Insurance specialist acts as your personal shopper and advocate. They can instantly compare the rates for the same Health Insurance plan options from all the different carriers in your state. They can also provide insight into a company’s history of rate increases, which is a crucial factor in your long-term satisfaction.

It is essential to understand that this expert guidance is provided to you at absolutely no extra cost. The insurance industry is regulated so that the price of a plan is the same whether you buy it through an agent or directly from the company. When you enroll with an agent’s help, the insurance company pays them a commission. This system provides free, unbiased, and professional advice to help you make the best possible choice.

To ensure you get the best value, it is usually best to use a licensed insurance agent, such as Steve Turner at SteveTurnerInsuranceSpecialist.com. Steve Turner is a licensed Agent/Broker contracted with most Insurance Carriers. An expert like Steve can help you navigate the 2026 Health Insurance market, find the most competitively priced Health Insurance plans for you, and ensure you have a Health Insurance plan that provides both financial security and true peace of mind.

OUR CLIENT REVIEWS

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1-813-388-8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm

SOCIAL FOLLOW + SHARE

LIFE INSURANCE POSTS

INSURANCE OFFERINGS

Can I Get Life Insurance On My Parents?

HEALTH INSURANCE

MEDICARE ADVANTAGE

MEDICARE SUPPLEMENT

PRESCRIPTION DRUGS

LIFE INSURANCE

DISABILITY INSURANCE

DENTAL INSURANCE

GROUP HEALTH INSURANCE

ACCIDENT INSURANCE

LONG TERM CARE INSURANCE

MEDICAID INSURANCE

MEDICARE INSURANCE

MEDICARE PART A INSURANCE

MEDICARE PART B INSURANCE

MEDICARE PART C INSURANCE

MEDICARE PART D INSURANCE

MEDICARE PLAN G INSURANCE

MEDICARE PLAN N INSURANCE

SERVICE AREA

MEDICARE STATEMENT

The Medicare Annual Enrollment Period is October 15th to December 7th. Steve Turner is not connected with or endorsed by the United States Government or the Federal Medicare Program. Some plans may not be available in your area, and any information I provide is limited to those offered. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

There’s no one-size-fits-all answer. Carefully evaluate your health status, anticipated medical needs, prescription drug usage, budget, preferred doctors and hospitals, and tolerance for network rules. During the Medicare Annual Enrollment Period (October 15th to December 7th), thoroughly research the specific plans available in your Florida county using the Medicare Plan Finder on Medicare.gov, compare their costs and benefits, and consider seeking free, personalized counseling from Florida’s SHINE (Serving Health Insurance Needs of Elders) program.