Insurance Agent Insurance Broker – Steve Turner

Steve Turner Insurance Specialist offers you, your family and your business the complete array of Insurance Services you need to protect and provide for their Insurance needs.

My goals are to (1) Listen to you tell me about your insurance needs, budget, and the outcome you require, and (2) Educate you on your various options, and (3) Setup the insurance plans you have selected and get your insurance coverage established.

Not sure what what type of insurance is best for your Personal, Family, or Business? No worries! Most of my clients aren’t sure when they first reach out to us. I’ll discuss with you all your insurance options pro’s and con’s so YOU can make the choices that fit your budget.

Tap the “+1.813.388.8373” button to call me now, or the “Book-A-Call” button to pick a time on my calendar for a chat. I look forward to answering your questions and helping you find the right insurance to fit your needs.

OUR RESULTS

LISTENING SKILLS

SCORE = 100

PLAN CHOICES

SCORE = 100

BUDGET FIT

SCORE = 100

Insurance Agent Insurance Broker – Steve Turner

INSURANCE FOR EACH PART OF YOUR LIFE

Insurance Agent Insurance Broker

My Commitment

My number one goal in life is to help people and ensure, without a shadow of a doubt, that you and your family are secure and protected. I will always be by your side, helping you mitigate risk by providing the industry’s best and most affordable insurance solutions.

I promise if you’ll give me one percent of your confidence, I’ll earn the other 99!

Needed Coverage

Here, you will find insurance plans for the entire family to help cover whatever life throws at you. I can help you save on severe medical emergencies, find you a health insurance plan with low- to no-cost doctor visits and low-cost prescription medication, and protect your family if something happens to you.

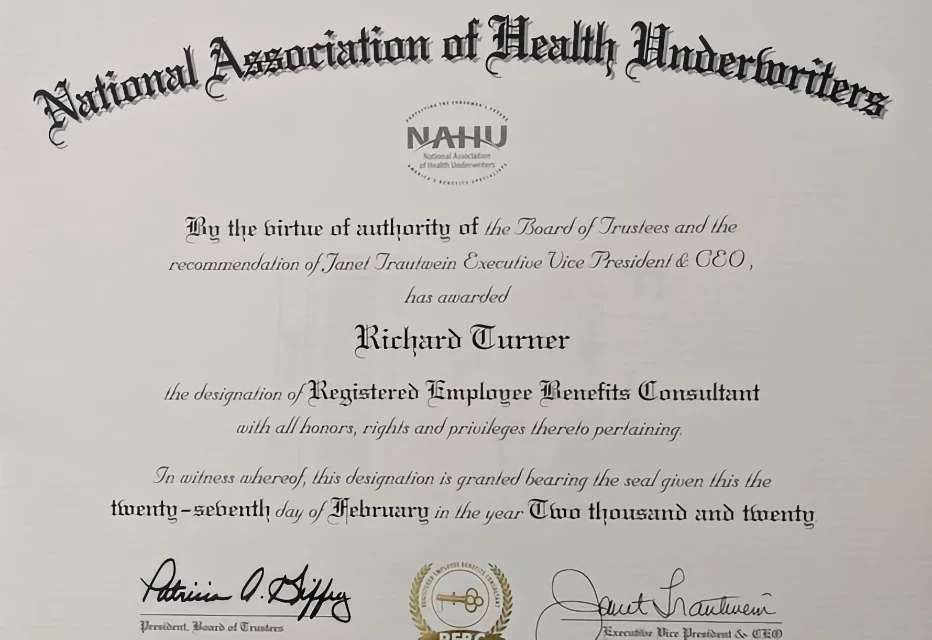

Maps to the Markets

I work tirelessly to stay informed about the latest changes in the Insurance markets. That’s why I am a long-standing member of the National Association of Health Underwriters® and hold the prestigious designation of Registered Employee Benefits Consultant®. I can provide you with information on your market’s availability and any expected changes.

DESIGNATIONS

CHARTERED LIFE UNDERWRITER (CLU)

The “Chartered Life Underwriter” designation, often abbreviated as CLU®, is a professional credential for individuals specializing in life insurance and estate planning. It’s conferred by The American College of Financial Services.

What is the CLU® Designation?

* Specialization: It signifies expertise in various aspects of life insurance, including product knowledge, risk management, and its application in estate planning and business planning.

* Comprehensive Knowledge: CLU® professionals have an in-depth understanding of insurance laws, taxation, wealth transfer strategies, and how to use life insurance to meet various client needs.

* Rigorous Education: To earn the CLU® designation, candidates must complete a series of college-level courses (typically eight, consisting of five core and three electives) and pass comprehensive examinations.

* Ethical Standards: Holders of the CLU® are expected to adhere to a strict code of ethics, prioritizing clients’ best interests.

* Long-Standing History: The CLU® is one of the oldest and most respected credentials in financial services, dating back to the late 1920s.

How much is the CLU® Designation Admired?

The CLU® designation is highly admired and considered a “gold standard” in the life insurance and financial planning industries for several reasons:

* Mark of Excellence: It is widely recognized as a mark of expertise, professionalism, and a deep commitment to the field of life insurance and estate planning.

* Specialized Knowledge: It demonstrates a specialized and in-depth understanding that goes beyond general financial planning. Many Certified Financial Planner (CFP®) professionals even pursue the CLU® to enhance their expertise in life insurance and risk management.

* Client Trust: Clients often seek out CLU® designees because they are seen as highly knowledgeable and capable of providing expert advice on complex life insurance and estate planning matters. This trust is further reinforced by the ethical standards CLU® holders must uphold.

* Career Advancement: Obtaining the CLU® can enhance an individual’s earning potential and open doors to more advanced roles in insurance companies, financial advisory firms, and wealth management.

* Reputation: Its long history and the rigorous educational requirements contribute to its strong reputation as a prestigious and revered title within the financial services industry.

In essence, the CLU® is greatly admired for its demonstration of specialized knowledge, ethical conduct, and dedication to helping clients navigate the complexities of life insurance and estate planning.

NATIONAL ASSOCIATION OF HEALTH UNDERWRITERS (NAHU)

Earning the Registered Employee Benefits Consultant® (REBC®) designation elevates your credibility as a professional. The field of employee benefits continues to evolve rapidly. A year does not go by without new government regulations, new or modified coverages, and new techniques for controlling benefit costs. To best serve their clients, professionals need to understand the provisions, advantages, and limitations associated with each type of benefit or program to meet economic security. The designation program analyzes group benefits concerning the ACA environment, contract provisions, marketing, underwriting, rate making, plan design, cost containment, and alternative funding methods. The most significant portion of this program is devoted to group medical expense plans that are a major concern to employers and employees.

CERTIFICATIONS

INDIVIDUAL HEALTH INSURANCE CERTIFICATION

MEDICARE CERTIFICATE

GROUP BENEFITS : BASIC CONCEPTS

ADVANCED TOPICS – GROUP BENEFITS

EMPLOYER SPONSORED PLANS IN A POST ACA ERA

ETHICS IN BUSINESS

SELF FUNDED

ORGANIZATIONS I’M A MEMBER OF:

NABIP represents over 100,000 licensed health insurance agents, brokers, general agents, consultants, and benefit professionals through more than 200 chapters across the United States. NABIP members serve the health insurance needs of both large and small employers, as well as individuals seeking individual health insurance coverage. Every day, NABIP members work to obtain insurance for clients who struggle to balance their desire for high-quality and comprehensive health coverage with the reality of rapidly escalating medical care costs. As such, one of NABIP’s primary goals is to do everything possible to promote access to affordable health insurance coverage.

NABIP members help millions of consumers navigate the complexities of health insurance purchasing and enrollment, ensuring they obtain the best policy at the most affordable price. We strive to understand each individual’s unique situation to provide recommendations that complement their financial and medical security needs. And our job continues after the sale. Our licensed producers assist clients with claims issues, service questions, and compliance matters throughout each policy they sell.

The clients of NABIP members range from Fortune 500 companies to mom-and-pop businesses and individuals seeking health insurance. Our members have a unique understanding of consumer healthcare needs, the perspective of business owners, and the economic realities of health insurance markets. We offer traditional health insurance products and coverage, including dental, long-term care, disability, Medicare Advantage, Medicare Supplements, and various consumer-driven products. Members agree to abide by NABIP’s Code of Ethics, which requires them to always make health care coverage recommendations with the customer’s best interest in mind.

NABIP offers its members numerous educational opportunities, including advanced designation programs, continuing education classes, and online learning courses. It also provides its members with professional conferences, networking functions, publications, and business development tools. We also conduct advocacy efforts at the state and federal levels of government to advance the interests of health insurance professionals and promote affordable and responsible private health insurance market solutions.

Insurance Agent Insurance Broker

An “insurance specialist” is a broad term encompassing agents and brokers, but the key difference lies in who the agent vs the broker represents.

An “insurance agent” works directly for an insurance company, selling their specific policies to clients.

An “insurance broker” acts as an independent intermediary, comparing policies from multiple companies to find the best fit for their client’s needs, essentially representing the client rather than the insurance company.

Can an “insurance broker” also be an “insurance agent”?

Yes, me being both an “insurance agent” and an “insurance broker” is good for you as my client!

An insurance broker-agent acting in the capacity of an insurance broker is an independent insurance sales person who searches the marketplace, working in the best interests of the client, not the insurance companies, and may place coverage with any admitted insurance company.

YOUR Insurance Agent Insurance Broker REVIEWS

STEVE TURNER INSURANCE SPECIALIST

MAP TO Insurance Agent Insurance Broker

STEVE TURNER INSURANCE SPECIALIST

CONTACT STEVE TURNER INSURANCE AGENT & BROKER

I’m here to take your calls and emails and answer your questions 7 Days a week from 7:00 a.m. to 8:00 p.m., excluding posted holidays.

Steve Turner is a licensed agent, broker, and a longstanding member of the National Association of Benefits and Insurance Professionals®. Steve holds the prestigious designation of Registered Employee Benefits Consultant®. NABIP® is the preeminent organization for health insurance and employee benefits professionals and works diligently to ensure all Americans have access to high-quality, affordable Healthcare, and related services.

Steve Turner is a licensed agent appointed by Florida Blue.

EMAIL ME: 24×7

OFFICE LOCATION

STEVE TURNER INSURANCE SPECIALIST

STEVE TURNER REBC®

14502 N DALE MABRY HWY

SUITE 200

TAMPA, FL 33618

I am Steve Turner, a licensed Insurance Agent and licensed Insurance Broker. My number one goal in life is to help people and ensure, without a shadow of a doubt, that you and your family are secure and protected. I will always be by your side, helping you mitigate risk by providing the industry’s best and most affordable insurance solutions. I provide the following Insurance products for All Stages of Your Life: Accident Insurance Plans, Dental Insurance Plans, Disability Insurance Plans, Group Health Insurance Plans, Health Insurance Plans, Life Insurance Plans, Long Term Disability Plans, Medicaid, Medicare, Medicare Part A, Medicare Part B, Medicare Part C, Medicare Part D, Medicare Plan G, Medicare Plan N, Medicare Advantage Insurance Plans, Medicare Supplement Insurance Plans, and Prescription Drug Insurance Plans. Visit my website to schedule a chat or ring me anytime.

Website: steveturnerinsurancespecialist.com

Email: [email protected]

Phone and Text: +1.813.388.8373

Business Hours:

Monday: 7 am to 8 pm

Tuesday: 7 am to 8 pm

Wednesday: 7 am to 8 pm

Thursday: 7 am to 8 pm

Friday: 7 am to 8 pm

Saturday: 7 am to 8 pm

Sunday: 7 am to 8 pm